C8 Currency Compass – “Don’t be a PANICAN” Pres Trump – April 2025

“Don’t be a PANICAN… GREATNESS will be the result” according to President Trump today, the financial markets are not yet convinced. The clearest explanation of what the US Administration is hoping to achieve is detailed in this excellent Money & Macro podcast:

https://www.youtube.com/watch?v=1ts5wJ6OfzA

In summary, there is a longer-term plan. Whilst the role of the USD as the key reserve asset has many advantages, it has also resulted in the hollowing out of US manufacturing, which has hit the Midwest hard. The conclusion of the podcast has a cautionary note: rebalancing goods trade with all trading partners means other countries simply removing tariffs on US imports will not be enough. Also, there is a longer-term trade off between the dollar’s reserve currency status and achieving these trade goals.

In line with this, Peter Navarro, one of the US president’s key trade advisers, reiterated yesterday that getting US tariffs removed is not as simple as removing any tariffs against US imports. For example, Vietnam announced at the weekend it would remove all tariffs against the US, after Trump imposed a 46% levy on the country. Navarro in an interview with CNBC noted that countries also needed to remove non-tariff barriers to trade. In particular, trans-shipping from China and dumping seafood and other goods was a major concern. Adding that the EU needed to look at removing VAT on US imports (no chance).

So, what does this mean for currencies going forward? After the tariff announcement, there was an initial USD drop on the risk that the US finds itself isolated, then a flight to the USD on risk aversion. Interestingly, our FX models, which have been bearish on the USD since the start of January, are broadly positive USD for April. In particular, reversing to short positions in AUD and NZD, which as commodity producers are most impacted by increasing recession risks.

In the medium term, the USD remains vulnerable, with a weaker USD seemingly a policy goal for the Administration, but, as the shock of the tariff announcements work through the markets, the USD can have a period of strength first.

Currency Focus: President Trump and Tariffs II

Pres Trump’s case for rebalancing goods trade flows has not been helped by the strange formula used to determine the tariffs to be imposed on each country. Calculating a price (tariff) from a flow (trade imbalance) will always be problematic, throwing up some strange results, not least large tariffs on the penguins of the Heard and MacDonald Islands.

This has overshadowed the real issue that the Administration wants to address, that the hollowing out of the US’s manufacturing capability is causing real economic problems in large parts of the US. To counter this, reshoring manufacturing is a key objective of President Trump’s second term.

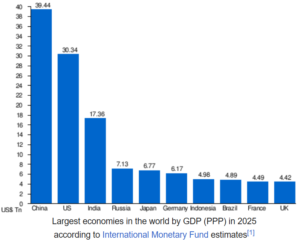

The risk for the US, compared to the Bretton Woods agreement in 1944, which created the USD-centered global system, is that the US is now only one quarter of the world economy in nominal terms, and, according to the IMF, only 16% of the world economy, behind China and in line with the EU, using purchasing power parity (i.e. taking account of relative price levels).

So, this radical approach has some risks: if the rest of the world simply moves on together, the US will quickly lose its leadership role, and reserve currency status, with the USD reflecting that. Therefore, Pres Trump’s ‘Art of the Deal’ will be key to determining the USD’s fate.