| Full Suite of New Combination Methodologies Released on C8 Studio |

| Our new suite of combination methodologies has been released. One of the most powerful advantages of using the C8 Direct Indexing platform, C8 Studio, is the ability to combine and weight indices from multiple sources.

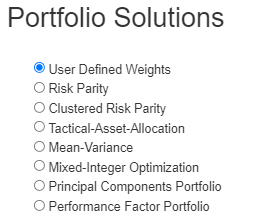

Importantly, the methodologies can also be used to solve other significant portfolio issues. For example, an investor has multiple indices to choose from, so just as important is the decision as to which index to select. C8 also assists with solving this problem. The C8 platform has now been extended to include all of the following portfolio solutions: |

|

|

|

|

Tactical Asset Allocation |

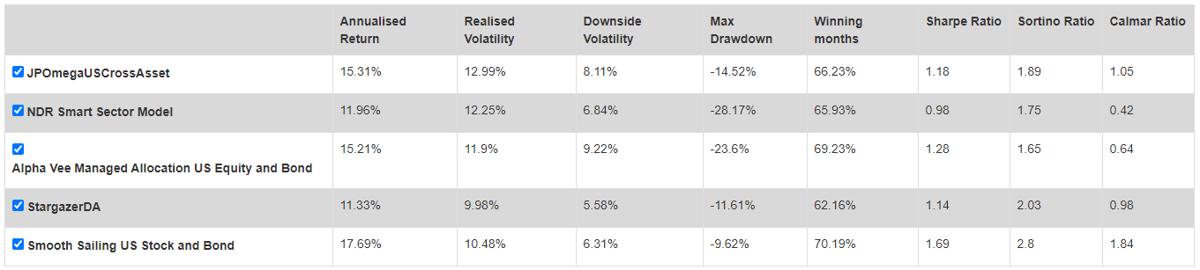

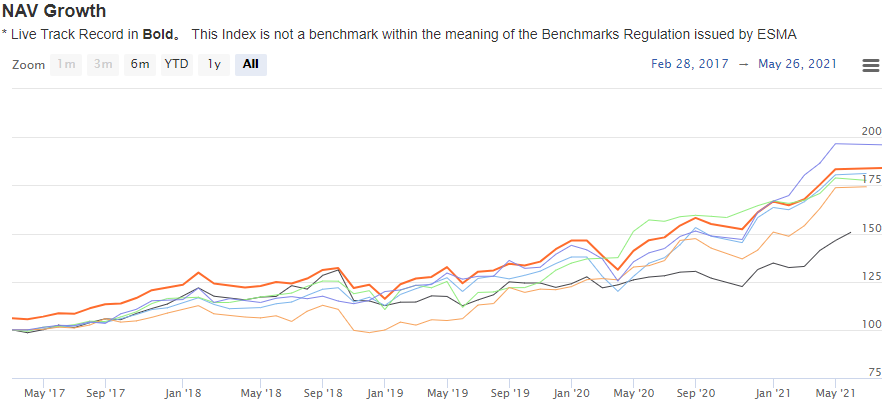

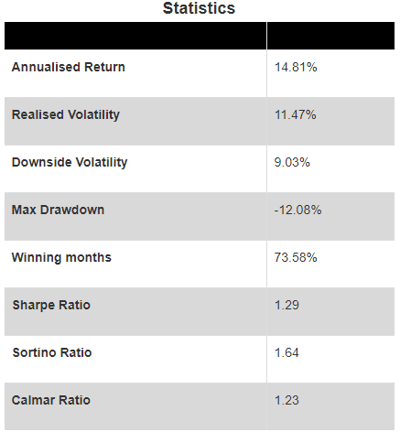

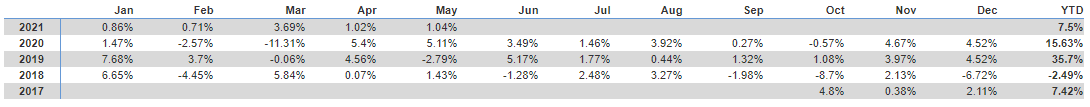

US Allocation Diversified CombinationOn C8 Studio, there are a number of good quality US allocation programmes which aim to maximise returns, relative to risk, by switching between equities and bonds (as well as other assets). C8 Studio gives investors the ability to easily combine a number of these disparate indices together to generate consistent and robust returns. In this example, we combine the following indices:

Please see C8 Studio for full details on each index (or please request login details). The indices are then combined using Tactical Asset Allocation, a C8 proprietary method, in which, unlike mean-variance, the allocation programme gives most weight to indices that performing in line with their average. That is, the methodology underweights underperforming indices (similar to mean-variance) but, importantly, also underweights indices outperforming their typical performance. Classic mean-variance optimisation will always give the largest weight to an index just before it mean reverts. With Tactical Asset Allocation, the weight will be reducing ahead of any correction to mean. Whilst each index in the combination has many strengths, we believe that using them with C8’s combinational algorithms can bring added value. |

|

|

|

|

|

|

Mixed Integer Optimisation |

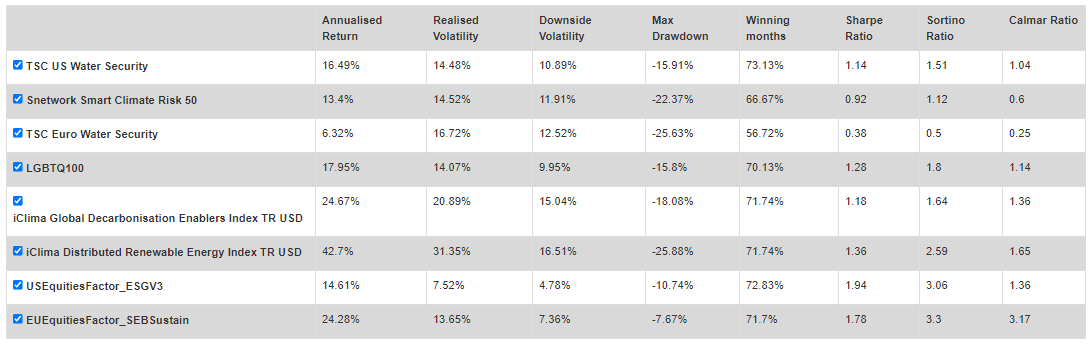

ESG Diversified CombinationThe C8 Studio works well with ESG indices, as direct indexing provides full transparency of holdings pre-execution (so no unexpected surprises), customisation (ESG mandates can differ considerably) and voting rights are retained, so investors can vote their shares in line with their ESG principles. We have a number of innovative ESG providers on C8 Studio:

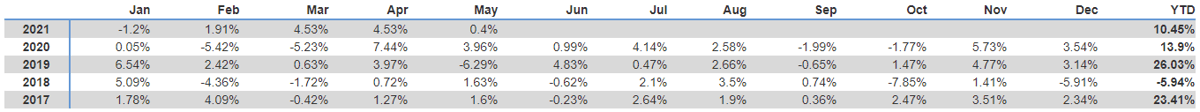

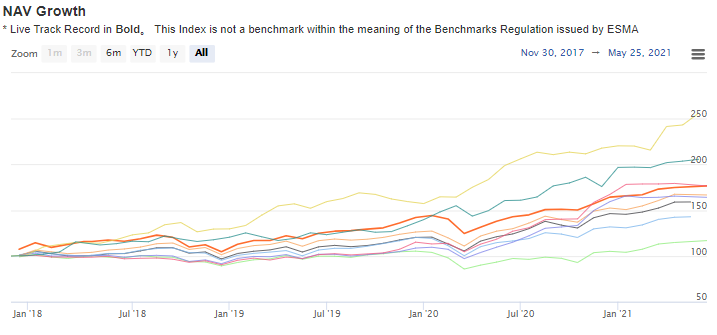

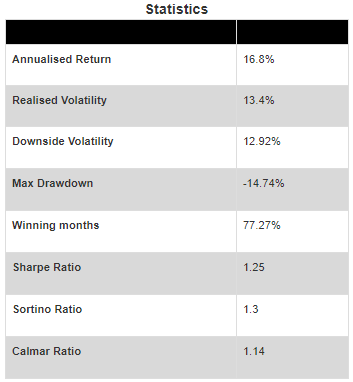

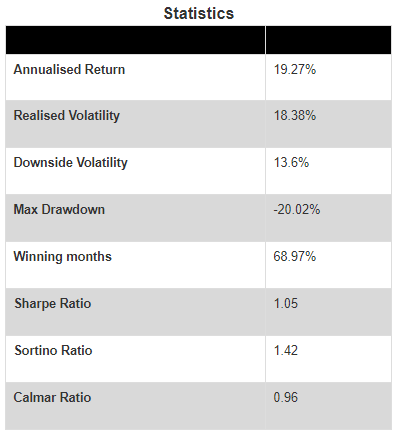

We use Mixed-Integer Optimisation to build an ESG portfolio across the above indices. This algorithm looks to chose between any 4 to 6 indices out of the 8 at any one time. We have set the rebalance to every three months using the previous 2 years returns (so all return streams are out-of-sample). The performance of the combination can be seen below: |

|

|

|

|

|

|

Performance Factor Portfolio |

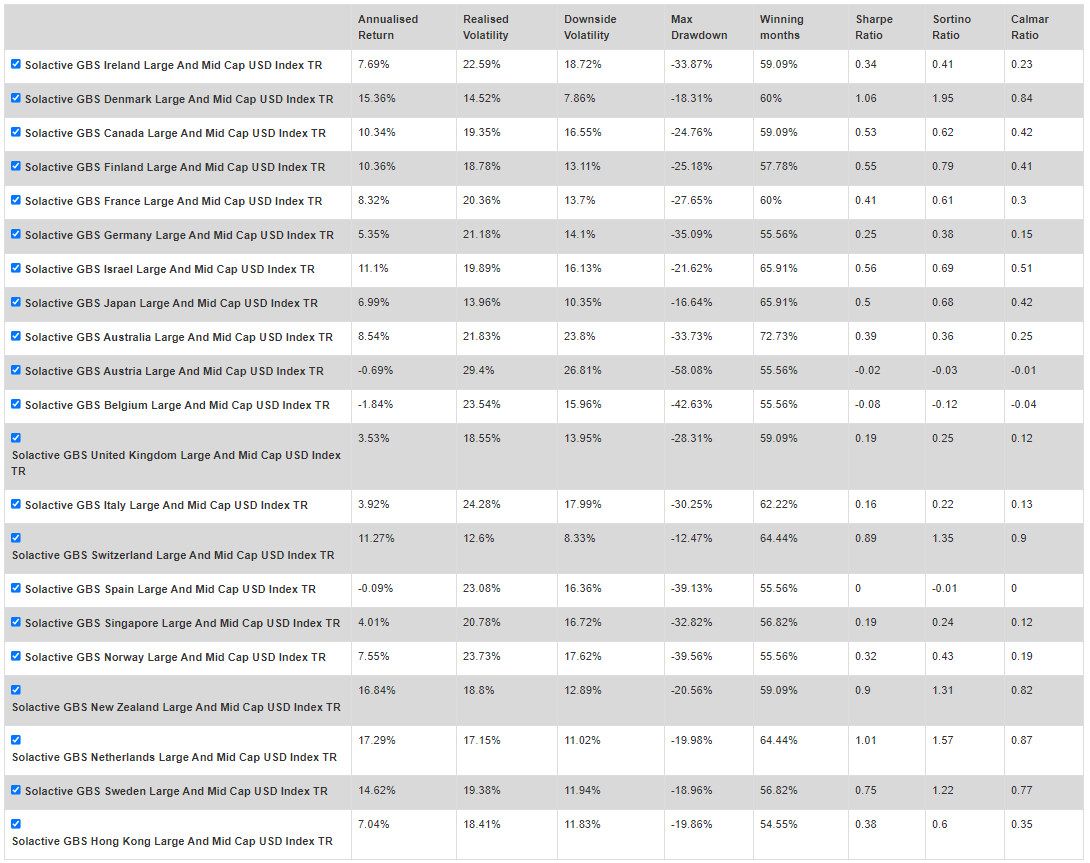

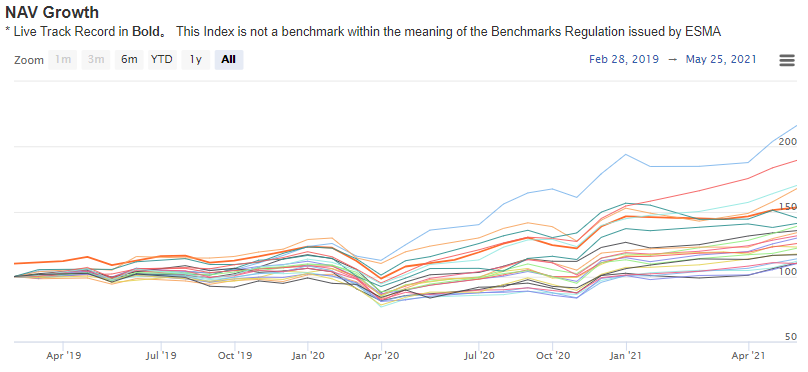

Global Equity Ex US CombinationAnother good example is of a larger combination problem, taking 21 non-US country market-cap weighted equity indices from Solactive, then selecting between 5 and 10 countries to track for the next year. The Performance Factor Algorithm takes a different approach to Mixed Integer Optimisation, which uses mean-variance and investigates the best overall combination on that basis. With Performance Factor, each index is scored by its performance using classic metrics such as Sharpe Ratio (average return relative to volatility), Sortino Ratio (average downside return to volatility), Calmar Ratio (average return to max drawdown), as well as other more esoteric performance measures. This algorithm creates a portfolio that, in terms of Sharpe, performs as well as the best performing equity market, but also substantially reduces the complexity of tracking 21 equity markets. |

|

|

|

|

|

|

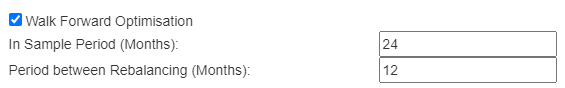

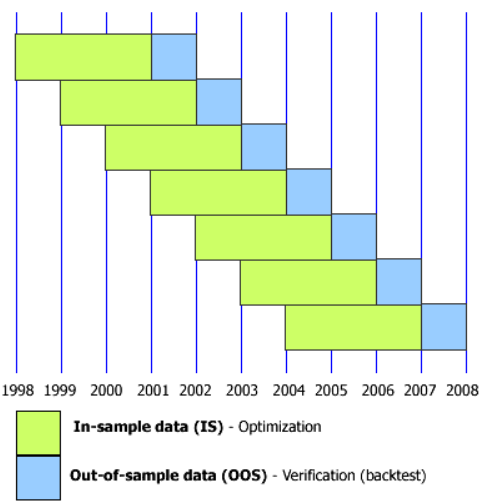

Walk-Forward AnalysisOne key element in all the combination methods discussed above is that these were all used in conjunction with ‘Walk-Forward’ analysis. In C8 Studio: |

|

|

This gives a more realistic view of potential real-life performance, as the performance is calculated ‘out-of-sample’ ie avoiding the risk of ‘curve fitting’ (where the portfolio selection and weights is based on a known past performance history). The figure below illustrates how this works, only the out-of-sample periods (blue) are used in performance measurement: |

|

|

|

C8 Continues to ExpandDavid Jervis joins as Global Client Officer for C8 Technologies to take responsibility for the firm’s client relationships, index and investor partners alike. David has worked in global capital markets for the past thirty-five years, his prior role being Head of Senior International Relationship Management at Bank of America. Previous management roles for Bank of America and Merrill Lynch over twenty-eight years included Head of Wealth Management in EMEA, Head of Equity Sales in EMEA, Chair of Merrill Lynch Capital Markets in France, Head of CEEMEA Equity Sales and Co-Head of Japanese Equity Sales in Tokyo. Before that, David worked at Baring Securities, Kleinwort Benson and New Japan Securities, always on institutional investor clients. |

|

|

|

Thanks for your interest, The C8 Team |