Trendrating

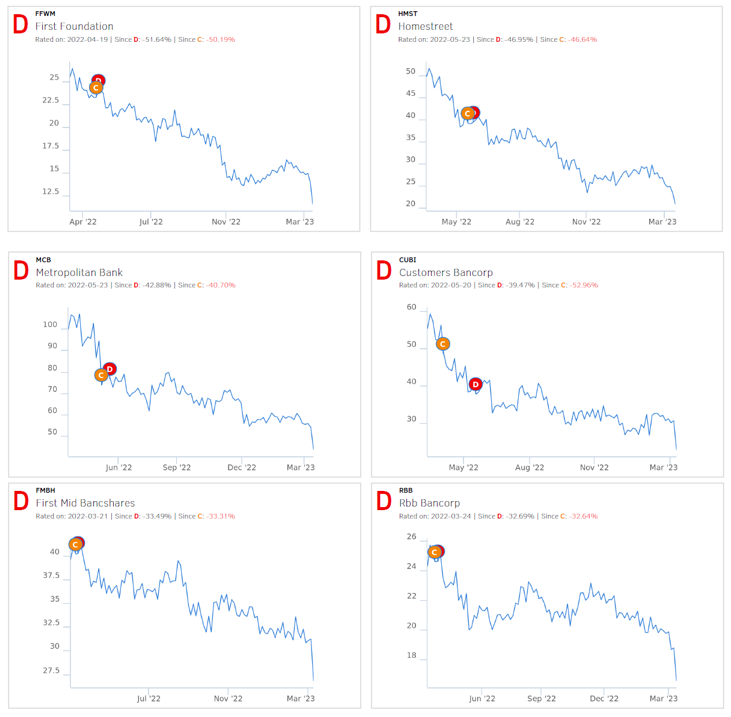

Trendrating (trendrating.com) gives a Rating Grade accompanied by other proprietary analytics which determine the duration, strength, and consistency of each company’s price trend.

The Rating Grade is derived from a self-adjusting algorithm that contains 8 technical indicators which were decided on after testing over 350 indicators across

15,000 stocks across 30 years of history. The model is updated at the end of each day with each security’s price, volume, and volatility. The model is designed for medium to long term investing, not trading.

Trendrating detect major shifts in money flow in either direction:

A = Confirmed Bull Trend

B = Emerging Bull Trend

C = Emerging Bear Trend

D = Confirmed Bear Trend

The top quartiles of A/B always outperform the top quartiles of C/D over our 10-year company existence.