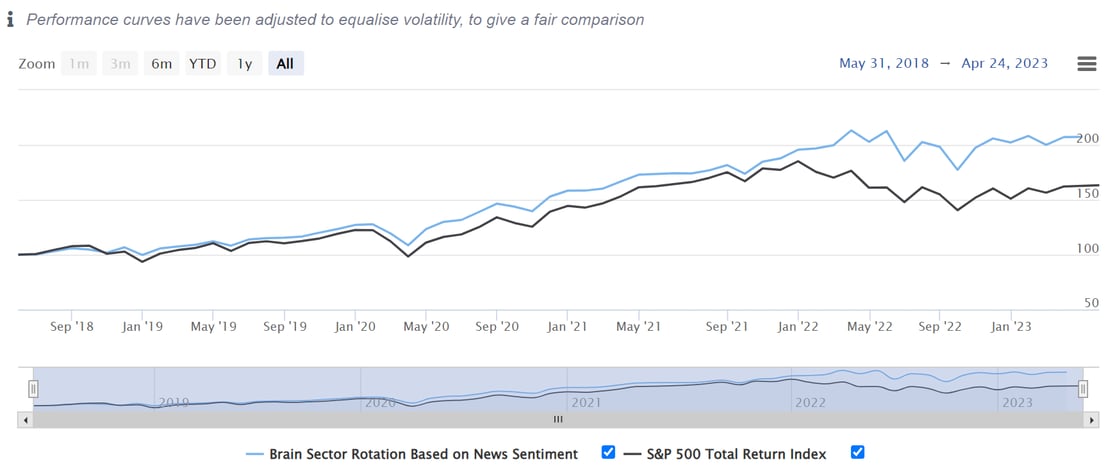

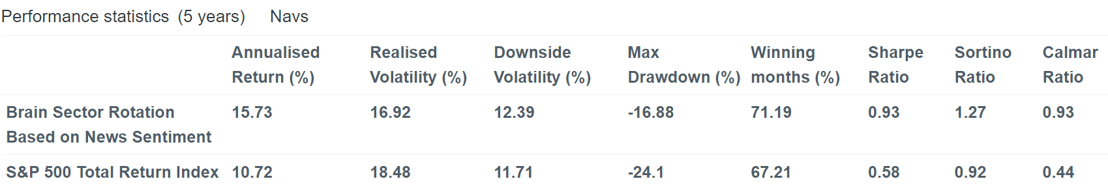

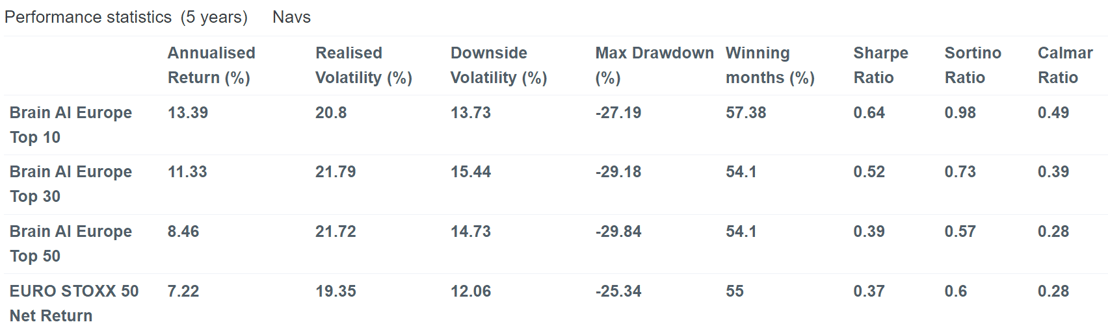

The C8 Weekly Bulletin returns after an Easter break with the announcement that Brain, an AI-driven research provider, has now joined the C8 platform. Brain has developed NODES; an integrated Artificial Intelligence Engine that combines Artificial Intelligence algorithms with proprietary Natural Language Processing techniques to process a large volume of external information.

Using NODES, Brain build alternative datasets, asset allocation signals and investment strategies, as well as Artificial Intelligence based products and services for the Financial Industry such as thematic selection or smart event-detection systems. Please find below two examples of the indices that can now be found on C8 Studio, do contact C8 if you would like to know more: