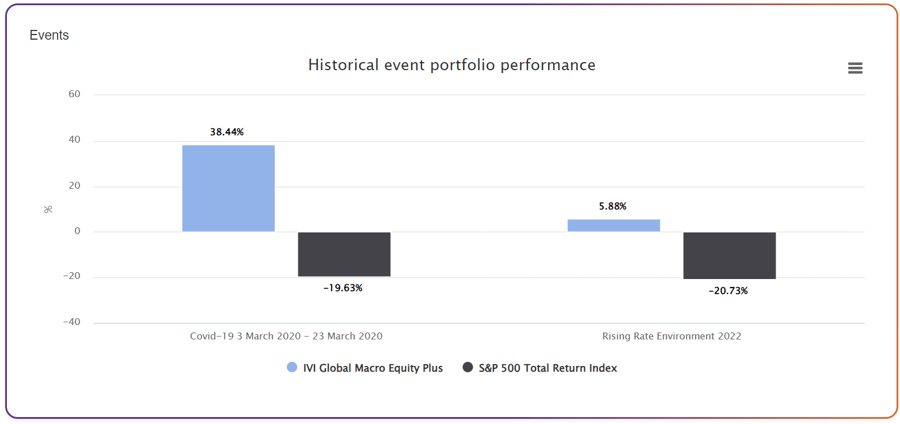

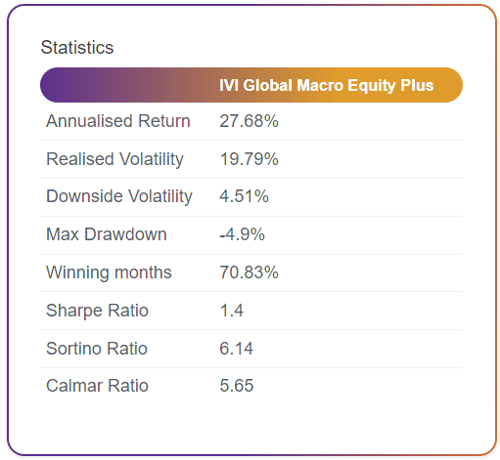

The negative correlation has kept the largest drawdown in this new index to 5%, despite the volatility of financial markets, with the annual return more than 5 times larger than the downside volatility (Sortino Ratio). Of course, this result has also been driven by the recovery in US stocks after each shock, however global macro positioning has historically provided protection even during longer-term equity declines.

Note that IVI charge no additional fees to add the S&P 500 position, in particular, any performance fee only applies to the Global Macro component. As an alternative, we would be pleased to demonstrate using C8 Studio to create a combination with one of the many excellent equity strategies on our platform.