C8 Hedge – Currency Compass – August 2025

FX Market and Strategy

The dollar’s renewed strength in recent weeks marks a tactical repricing—driven by improved sentiment around U.S. policy and trade—but broader macro uncertainty and overextension leave its longer-term downtrend intact. Safe-haven and Scandinavian currencies outperformed, while commodity-sensitive FX underperformed on the back of dovish central banks. The EUR, JPY, and CHF continue to benefit from diversification flows (see our May edition), GBP held up better than expected amid structural challenges, and CAD remains relatively resilient in a shifting global landscape.

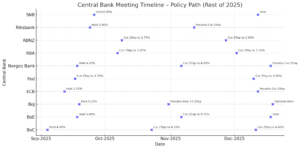

Looking forward, G10 monetary policy is diverging (see chart below). In particular, central bank comments suggest more aggressive cuts in Australia and New Zealand, whilst the Fed, following poor US employment data, remains under tremendous pressure to cut rates from the Trump administration. In contrast, rate cuts in Europe will be more gradual. In the near-term this combination favours the EUR, and even the GBP, despite the UK’s fiscal challenges.

C8 Hedge ratios for August have been broadly neutral across the board against the USD, with a small overweight for the AUD and large overweight for the CAD being the only notable hedge positions. Both positions started well but the recent news flow has not been as positive. It is notable that after capturing the weak USD at the start of the year, our hedge ratios are much more balanced now.

C8 Currency Compass – Tracking our proprietary FX models

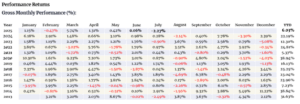

It was a tricky month for the Currency Compass strategy as the USD recovered lost ground, as the imposition of US tariffs was not as harsh as feared . Over the month, the model gave back 227bp, leaving the strategy up 6.03% on the year. We have had a solid run in the first half of the year, so some correction is not surprising.

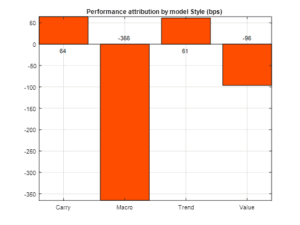

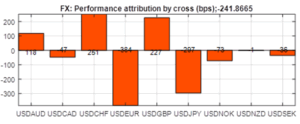

As can be seen from the table below, the losses are attributable to the macro model, as the US trade tariffs end game caught the FX market by surprise. In terms of currencies, it was a reversal of the long EURUSD and short USDJPY that did the damage on the month (though to be fair these currencies pairs have also been standout performers for Currency Compass in 2025).