|

INNOVATIVE TRADING I COST-EFFICIENT I FULL CONTROL I TRULY GLOBAL I TRANSPARENT & ETHICAL |

C8 Update – IHS Corporate Bond Index Customization and Crypto Combination – Sep 2021 |

|

|

Direct Indexing Comes to IHS Markit Corporate Bond Indices |

|

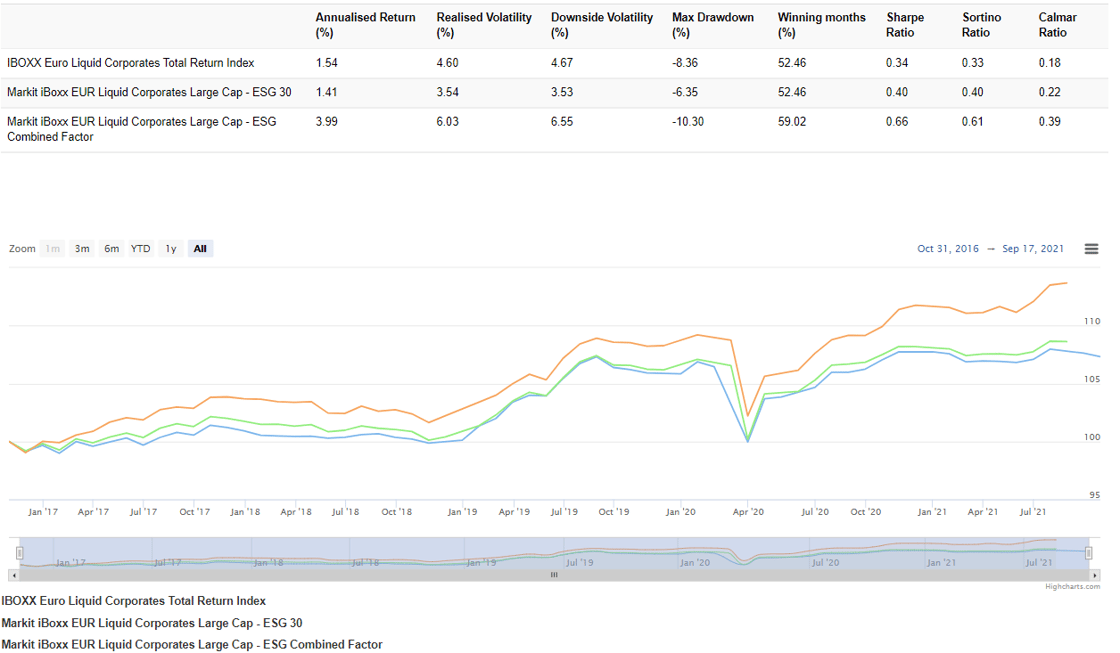

IHS Markit’s iBoxx indices have a major market role as benchmarks for corporate bond performance and we are delighted that these are part of the C8 universe of indices. Alongside these headline iBoxx indices, we have developed a range of investable portfolios. These span vanilla tracking solutions for the broader indices (the iBoxx USD High Yield Index spans over 1,200 bonds) alongside portfolios which also incorporate ESG and factor themes. Tracking solutions are now available for the major USD and EUR iBoxx Corporate indices while we have applied ESG/factor themes in the European investment grade context. In the initial approach, we put an emphasis on tradability and transparency. The iBoxx Euro Liquid Corporates Large Cap Index (blue line below) spans just over two thousand investment grade bonds which meet the iBoxx liquidity criteria (such as a minimum amount outstanding). We filter the portfolio to create an ESG index by selecting issuers included in the S&P European 350 ESG Equity Index, and then purchase the largest issues of the 30 largest issuers. The market-cap weighting scheme for this set of 30 bonds is very transparent and, perhaps surprisingly, doesn’t harm the performance of the overall portfolio. Indeed, the tradeable ESG 30 portfolio modestly outperforms the overall EUR Liquid Corporates Large Cap Index on a volatility-adjusted basis (green line below). |

|

|

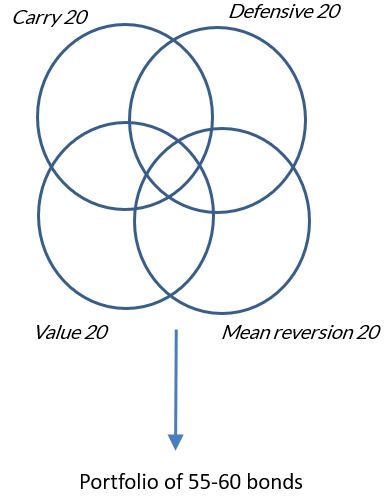

A more sophisticated approach uses a tracking portfolio weighted by bond factors that reflect the historical drivers of excess returns in corporate bonds:

|

|

|

The highest rated bonds on each of these criteria are included in the ESG Combined Factor portfolio, giving a portfolio of around 55-60 bonds. Strikingly, this significantly outperforms – both from a total return and Sharpe ratio perspective – and the outperformance has been even more marked over the past year (orange line above). The larger pool of bonds does require more trading than for ESG 30 – but higher transaction costs are more than offset by better bond selection, while we use “smart” portfolio management rules to prevent overtrading. |

|

Direct indexing of corporate debt, based on the IHS Markit framework, allows C8 clients to create customised, investable portfolios and trading signals in a way not readily achievable in the ETF/mutual fund context. We look forward to feedback from our clients on the direction for development of new corporate bond portfolios. |

|

|

Power of Combination: Using Tactical Asset Allocation on Four Cryptocurrency Indices |

|

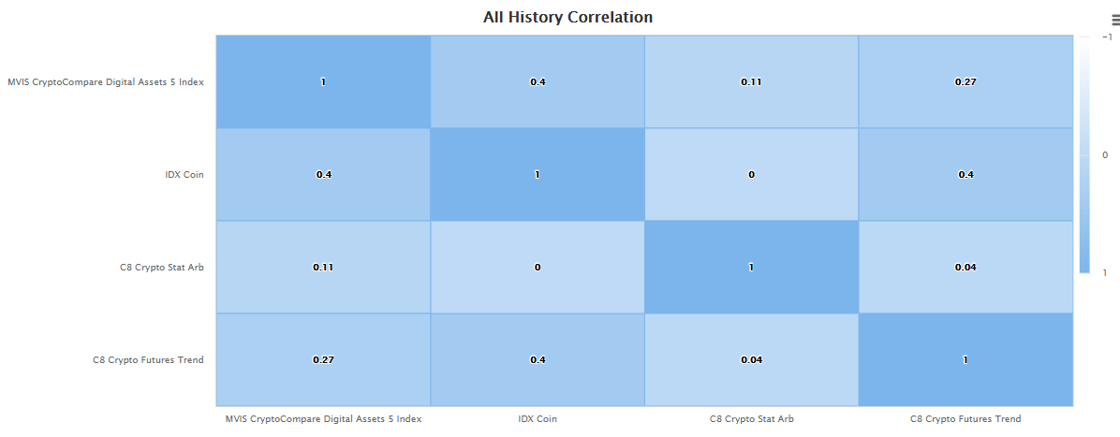

As interest continues to grow in cryptocurrencies, C8 has been adding tradeable indices to the platform. In particular, MV Index Solutions (a subsidiary of Van Eck) has joined the platform adding market-cap weighted, passive crypto indices to C8 Studio. The MVIS CryptoCompare Digital Assets Indices are a family of modified market cap-weighted indices that tracks the performance of the largest and most liquid digital assets. The indices have demanding size and liquidity screenings applied to potential components to ensure investibility. C8 Studio now includes both the ‘top 5’ and ‘top 10′ indices. The MVIS CryptoCompare Digital Assets 5 Index (illustrated below) currently contains Ethereum, Bitcoin, Cardano, Binance Coin and Dogecoin. IDX is also on the platform, their IDX Crypto Opportunity Index (COIN) is an active index that seeks to provide tactical upside participation to the Grayscale Bitcoin Trust (GBTC) while limiting drawdowns and downside volatility. A long allocation in GBTC is established when momentum in BTCUSD is both positive and increasing; otherwise, capital is allocated to a diversified portfolio of fixed income ETFs. C8 has a long experience of creating Trend Following and Stat Arb indices across multiple asset classes, not least during the founders’ time building out the hedge fund BlueTrend. Applying these methodologies to the crypto world has also produced some exciting results: C8 Crypto Futures Trend applies C8’s trend-following methodology to Bitcoin and Ethereum futures contracts. In contrast to IDX COIN, the index can be both long and short of these two instruments. C8 Crypto Stat Arb uses C8’s Stat Arb methodology on the following coins: Bitcoin, Ethereum, Blocknode, Bitcoin Cash, Cardano, Litecoin, EOS, Ripple and Stellar. Statistical Arbitrage employs short-term, mean-reversion models across the portfolio of these nine coins. Whilst each of these indices has strong merits, importantly, the performance of these four indices detailed above have relatively low correlation with each other (see table below). |

|

|

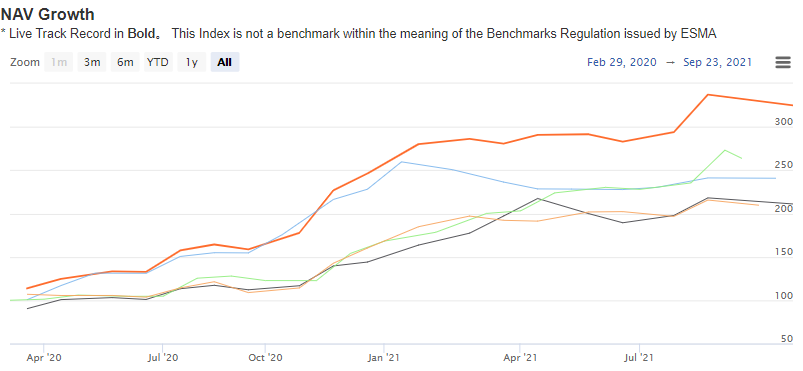

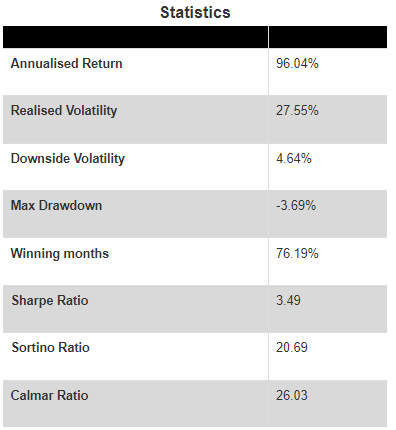

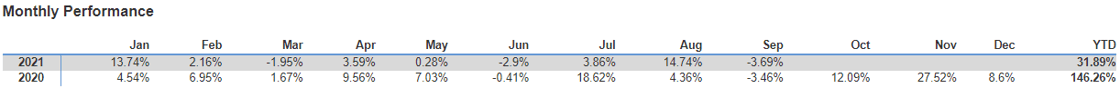

Applying one of C8’s proprietary combination algorithms, Tactical Asset Allocation (which underweights under-performing indices and over-performing indices) to the four indices produces exciting results. As some active coins having a relatively short history, there is only 21 months of out-of-sample performance for the combination. However, the strong risk/return profile again demonstrates how selecting high-quality, uncorrelated indices on C8 Studio, then using C8’s advanced combination techniques, can produce a ‘sum even greater than its parts’. |

|

|

|

|

|

|