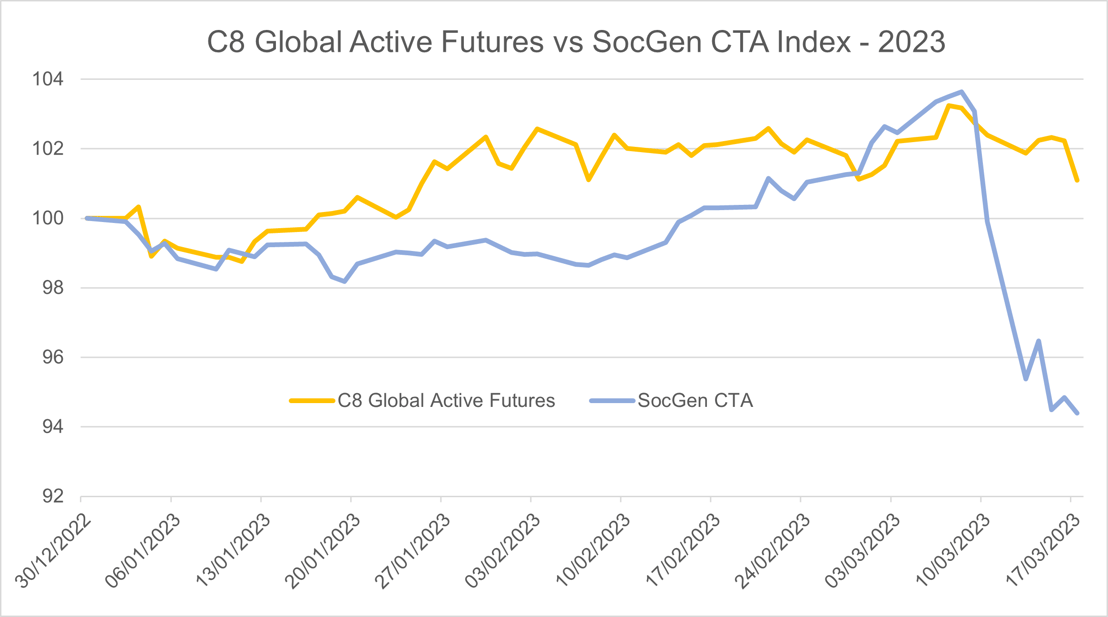

The first quarter of 2023 has been notable for its skittish financial markets. First, there was optimism that this year would prove calmer than 2022, followed by renewed concern about inflation and the impact of bond holdings in the US banking system. This culminated in the forced takeover of Credit Suisse at the weekend. Traditional trend-following strategies performed strongly in 2022, but these rapid shifts in sentiment have proved more difficult to navigate. The SocGen CTA index is down 6% year-to-date, and down nearly 10% in the past week.

Here is the good news! The C8 Global Active Futures index avoided this sell-off and remains up on the year. Why the difference? C8’s proprietary allocation process selects from a wide range of trend and counter-trend strategies, and is responsive to volatility levels, so adapts more readily to changing market environments.

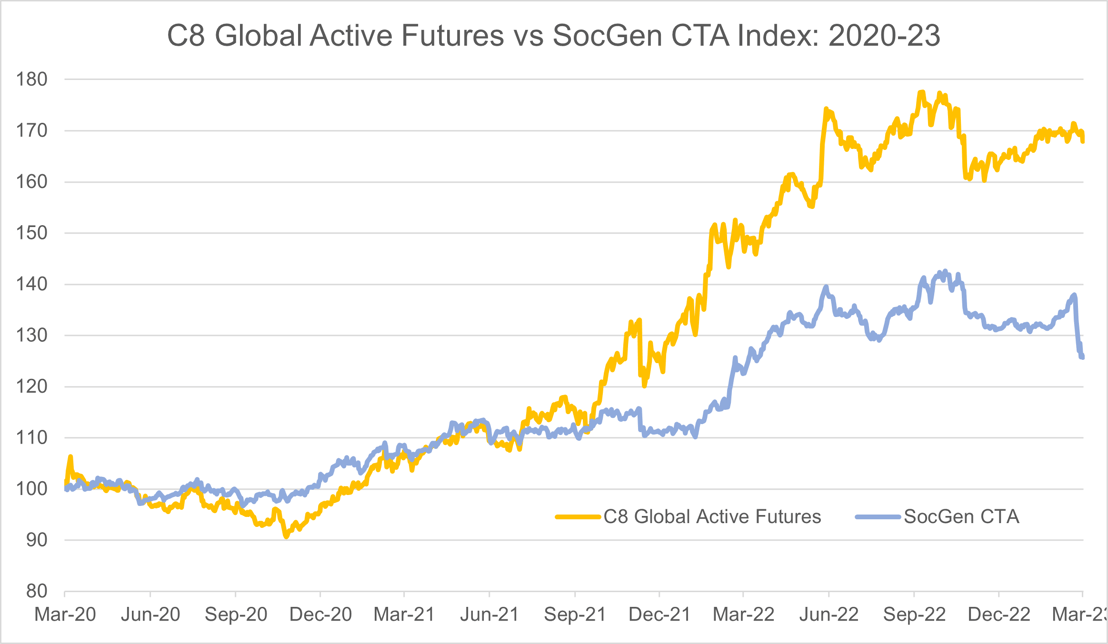

Indeed, this methodology has outperformed the SocGen CTA index by 40% over the past 3 years (up 68%, versus 26% for the CTA index).