Closing the USD Structural Short

FX Market and Strategy

The past month saw broad USD softness as markets priced the September Fed cut, with calmer rate volatility and record equities fueling risk appetite. EUR and GBP gained on narrowing transatlantic spreads and cautious BoE guidance, while JPY and CHF stayed heavy as yield gaps persisted. Commodity FX diverged: CAD underperformed on soft data and tariff battles, AUD and NZD struggled in August under dovish RBA/RBNZ rhetoric before bouncing back on improved risk environment. Scandies firmed, with SEK modestly ahead of NOK. LatAm FX led gains—MXN surged to multi-year highs on carry and positioning, while BRL advanced on restrictive Copom policy despite uneven growth. CNH appreciated with firmer PBoC fixings amplifying the broadly softer USD. Overall, high-carry and pro-cyclical currencies outperformed, low-yielders consolidated, and USD drifted lower as global risk sentiment stayed constructive.

Indications that corporates and asset managers are overweight USD exposures has been a key theme for Currency Compass since the start of this year, with important implications for USD exposure. As the chart below from the FT shows, a EUR investor would be underwater holding the S&P500 this year, with only small gains for a GBP-based investor.

Indeed, on the back of this, a well-known investor survey now has nearly 40% of fund managers looking to increase hedges against a weaker USD versus almost none worrying about a stronger USD. This may be a sign that the USD is now oversold, however, we disagree given the structural USD overweight that built up over a number of years with a belief in US ‘exceptionalism’.

C8 Currency Compass – Tracking our proprietary FX models

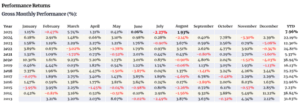

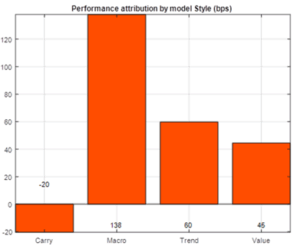

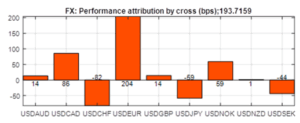

There was strong recovery to the FX strategy in August as the USD bounce proved short lived. The strategy gained 193bp, leaving it up just under 8% on the year so far. As can be seen from the charts below, the Macro model, in particular, regained lost ground, on weak US employment data (including major downgrades to previous months). In terms of currencies, it was the strength of the long EURUSD that created much of the month’s gain with performance mixed elsewhere.