|

INNOVATIVE TRADING I COST-EFFICIENT I FULL CONTROL I TRULY GLOBAL I TRANSPARENT & ETHICAL |

C8 Monthly Update – Is Trend Following Back? – February 2020 |

|

|

Is Trend-Following Back?There was a period of under-performance in trend-following strategies (from around 2015-2018, though notably not in our China commodity futures index). This culminated, in early 2019, in a number of the well-known systematic houses such as Renaissance Technologies, Winton and Man Investments downplaying the future role that trend-following would have in their investment approaches. Multiple articles in the press at the time attested to the end of the trend-following e.g. https://www.bloomberg.com/news/articles/2019-03-01/one-of-wall-street-s-most-popular-trading-strategies-is-now-failing a chart from the article is below: |

|

|

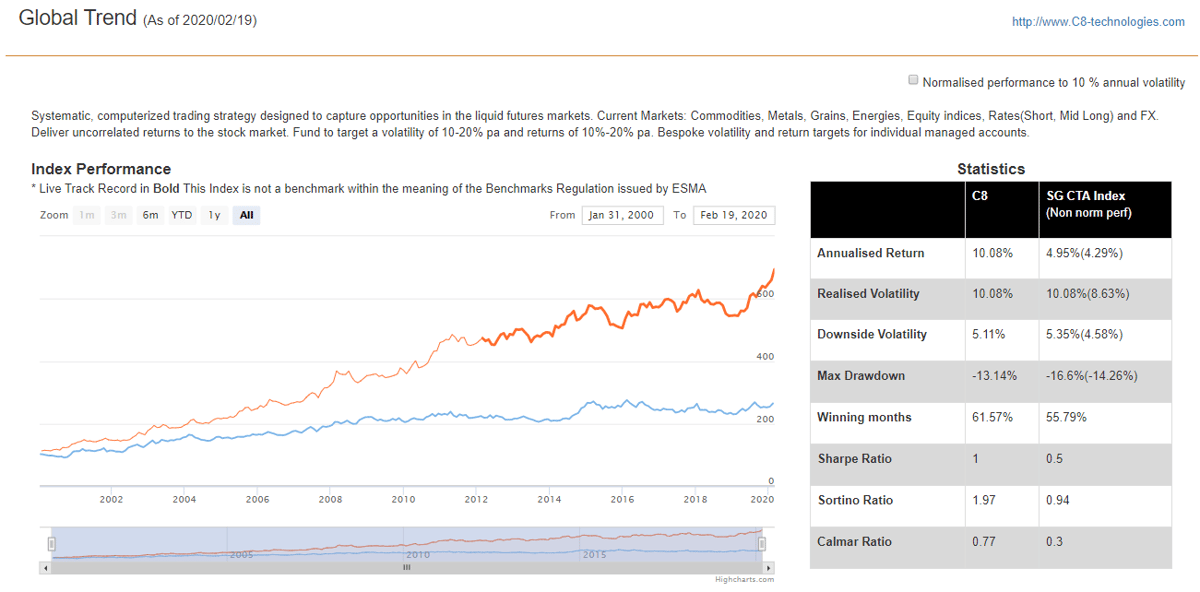

As often seems to be the case, this general ‘throwing in the towel’ marked a return to profitability in our long-standing Global Trend-Following index. As the chart below shows, not only was 2019 up 18.7% but 2020 has started strongly, up 7.1% ytd. Not surprising given that our founders’ background was as senior team members of the Bluetrend hedge fund, our Global Trend-Following Index is C8’s longest running Index, running out of sample since 2012. It is worth pondering whether the recent out-performance of trend-following is indicative of a return to a more unstable investment environment, which is typically favourable to this approach. |

|

|

|

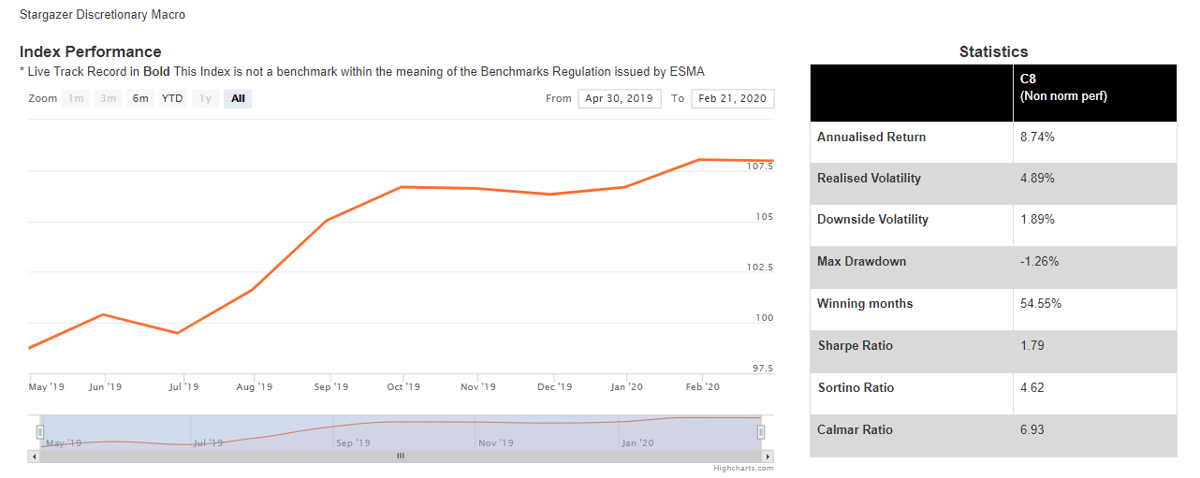

Stargazer Discretionary Macro Index Joins the C8 PlatformWe are pleased to announce the addition of a Discretionary Macro Index to the C8 platform, from Stargazer Asset Management, which was set up by Eric Fill. The Index has a daily rebalancing (though actually trades less frequently) and only uses listed financial futures and options. Whilst Stargazer has only been live for 10 months, Eric has a vast experience in macro trading as a macro hedge fund manager for Graham Capital and Diamondback Capital, amongst others. The environment for discretionary trading has also been improving with macro funds rising 6.4% last year, the best performance since 2014, according to Bloomberg data. As the chart below shows, the Stargazer Macro Index has made a strong start, with Eric catching the bond rally and correction through last year. |

|

|

In addition, Eric has made his weekly macro overview available in the C8 Studio Knowledge Hub (see Jan Update for details). This gives an insight into Stargazer’s current macro market views, whilst also reviewing the current macro backdrop and upcoming events. From my background in macro research and trading, I can confidently say this piece offers real insights into what are the current and potential macro drivers in the financial markets. |

|

|

|

C8’s Unique Platform now Covered by Patent Protection.The C8 platform is unique, and we are proud to announce that we have put in place strong patent protection around our innovative technology. An international patent application covering our core technology has recently been filed, which will result in patent protection for the C8 platform all around the world. We, at C8, are very excited by this development. |

|

|

|

|

Thanks for reading, The C8 Team |

January 2020 PerformanceThe more unstable macro environment left the Fixed Income Indices up markedly in January, with our Rates Alternative Risk Premia up a notable 5.7% on the month. The Trend-Following Indices, Global and China, made a strong start, as noted above, whilst both FX and commodity combinations made gains. It was a different story for equities hit by increased geo-political risks, though, not surprisingly, the Global Defence and Security Index rose by 7% whilst our C8/GreenBlue Good Governance US equity L/S made gains, in the flight to quality. |

|

|

|

|

|

|

| C8 Technologies, Michelin House, 81 Fulham Road, London, SW3 6RD, UK, +44 (0) 20 3826 0045 |

|