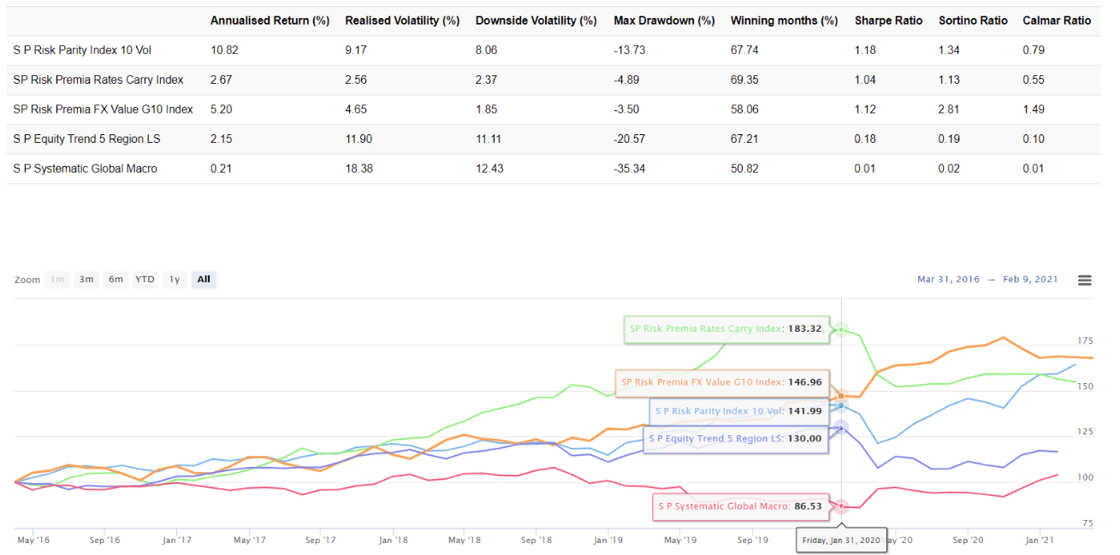

New Index Provider: S&P Dow Jones IndicesWe are delighted that S&P Dow Jones Indices, the world’s largest index provider, has joined the C8 platform. Our initial offering includes their innovative Liquid Alternatives indices such as as Risk Parity, Risk Premia and Systematic Macro, whilst adding in some of their keynote indices, such as the S&P 500, but also their Global 1200 series which contains the largest global stocks, along with indices for ESG and Sharia-compliant variants. Whilst S&P Dow Jones Indices need little introduction, to put this in perspective, they calculate over 830,000 indices, publish benchmarks that provide the basis for 575 ETFs globally with $387 billion in assets invested, and serve as the DNA for $1.5 trillion of the world’s indexed assets. Now these indices can be traded and tracked using C8’s direct indexing solution. Liquid Alternatives |

|

|

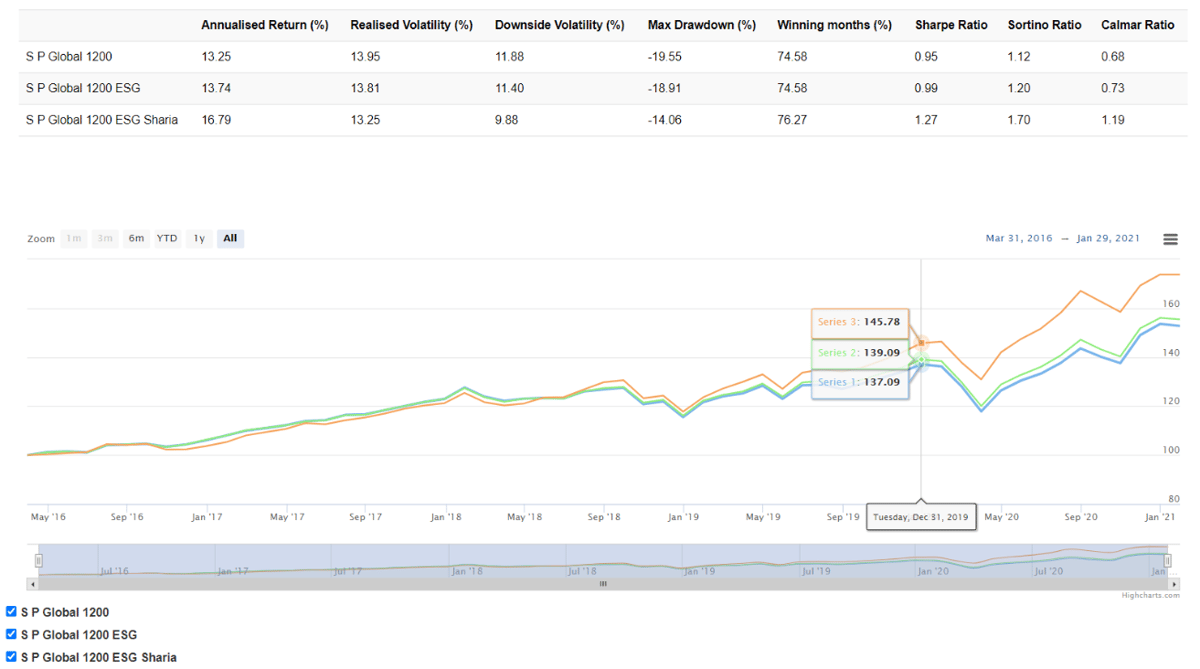

Global 1200 Series |

|

|

|

New Index Provider: Ned Davis Research |

|

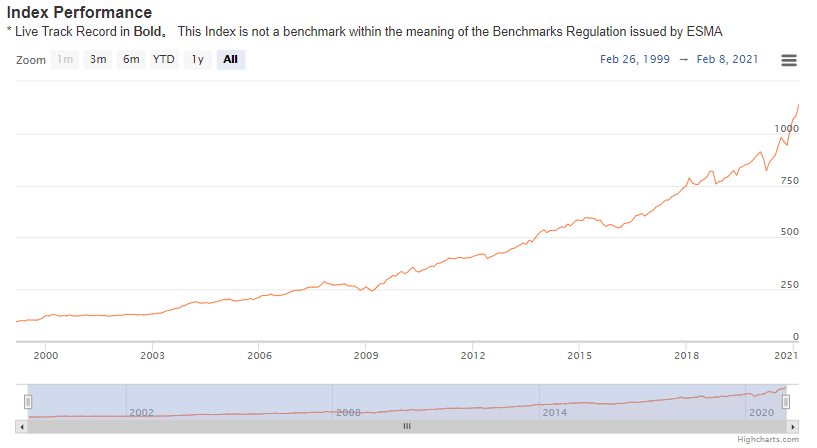

Furthering our expansion into the US, we are also excited that Ned Davis Research has joined the C8 platform, with 8 NDR indices being added to C8 Studio. In their own words, ‘NDR (Ned Davis Research) uses the weight of the evidence and a 360-degree approach to build up to market insights. When we say “evidence,” we mean processing millions of data series to fuel a historical perspective, building proprietary indicators and models, and calming investors in a world full of bull/bear news hype and hysteria. We believe that no client is too big or too small to benefit from NDR’s insights.’ One of the great research houses, it is now straightforward for our clients to track the performance of indices produced by NDR, by directly trading the underlying positions on the C8 platform. The chart below is for the NDR Dynamic Allocation Strategy, a global index, where trend-following and macro-economic indicators are used to evaluate the equity/ fixed income balance, with further indicators then used to drive the ETF selection, and, finally, a turnover algorithm is used to reduce trading to a minimum. |

|

|

|

C8 Featured in the Financial Times |

|

|

C8 featured yesterday in an Financial Times article which discusses how Direct Indexing can be a complement to Funds and ETFs. Mattias (our CEO) was quoted: “We have 7,000 strategies to choose from. We work with pension funds, sovereign wealth funds, fund of funds as well as family offices and corporate treasurers. It’s going to be big going forward. We are starting to see what is going to be the future,” said Eriksson, who added that interest had been particularly strong among Chinese institutions. Two of our index providers, Ned Davis Research (see above) and Solactive, were also interviewed for the article. Please read the full piece at: https://on.ft.com/3rDhUd5 |

|

|

|

Thanks for your interest, The C8 Team |