|

C8’s Weekly Bulletin: Seasons Greetings!

22 December 2022 |

It has been another strong year for C8 Technologies, as we continue to expand and spread the direct indexing message worldwide. We could not have done it without you all, our clients, partners and friends. We are very grateful for all your support in sharing our journey and achievements. Thank you! May we wish you the season’s greetings and best wishes for 2023

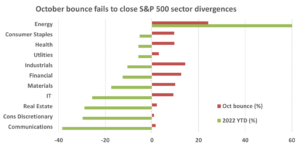

For our final issue of the year, we highlight the recent recovery in interest rate and bond markets, and in ‘long-only’ allocation strategies, both of which were hit hard in the first three quarters of 2022.

Bright Spots Amidst High Interest Rates

|

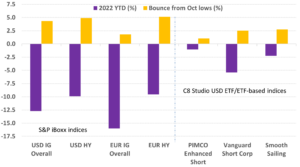

| The USD and EUR credit markets end the year on a more positive note amidst the downshift in the pace of Fed policy tightening. S&P’s iBoxx High Yield indices for both USD and EUR have bounced by around 5%, although they still post substantial declines (-10.0% and -9.5%, respectively) for the year as a whole.

Notably, the iBoxx high yield benchmarks have outperformed those for the broader debt market universe – whilst C8’s HY tracker portfolios have, in turn, outperformed these overall iBoxx HY benchmarks. Amongst the C8 Studio indices from external providers, those focused on short-term maturities have, unsurprisingly, posted the smallest year-to-date losses (the PIMCO Enhanced Short Maturity Active ETF has edged just 1.0% lower). Amongst the long only ‘whole bond market’ indices, the Smooth Sailing Tactical Multi-Sector Bond Index has posted a very modest -2.2% drop in 2022 – reinforcing its defensive status in adverse market environments (indeed C8 Studio reports a Sortino ratio of 3.3 for this Index).

While 2022 credit market losses may have been unwelcome for existing investors, they have substantially boosted yields for new entrants to these markets in 2023. HY benchmark yields are now double those prevailing at end-2021 (8.5% up from 4.3% in USD, 8.0% up from 3.1% in EUR) and carry may play a much bigger a role in supporting total returns in the year ahead. |

‘Long Only’ Portfolio Allocation Indices Recover

|

|