C8 Monthly Update – Solactive Joins C8 Studio – April 2020 |

|

|

Solactive adds their Global Benchmark Series and ESG IndicesWe are delighted to announce that Solactive AG has joined the C8 platform. Solactive is an innovative index provider that focuses on the development, calculation and distribution of tailor-made indices across all asset classes. As at January 2020, Solactive AG served approximately 400 clients in Europe, America and Asia, with approximately USD 200 billion invested in products linked to indices calculated by the company globally. Solactive AG was established in 2007 and is headquartered in Frankfurt. They have added their Global Benchmark Series and some ESG Indices. Solactive Large & Mid Cap Benchmark Index The Solactive Global Benchmark Series is Solactive’s largest index family. It provides investors with a comprehensive framework of indices covering the global stock market. This index family includes individual benchmark indices for 23 developed market countries as well as a compound index covering the performance of the top 85% in terms of free-float market capitalization of all the 23 developed countries. This flagship index is now tradable on C8 Technologies’ platform giving investors access to a broad universe of global stocks and underlyings. Solactive ESG Indices Two series of Solactive ESG Indices will be available on C8 Technologies’ platform: the Solactive ISS ESG Screened Index Series and the Solactive ISS Prime Rated ESG Index Series. Both index families originated in close collaboration with major ESG provider ISS ESG and are based on the Solactive Global Benchmark Series, discussed above. Using the C8 platform allows for full transparency on the underlying asset holdings, which combines perfectly with this ESG approach, so we are pleased to add these new indices. The Solactive ISS ESG Screened Index Series aims to track various size and regional segments of the global capital markets, including only companies that have a record of low involvement in controversial areas, according to market standards on ESG controversy screens. Solactive ISS Prime Rated ESG Index Series applies even more severe norms-based and activity exclusion criteria. More importantly though, it selects companies based on an absolute best-in-class approach, including only companies fulfilling ambitious absolute ESG performance requirements. |

|

|

|

|

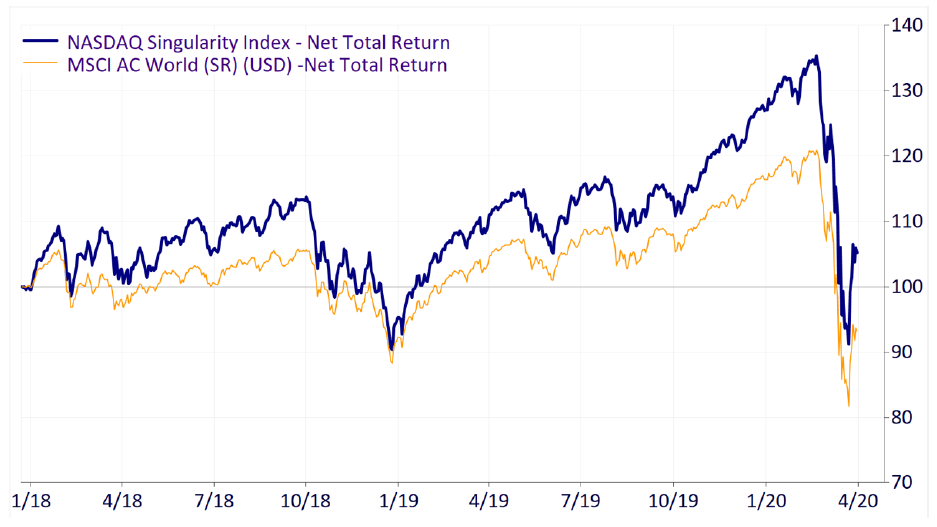

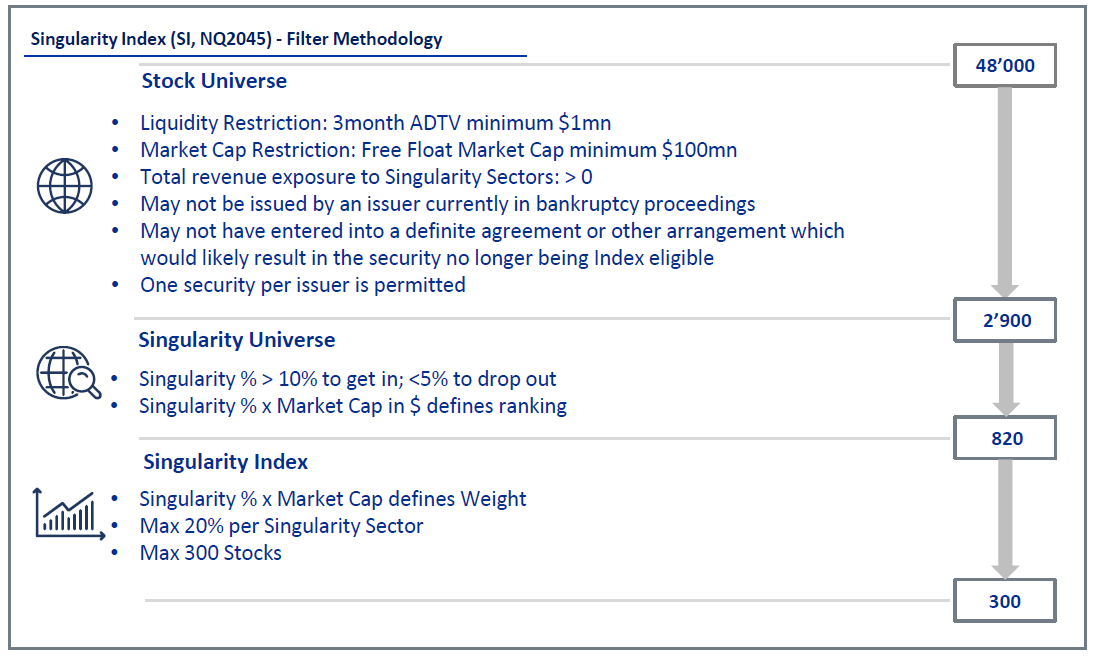

The Nasdaq Singularity Index is now available on the C8 PlatformThe Singularity Group (TSG) aims to make exponential innovation investable. They have defined a new classification system for equities that allows them to filter for the Singularity Universe: a set of listed companies across all countries and industries, contributing to and benefiting from exponential innovation in 12 Singularity Sectors including Artificial Intelligence, 3D Printing, Big Data, Bioinformatics, Blockchain, Internet of Things, Nanotechnology, Neuroscience, New Energy, Robotics, Space and VR/AR. The key element is that the methodology uses actual revenue generation from innovation rather than a more typical focus on headline announcements. The Nasdaq Singularity Index has so far outperformed its benchmark (MSCI World) by around 15% over the past two years. |

|

|

The Nasdaq Singularity Index is a global, all-sector strategy based on a unique methodology (see chart below) able to capture exponential innovation globally. Companies from all conventional sectors and industries are weighted according to their revenue exposure to Singularity (e.g. Adidas at 21%, Alphabet at 33%), resulting in a high level of diversification away from the technology sector. |

|

|

|

|

|

C8/GreenBlue Good Governance Certificate PerformanceThere have been a number of requests to dig deeper into the causes of the large outperformance of the C8/GreenBlue Good Governance Certificate which remains around par, versus a 22% drop in the S&P 500 benchmark. We discussed, in the monthly report, evidence in stock selection performance that well-governed stocks tend to attract ‘safe haven’ flows, with few of the large S&P 500 underperformers in the long portfolio. However, leverage plays an important part as well and, to explain that, we refer to the wise words of C8’s Strategic Advisor and trusted friend, Tim Bell (who built the advisory hedge fund business of UBS Wealth Management). “When I was an allocator, I focused far more on the long/short ratio rather than the net exposure. It also goes a long way to explaining why the certificate has done so well in March, despite its net long exposure. Here is why: There was a famous example put out by Lee Ainslie of Maverick about 25 years ago, who was a protégé of Julian Robertson at Tiger. Maverick was renowned for running at 50% net long, but the portfolio construct was typically 150% long and 100% short, or thereabouts. What Ainslie focused on was not the net exposure but the long/short ratio. At 150% long and 100% short, the long/short ratio is 1.5:1. He then cited the example of a hypothetical hedge fund which might also run at 50% net long but without deploying leverage, therefore by definition 75% long and 25% short, for 100% gross. It therefore would have a long/short ratio of 3:1. Why does this matter? Ainslie gave an example of where the market falls by 15%, but where both managers are skilled and manage to add 5% alpha on both the long and short sides of the portfolio. So: In the case of Maverick at 50% net long: Long book: 150% x -10% = -15% Short book: -100% x -20% = +20% = +5.0% return In the case of the other fund operating without leverage at 50% net long: Long book: 75% x -10% = -7.5% Short book: -25% x -20% = +5.0% = -2.5% return A fuller explanation can be found here. Of course, if the manager does not turn out to be skilled and has negative alpha, the leverage will hurt more. But that is not what skilled investing is about.” So, in conclusion, the outperformance in the good governance long portfolio was amplified by the leverage (in March at 256% long versus 217% short), such that the Certificate’s value remained around par despite a long bias and the drop in the S&P. |

|

|

|

Thanks for reading, The C8 Team |

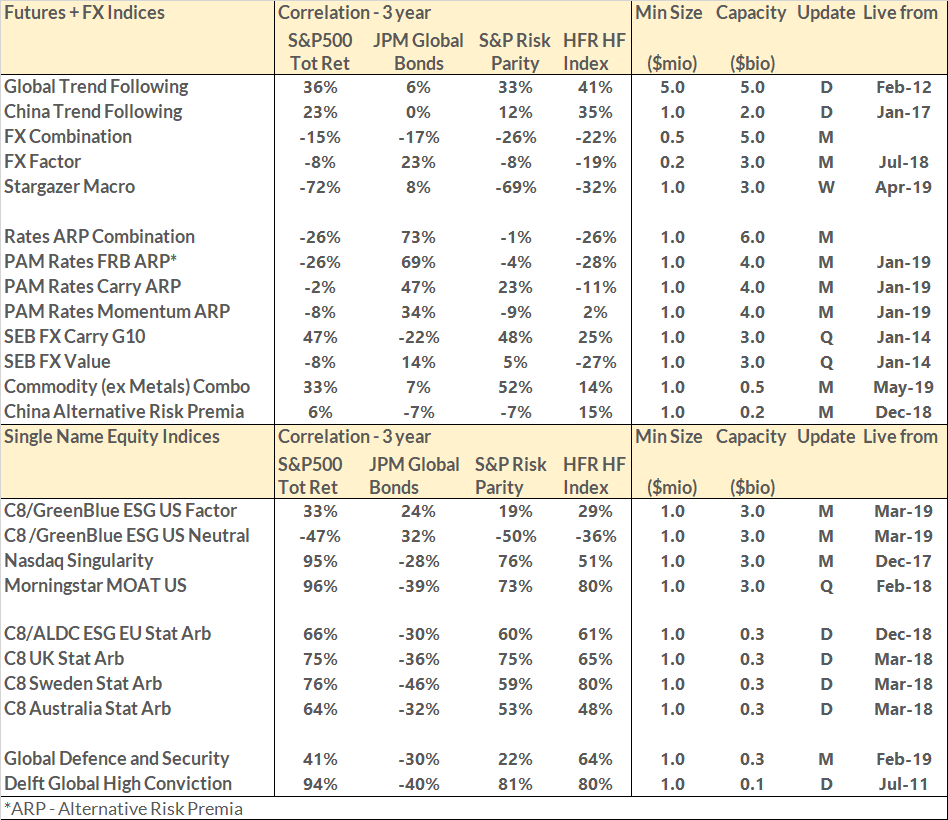

March 2020 PerformanceThe benefits of diversification from the classic long equity/bond portfolio were illustrated during the current financial market fallout from the Coronavirus. In particular, we note the performance of Stargazer Macro (who we featured in our February Update). They were up 9.7% in March, taking advantage of the market volatility. They now have a 1 year track record showing up 16%. Other strong performers were in our Chinese Indices, with China ahead in the recovery cycle, whilst our FX combination recovered well in the month and interest rate risk premia made further gains. Understandably, it was a tough month for long-only equity and Stat-Arb indices, though most have outperformed the S&P 500 this year. Our Long/ Short Good Governance Equity Index is up on the year, whilst the equity-neutral version has risen 11%. Indeed, the equity-neutral index has a 50% negative correlation to the S&P 500, so gives added diversification benefits. |

|

|

|

|

|

|

| C8 Technologies, Michelin House, 81 Fulham Road, London, SW3 6RD, UK, +44 (0) 20 3826 0045 |

|