|

INNOVATIVE TRADING I COST-EFFICIENT I FULL CONTROL I TRULY GLOBAL I TRANSPARENT & ETHICAL |

C8 Monthly Update – China Reform and C8 China Indices – Oct 2020 |

|

|

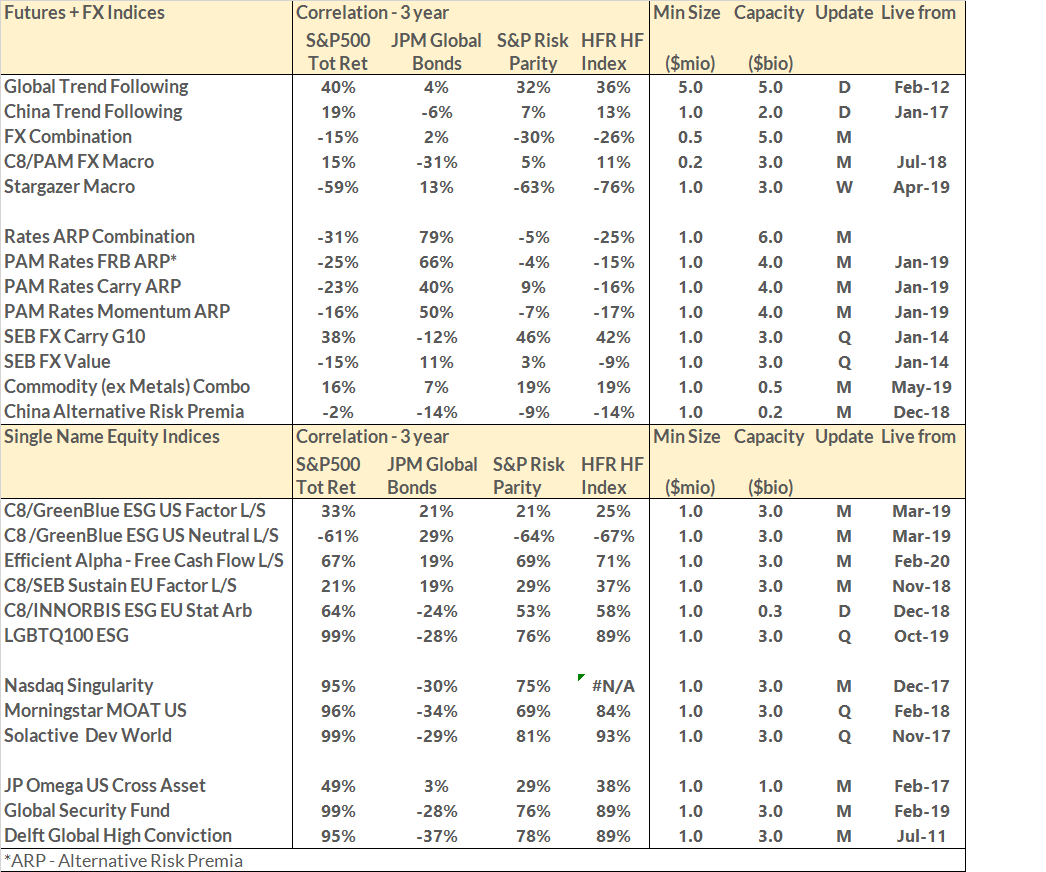

China Financial Market ReformsIt has been long expected that the Chinese financial markets would open up to foreigner investors. US/China trade disagreements may have put paid to that last year but, on 1 November, there will be a major reform of capital inflow restrictions in China. Since 2002, foreign investors have been able to access Chinese markets with an allocation from QFII or CNY-denominated RQFII schemes to trade Chinese stocks and bonds. This has been followed by the China Connect programmes making the process even more straightforward. However, many restrictions remain. For example, foreign trading in the Chinese domestic futures markets had to be purely for hedging, not speculative, purposes and there was no access to IPOs and other primary issuance channels. In addition, short sales and stock lending were not allowed nor was investing in Chinese alternative fund managers. On 1 November, much of these restrictions will be swept away, which will have two major implications for C8 clients. First, C8 has been active in Shanghai for four years, bringing our cutting-edge trend following and risk premia techniques to the domestic futures market. This will now become directly available to our non-Chinese clients (see below). Second, C8 clients will be able to track the performance of any Chinese index, e.g. passive or smart beta, or indeed a Chinese asset manager, without needing to allocate, by implementing C8’s Direct Indexing solution. The link, below, from the financial markets department at Simmons and Simmons gives a good overview of the changes: |

C8 China Commodity Futures Indices Available Offshore |

|

|

|

|

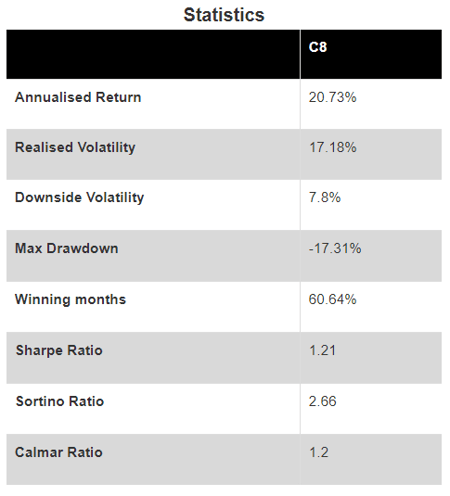

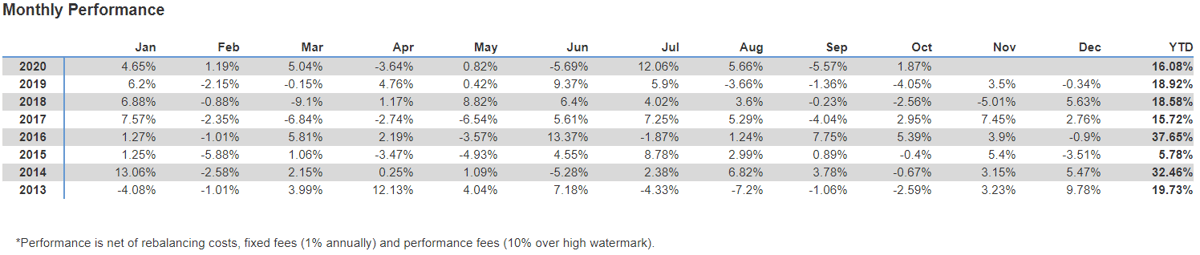

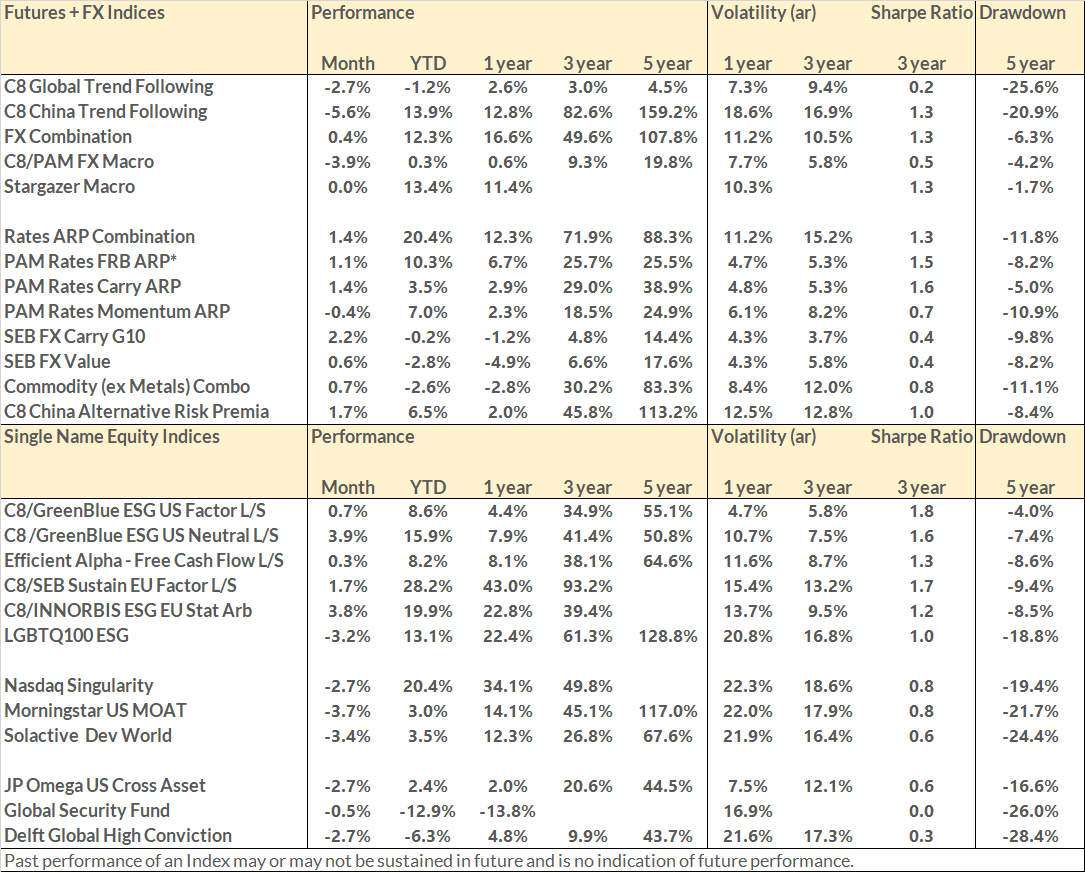

The C8’s China Trend-Following Futures Index now has a three year live track record. The charts, above, illustrate how the Index has recorded around 18% annual gains since inception, and there is little correlation to the performance of non-Chinese markets. Indeed, in China, C8 can also facilitate the execution of the underlying instruments on a client’s behalf, making it straightforward to enter the world’s second largest financial market. We would be happy to discuss these exciting developments further with any interested clients. |

|

|

FX Hedge Fund ExpoJon Webb, C8 COO, is speaking at the FX Hedge Fund Expo this Wednesday, 28 October, 1pm – 2pm (UK Time) on Panel 2: Technology for Currency Hedge Funds. He will be discussing the C8 Direct Indexing solution that allows asset owners to track hedge fund’s FX strategies themselves, by trading the underlying instruments, rather than having to allocate. This not only has many advantages for the allocator but also allows HF managers to focus solely on their FX strategy, avoiding all the time and expense of HF operational issues. The conference is free for market participants, please see the link below for more details, and to register: |

Solactive WebinarMattias Eriksson, our CEO, will be speaking at 3pm (UK time) on Thursday, 5 November on a Solactive webinar to discuss C8’s Direct Indexing solution. He will be discussing Direct Indexing but also some of the exciting new developments at C8. Please let us know if you would like to join the call. We can send through access details nearer the date. |

|

Thanks for reading, The C8 Team |

Sep 2020 PerformanceSeptember was a difficult month for equity indexes as the bounce back in equity markets came to an abrupt end. However, our ESG equity L/S indexes performed well in the selloff, with the C8/GreenBlue US ‘Good Governance’ Neutral Index and the C8/SEB EU Sustainability Index showing good gains, leaving them up 16% and 28% ytd respectively. Risk Premia continues to perform well with our FX Combination now up 12% ytd and the Rates Combination up 20%. |

|

|

|

|

|

|

| C8 Technologies, Michelin House, 81 Fulham Road, London, SW3 6RD, UK, +44 (0) 20 3826 0045 |