Cirdan Capital Launch the C8/GreenBlue Good Governance US Equity L/S Certificate

C8 and Green Blue Invest are excited to announce that Cirdan Capital Management has launched an Actively Managed Certificate based on the C8/GreenBlue Good Governance Index. The Certificate will be listed on the Frankfurt Stock Exchange, for professional investors.

As the first of its kind, each year, the Index takes the 100 best-governed stocks in the S&P 500, measured by natural language processing for each company’s annual report. This is then combined with C8’s factor-weighted equity long/short overlay. The portfolio has been rated as a top-quartile ESG portfolio by Impact Cubed, an independent ESG rating agency.

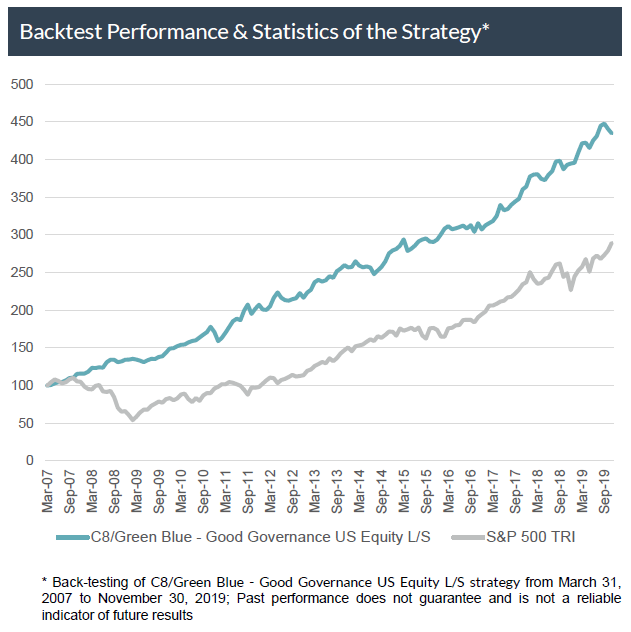

The Index provides evidence that a long-term premia for well-governed companies exists.

The ‘C8/GreenBlue – Good Governance US Equity L/S Certificate 2027’

- L/S equity strategy with a net exposure typically around 40% net long (with a volatility filter). The long side is made of stocks that have been selected for their quality of governance and the short side is made of the S&P 500 Total Return Index

- USD denominated

- Listed on the Frankfurt Stock Exchange on 9 January, with a subscription period until 20 January.

- Intraday liquidity

- Also available now by private placement from Cirdan Capital

- Available to all professional, HNW and institutional investors outside the US, with a minimum investment of $125k

- Target volatility of 7 1/2%, based on back testing, this level of volatility would have an average return of 12%

- Management fee of 1% and performance fee of 10%, with High Water Mark

- ISIN XS2101399314

Cirdan Capital is a UK Finance Boutique, regulated by the FCA, who have launched the Certificate from their Luxembourg Securitised Vehicle, Aldburg SA. Aldburg is structured with segregated compartments so that the Certificate avoids counterparty risk.

This is the back-tested performance from Cirdan’s Certificate presentation:

If you are interested in knowing more on the Good Governance Long/Short Index we would be delighted to help and the C8 platform makes it straightforward to track this Index directly using the underlying equities.

However, for those interested in the newly launched Certificate we will pass any enquiries on to Cirdan Capital. Importantly, this process can be replicated by Cirdan to create, on demand, a Certificate based on any Index or combination of Indices available on the C8 platform.

Thanks for reading,

The C8 Team