Empowering Investors

Why C8

Capital Efficiency

An asset owner’s capital is only used to margin their actual net positions, not funding gross offsetting positions across managers. This can be up to 4 times as efficient compared to allocating to each separate strategy.

Full Control and Cost Efficiency

Asset Owner maintains full control of their capital and trading. No need for Operational Due Diligence and no duplication of administration costs incurred by an external manager. Easy onboarding as no need to make separate contracts with each Index provider.

Full Transparency and Global Reach

With C8, an asset owner always has full transparency on what they own in real-time and, because their capital is not moved, investment approaches can be sourced from anywhere in the world.

Customisation at Will

Allocating to an external manager is a ‘one size fits all’ approach. The C8 platform allows customization at will so that a client can adopt an index to their particular investment goals or mandates, even on the fly. Limit the number of instrument traded in an Index through tracking solutions. Create portfolios of Indexes through state of the art Optimisations.

Size no Longer Matters

Solves the age-old concentration limit/minimum allocation size dilemma, where an allocator needs to make a meaningful investment relative to their AuM, but the fund is too small. An asset owner can access innovative, new investment approaches, whatever the fund size.

Cutting-edge Technology

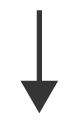

Our execution platform, C8X, uses patented technology to keep track of the entire execution process; asset owners only trade the net position change across all underlying instruments, allowing multiple Indexes to be rebalanced in minutes.

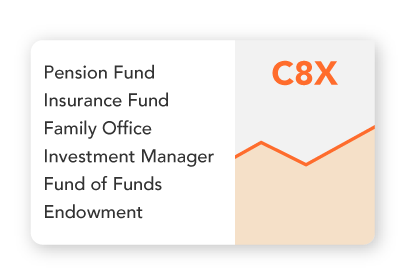

How it works

C8 platform offers Direct Active and Passive Index tracking, across asset classes. The C8 ecosystem connects asset owners around the world with some of the most skilled and innovative investment professionals in the financial markets. Through Tradeable Indexes, asset owners may track the performance in any of our cutting edge investment approaches (including Hedge Funds), both systematic or discretionary, using different assets classes such as Equities, Futures and FX.

Our clients implement Direct Indexing through trading the actual underlying assets rather than sub-allocating capital to external managers. These Indexes can be tracked as closely or as loosely as desired, as our clients have full control. Clients gain perfect transparency of all positions and an ability to customise their portfolio, without the costs associated with sub-allocating your capital externally.

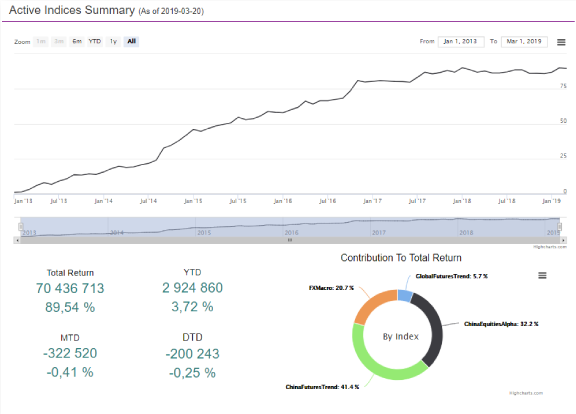

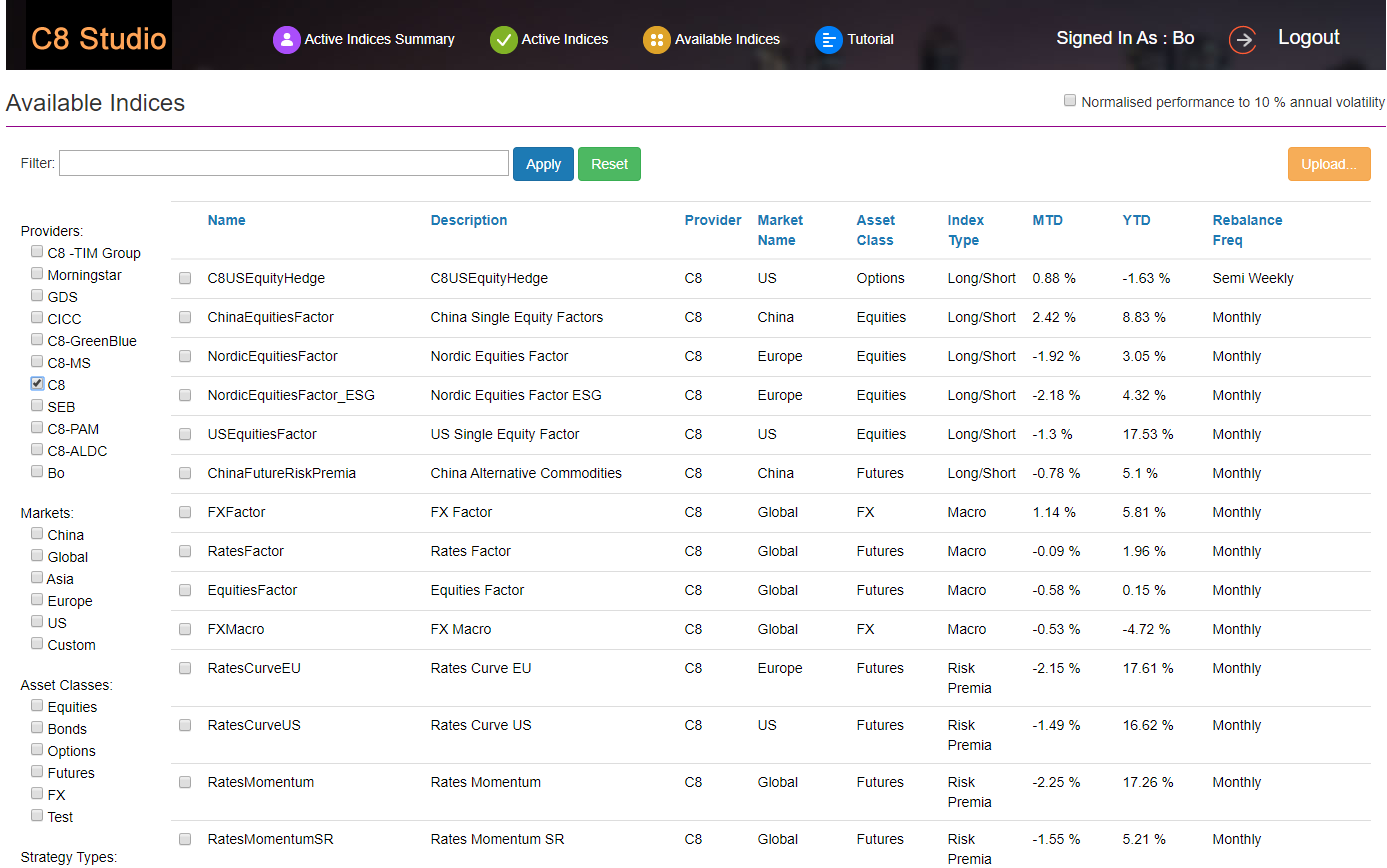

We provide our clients with C8 Studio, our research platform, and C8X, our execution platform, so that clients have all the tools needed to easily trade equities, FX, financial and commodity futures directly on-premise and using their own broker accounts. C8X integrates seamlessly with the Asset Owners current set-up, indeed, C8 can even advise on setting up an execution capability, if needed.

If the client can’t trade, C8 is working with Institutional Local Service providers that can execute for you using C8X. The service providers can set up cost-efficient local solutions such as structure products e.g. Swaps, Notes, Certificates or what is the best for the local market. C8X is the engine running behind these products.

Tradable Index Providers

Positions to hold in the underlying instruments of Index i.e Equities, Futures, FX, OTC is populated in C8X

Positions to hold in the underlying instruments of Index i.e Equities, Futures, FX, OTC is populated in C8X

Asset Owners

C8X will send the Buy/Sell orders of the underlying instruments. The fills are monitored and reported

C8X will send the Buy/Sell orders of the underlying instruments. The fills are monitored and reported

Asset Owner's Current Trading Partner

The Ecosystem

Providers

- C8

- S&P Global

- IHS Markit

- SEB

- Solactive

- Morningstar

- GreenBlue

- Ned Davis Research

- Stargazer Asset Management

- The Singularity Group

Markets

- Global

- US

- Europe

- China

- Asia

- Custom

Asset Classes

- Equities

- Bonds

- Options

- Futures

- FX

Strategy Types

- Long Only

- Long/Short

- Macro

- Alternative Risk Premia

- Statistical Arbitrage

- Trend Following

- ESG (Environment, Social and Governance)

About C8

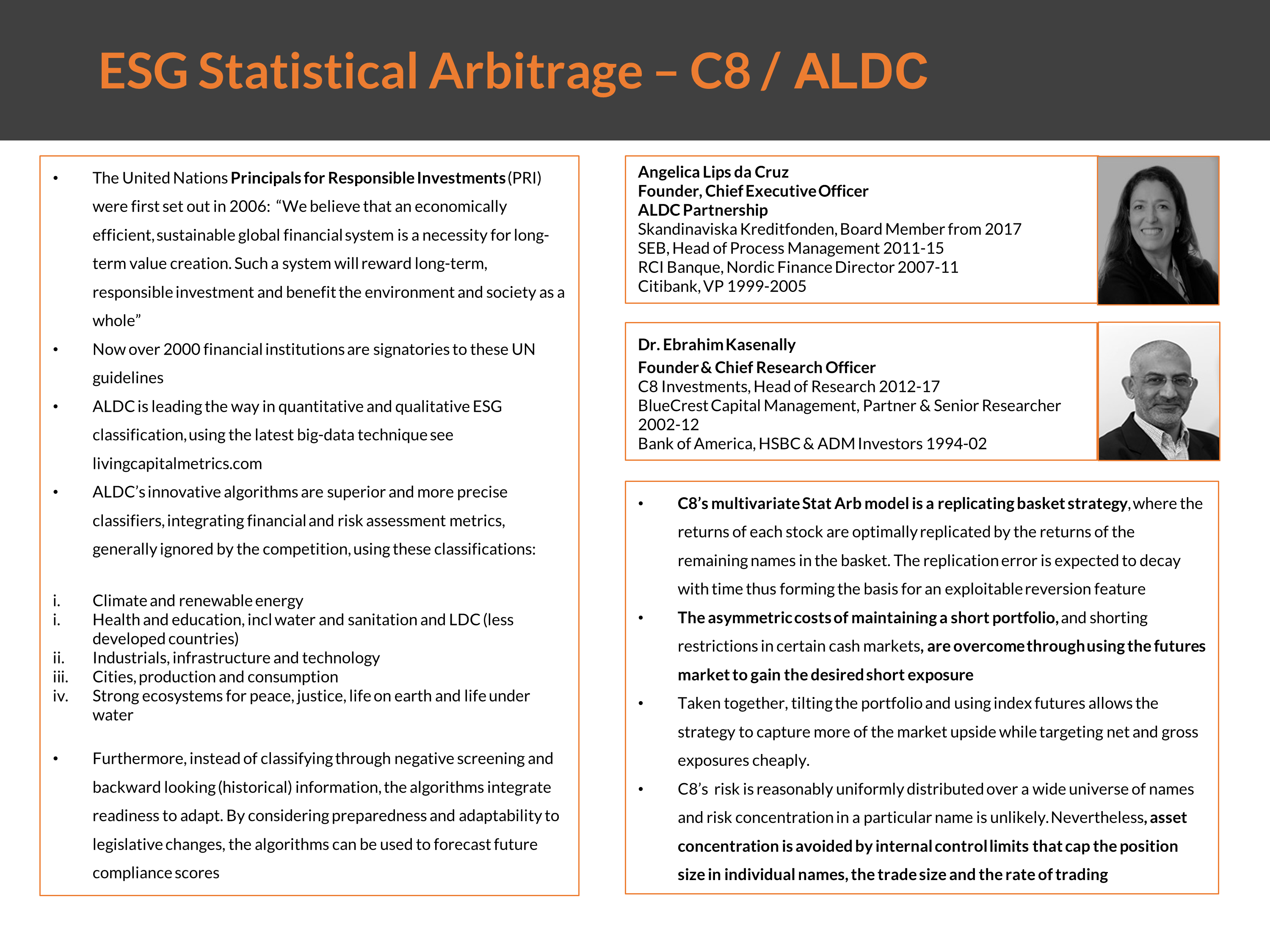

C8 was established in 2017 in London by Mattias Eriksson and Dr. Ebrahim Kasenally, previously partners and senior executives at BlueCrest Capital Management – one of the largest global alternative investment management firms. C8 combines decades of investment research, trading and technology experience.

Get in touch

London Office

Michelin House

81 Fulham Rd

Chelsea

London SW3 6RD

UK

Jersey Office

3rd Floor

One The Esplanade

St Helier

Jersey JE2 3QA

Stockholm Office

Riddargatan 30

114 57 Stockholm

Sweden

Ireland Office

Lee View House

13 South Terrace

Cork

Ireland

Shanghai Office

Room 3AN20

4F Kerry Parkside

1155 FangDian Road

Pudong District

Dubai Office

Level 4

Gate Village 10

DIFC Dubai

UAE

Hong Kong Office

Rooms 1101A-4

China Evergrande Centre

38 Gloucester Road

HK