C8 Hedge – Currency Compass -The end of the implied USD equity hedge – May 2025

FX Market and Strategy

US tariff shenanigans continue to dominate the currency markets with President Trump now looking to dial back on tariff escalation as his ‘Sturm und Drang’ (Storm and Stress) approach failed to generate trade deals. Most notably the US and UK have finally agreed a deal (albeit a few years in the making), whilst China and the US will look for compromise in upcoming talks in Switzerland.

That being said, there is no return to the previous status quo. The US economy has to rebalance one way or another – gradually or traumatically. The US current account deficit has risen to $600bio (5½% of GDP), absorbing an unsustainably large percentage of the rest of the world’s savings.

Over the last month, the USD fell sharply as the tariff escalation backfired but has recovered ground as the search for some middle ground begins. Interestingly, our FX models are now broadly neutral USD, after the recent USD moves, having been negative USD at the start of the year. This seems broadly fair, with the USD lower but risks are more balanced over the next month. However, US growth is still at risk, if more balanced trade is achieved.

Importantly, European investors now own 15% of US stocks, whilst they have reduced EURUSD and GBPUSD hedges over the past 4 years, as any risk aversion from lower US equities has driven EURUSD lower – being underhedged counterbalances US equity returns. However, this did not work last Summer and the USD has been notably weak during the recent equity sell-off (see full discussion overleaf). With this correlation reversed, we note that European investors now find themselves underhedged their US equity exposure.

It has been a volatile month for FX however the USD held key levels and recovered from the lows as US trade policy has become more measured. The longer-term risks remain for USD, as the Administration attempts to rebalance the US economy, whilst positioning is structurally long USD.

Currency Focus: The end of the implied USD equity hedge?

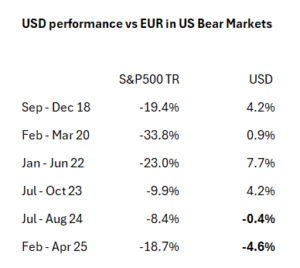

Why hedge US equity exposure when the USD tends to rise on a US equities sell-off . This is illustrated in the table to the right and has been well understood by foreign investors into US markets.

However, the breakdown in this correlation has been painful for these investors this year, adding to their losses, with equities, bonds and USD all down on the back of Trump trade policy. Risk-off was generated by the US Administration, so has had a different impact. The chart below shows that overseas US equity buyers have limited FX hedges, falling from around 40% pre-Covid to a little over 20% now. These hedge ratios will need to rise again.