C8 Hedge – Currency Compass – Focus on our Systematic FX Models and Brazil – July 2025

FX Market and Strategy

The news flow impacting FX markets has been driven by shifting US tariff proposals whilst focus also moved onto the US government’s large fiscal expansion. Over the past few weeks, USD has regained some losses as expectations grow that the Fed will pause rate cuts amid solid U.S. data. This boost has seen USDJPY higher, pushed EUR and GBP lower, and nudged USDCHF and USDCAD higher. JPY’s weakness has been intensified by political risks as the government loses its Upper House majority, on the back of higher inflation. For the first time in 70 years, the LDP now controls neither chamber in the Diet. Sterling has fallen against most currencies on the back of weak economic data and lax fiscal policy. The Swiss franc has held up better, acting as a safe-haven anchor. AUD has weakened amid concerns around slower world growth from US tariffs whilst the CAD has lagged as the US once again threatens Canada with 50% tariffs on steel and aluminium and steel and 35% tariffs on everything else.

Looking forward there is a new deadline for the imposition of US tariffs on 1 August. So far, the USD has not been much impacted given better than expected inflation data, despite the tariffs, with financial markets still hopeful that the TACO trade (Trump always chickens out) remains on track for 1 August. We believe that there is too much complacency on both issues as the inflationary impact of tariffs will take time to work through (given stockpiling ahead of time) whilst it is less likely that the 1 Aug deadline will be pushed further out again.

Our FX models performed well in June on initial USD weakness, whilst also capturing the particular issues in the UK, proposing that sterling risks should be fully hedged. In July, the models remain mixed, though now with an overall USD negative bias. We are more negative on GBP and AUD whilst becoming more positive on JPY and NOK.

Going forward, our Currency Compass monthly will include insight into our FX model output to gives a flavour around how the underlying models are performing (see next page). Please note our FX models (and hedge ratios) have been designed to capture longer-term FX trends, so we do not put too much weight on any one month’s performance.

In Brazil, strict capital controls have been loosened allowing Brazilian residents to now invest overseas, whilst it is an attractive consumer market to foreign corporates. High interest rates in Brazil complicates FX hedging, we investigate how C8 Hedge ratios add value to this hedging decision.

C8 Currency Compass – Tracking our proprietary FX models

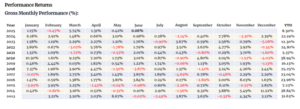

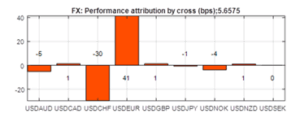

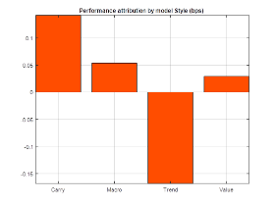

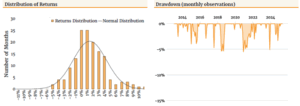

As we have discussed, C8 Hedge has been developed on the back of our long-standing, battle-hardened systematic FX models, currently active in the FX markets. After a strong gain of 8.3% in the first half of the year, the strategy was broadly flat in June. This follows a robust 22.2% gain in 2024. On the month, EUR was the strongest outperformer and CHF the underperformer, whilst in terms of FX model style, carry outperformed and trend underperformed (reflecting the USD reversal through the month). Our Currency Compass strategy is available directly as a model portfolio or managed account, as well as driving the underlying hedge ratios for C8 Hedge.

C8 Hedge: Managing Brazil Exposures

Brazil is the world’s 7th largest country by population and the 10th largest economy. Strict capital controls have been loosened allowing Brazilian residents to now invest overseas, whilst it is an attractive consumer market to foreign corporates. To make the hedging decisions more crucial, higher rates in Brazil, at 14.75%, are the highest in nearly two decades. There can therefore be a high cost from getting the hedging decision wrong, especially given the current antagonism between Brazil and the US.

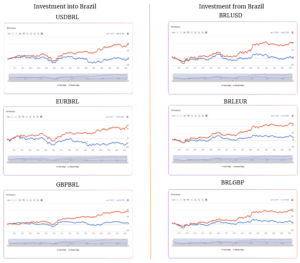

Below, we highlight the performance of C8 Hedge ratios for a number of Brazilian Real (BRL) currency pairs. On the left, from the hedging perspective of an investor/ corporate with exposure to the BRL. On the right, from the perspective of a Brazil-based investor buying USD, EUR or GBP denominated assets.

As can be seen from the charts below, C8 Hedge can typically add 2-3% extra returns per year from BRL exposure whether based in Brazil or offshore.