|

C8 are delighted that Arabesque has joined the C8 ecosystem. Arabesque have a well-respected ESG ratings business, S-Ray, as well as an innovative AI-driven investment allocation platform, combining both to be the world’s first AI ESG fund manager. We then illustrate how C8 Studio can be used to build a portfolio of their AI ESG indices. |

New Provider – Arabesque |

|

Arabesque have added eight long only equity indices onto C8 Studio: ESG

Non-ESG

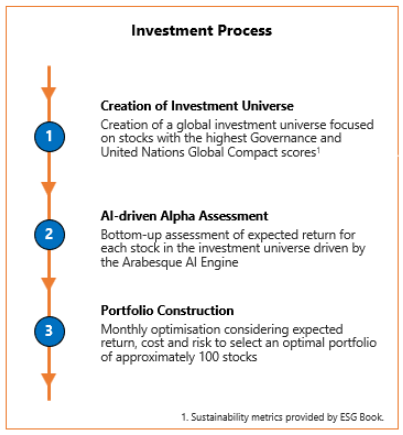

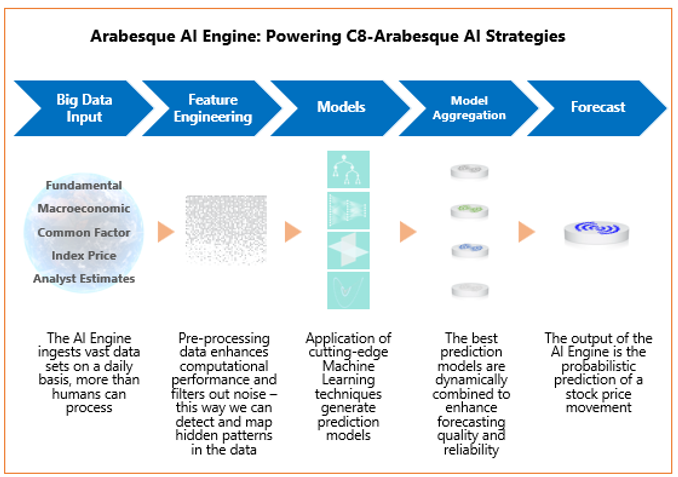

Arabesque Investment Process |

|

|

|

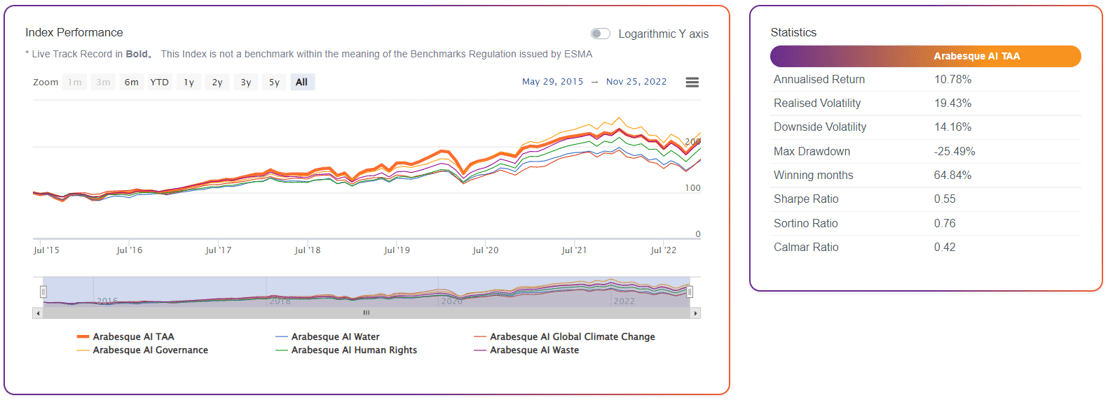

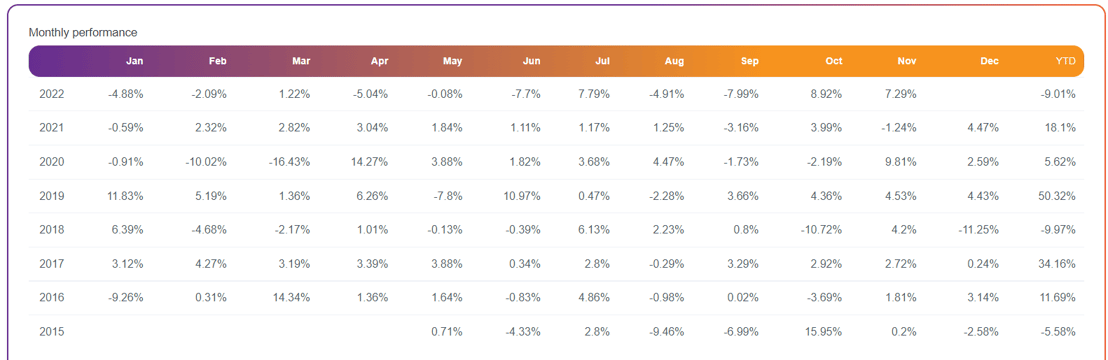

Combine Arabesque AI ESG Indices on C8 Studio |

|

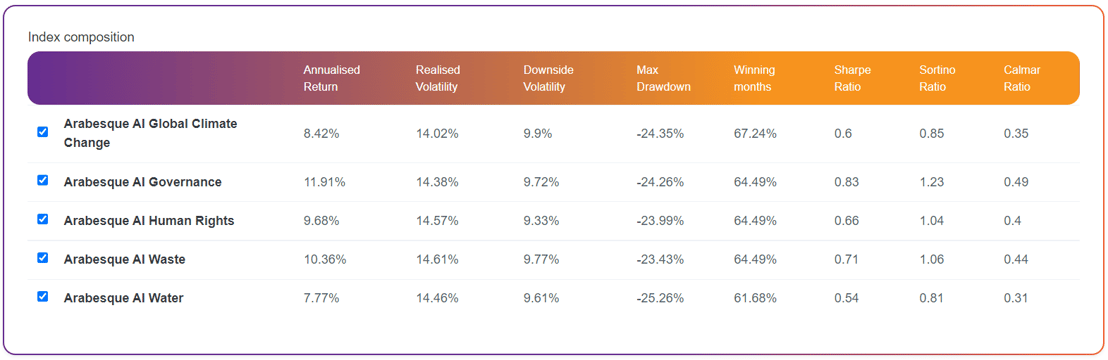

Selecting the five Arabesque Global ESG indices on C8 Studio, these indices can then be combined using C8’s proprietary methodology, Tactical Asset Allocation. For diversification we use a minimum of three of the five indices each year, the TAA combination produces returns close to the best performer without the benefit of hindsight. This analysis is done on a walk-forward basis which gives a realistic assessment of achievable returns (i.e. not just optimising past performance). |

|

|

|