C8 Hedge – Currency Compass – Manage Currency Balances with C8 Hedge – June 2025

FX Market and Strategy

The ever-greater escalation of US Tariffs has been pushed into the long grass, having resulted in few notable gains for the new US Administration. The move has spawned the unfortunate acronym, the TACO (Trump Always Chickens Out) trading strategy, the new FOMO strategy for retail investors. However, it is too early to call an end to trade hostilities with the accumulated imbalances in currencies (see last month’s Currency Compass ‘The end of the implied USD equity hedge’) also suggesting that a return to the old (calmer) FX world is unlikely. Nevertheless, expect a relief trade now that President Trump has started ‘old-fashioned’ trade negotiations.

In line with calmer financial markets, our FX models see more balanced risk for the USD, though we note an increasing dispersion amongst the major currencies. C8 Hedge favours EUR and JPY against the USD whilst expecting the GBP, NOK, CHF and NZD to weaken. Our hedge ratios are, on balance, positive EUR crosses, and mixed for GBP. However, the strong USD negative, GBP positive story that C8 Hedge captured at the start of the year has now run its course.

Of note is the ongoing US/ China trade negotiations currently taking place in London. We believe that the Chinese delegation feel they have the upper hand given the demand for their rare earth exports, and US retailers’ upcoming Xmas buying season which will quickly become a political issue if general China exports are not resumed. Recent announcements back this up.

Looking ahead, there is a G7 meeting this weekend followed by central bank meetings the following week with the BoJ (Tues), FOMC (Weds) and BoE (Thur). Expect no change in rates at the first two meetings, given recent rate moves and as the FOMC and BoJ monitor the ongoing trade situation. However, analysts have mixed views for the Bank of England meeting. We are firmly in the camp that rates will remain on hold at 4.25%, due to inflation risks from strong wage growth and higher taxes, whilst the upcoming release of the Bernanke BoE policy review also suggests waiting.

Overleaf, we introduce C8 Hedge’s new Cash Balance tool. Businesses typically hold cash balances in multiple currencies, for upcoming payments and on a precautionary basis. Using the same underlying FX models that generate our recommended FX hedge ratios, C8 can provide guidance on the best currency/ies to maintain excess cash balances. An opportunity to boost returns by adding C8’s input to this important question

C8 Hedge Upgrade: Manage Cash Balances

All corporates and asset managers hold cash balances, to cover upcoming outgoings and, in reserve, an excess balance, for example, in case of fund redemption. A corporate or asset manager will build excess balances as they randomly accrue in various currency accounts, we propose managing these cash balances in a more systematic way.

As regular readers will know, C8 Hedge is designed to add value to the FX hedging process by modelling key drivers of FX markets: fundamental, trend, carry and value. Importantly, these key drivers can be just as easily used to optimise cash balances. Hold excess cash in currencies that are likely to appreciate on a total return basis (combining spot movement and interest carry).

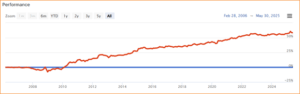

Below is an example where a EUR-based investor or corporate has balances in USD, GBP, CHF, NOK and SEK. Rebalancing excess balances each month would have generated over 2% additional annual return on cash balances in the past 20 years.

We will be adding this new functionality to C8 Hedge in the next few weeks, please let us know if you want to know more.