C8 Weekly Bulletin:Europe performs well in ‘long only’ recovery16 January 20223 |

|

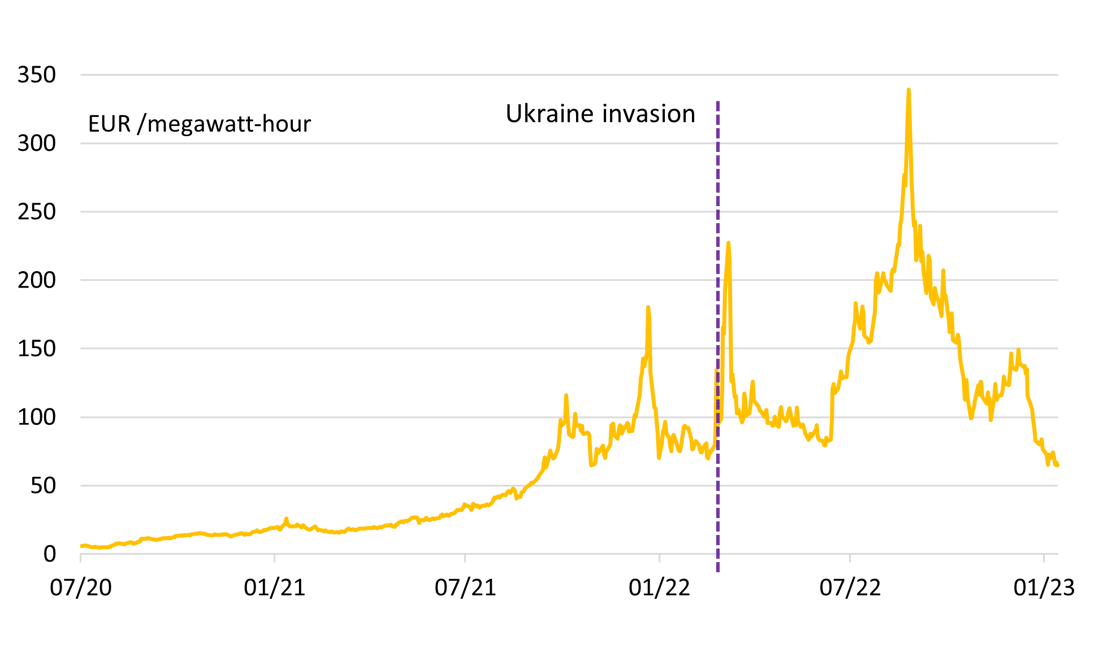

The new calendar year has begun with an explosive extension of the ‘long only’ asset rally which has been underway since last October’s Fed signal of smaller rate hikes. The positive case for European asset markets specifically been reinforced by a new slide in regional natural prices – to levels last seen ahead of the Ukraine invasion. In this Weekly Bulletin, we take a look at how investors can build European asset market exposure on the C8 platform. |

European natural gas price retreat |

|

|

The unseasonably warm weather in Europe in the early weeks of 2023 may have been bad news for skiers – but came at a very favourable time for the European economy and policymakers. Soft energy demand has triggered a new leg lower in north European natural has prices. Dutch gas futures prices of around 65 EUR per megawatt/hour are half Dec 2022 levels and similar to those seen ahead of the Ukraine invasion. Efforts to weaponise European energy markets this winter appear to have failed. The drop in gas prices brings immediate relief to heavily energy-dependent industries but also considerably eases the pressure on European policy makers as the budgetary cost of subsidies are scaled back and weaker inflation pressures give the ECB new scope to slow rate hikes. Lower gas prices are reinforcing more constructive global influences for European asset markets even amidst persistent risks around the Ukraine conflict. Against this backdrop, European asset markets have performed well in the “long only” asset recovery since end-Sep 2022. Germany’s DAX gain of 8.4% year-to-date brings the total rally to 26.0%, leading a 18.1% advance in the STOXX Europe 600 Index and far outpacing the US S&P 500’s 11.5% gain. |

Overview of European access on C8 platform |

|

|

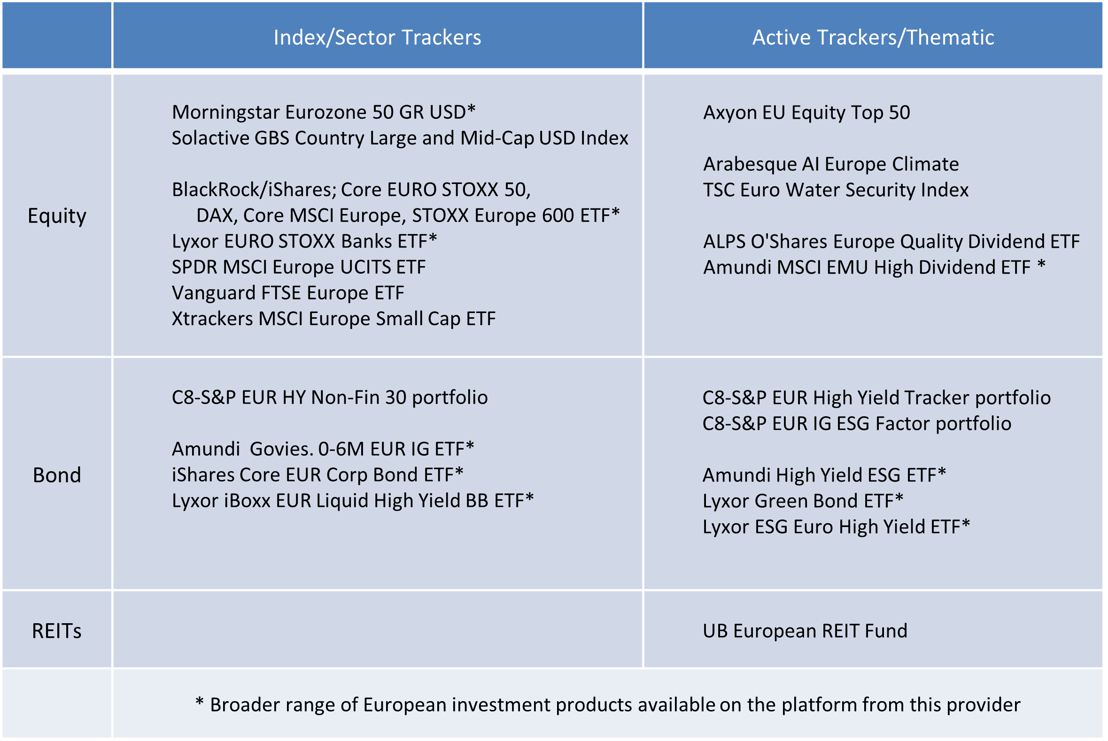

The unseasonably warm weather in January 2023 may have been good news in the short-term but the month brought the warmest January on record in eight European countries, reinforcing fears over long-term climate change. Amongst the thematic products on the platform, the Arabesque AI Europe Climate strategy invests in a portfolio of around 25 European equities of companies well-positioned to benefit from the opportunities and manage the risks associated with climate change. In the bond context, Lyxor’s Green Bond ETF invests in EUR (and USD) bonds issued specifically to finance eligible green projects whilst there are a broad range of ESG bond portfolios on the C8 platform. Amongst these, the C8-S&P EUR ESG Factor strategy combines both ESG criteria and bond factors to develop a portfolio of around 65-70 investment grade corporate bond issues (which has persistently outperformed the broader IG universe in recent years). |

|