C8 Weekly Bulletin: Giving Investors an Edge24 October 2022 |

|

With inflation returning to the world economy, central banks have had to act aggresively to contain inflation expectations. This has led to an unwinding of the excess liquidity in the global financial system, with differing responses across various asset classes. Importantly, we see this as a return to a more normal financial markets environment, with lower central bank support for asset prices and continued volatility ahead. |

Trend Following |

|

In this environment, there is increasing interest in trend-following strategies that take advantage of diverging trends in financial markets, across regions, countries and asset classes. C8 Studio contains a number of providers with high quality trend-following indices. Please find below two examples of combinations, built in C8 Studio using our innovative combination technology. C8 Studio allows users to create combinations on a walk-forward basis (i.e. combined performance is calculated out-of-sample). This gives a more realistic approximation to real world conditions and is used below. |

(I) Futures Trend Following |

|

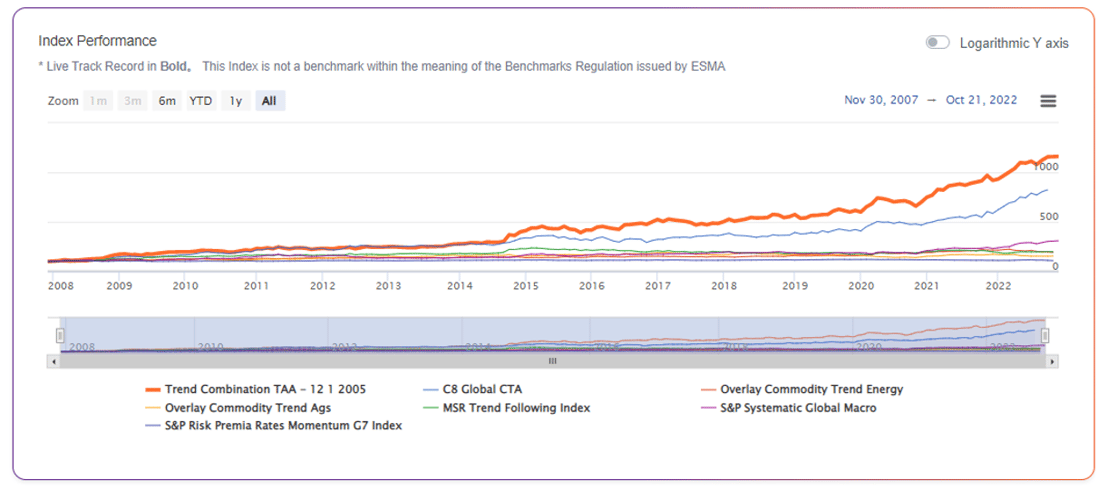

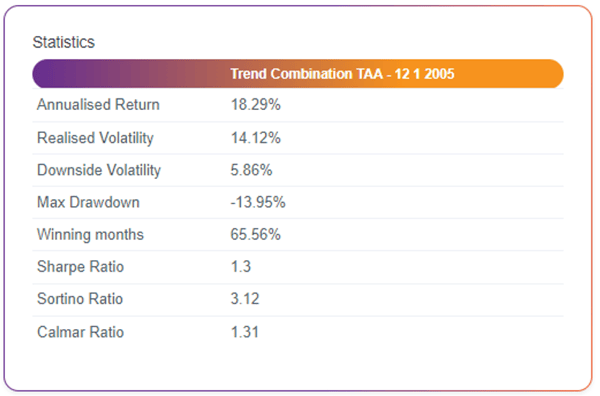

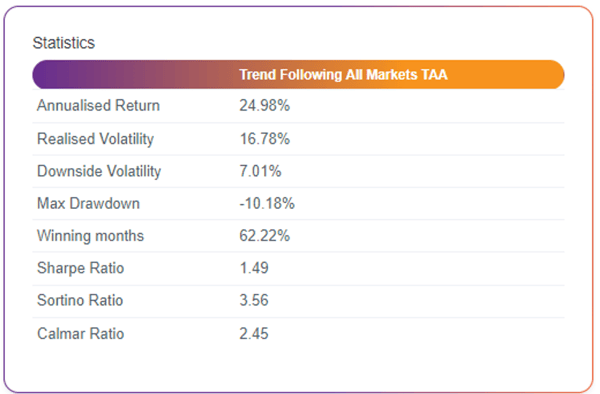

Futures have traditionally been the primary instruments for trend-following activity. In the chart below, we illustrate the results from a combination of S&P, MSR and C8 indices, combined using C8’s proprietary tactical asset allocation process. |

|

|

|

|

|

(II) Extended Trend Following |

|

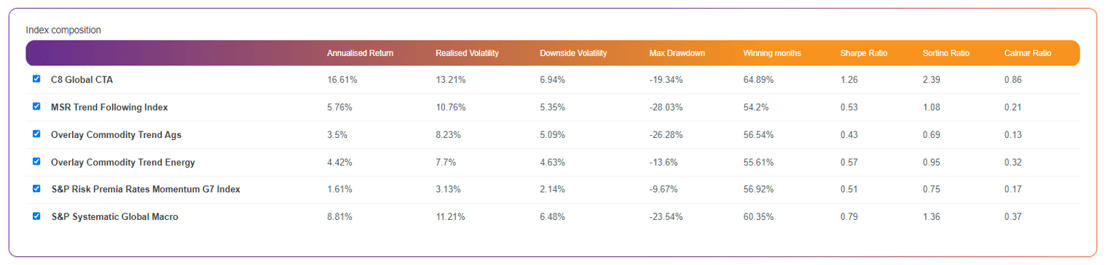

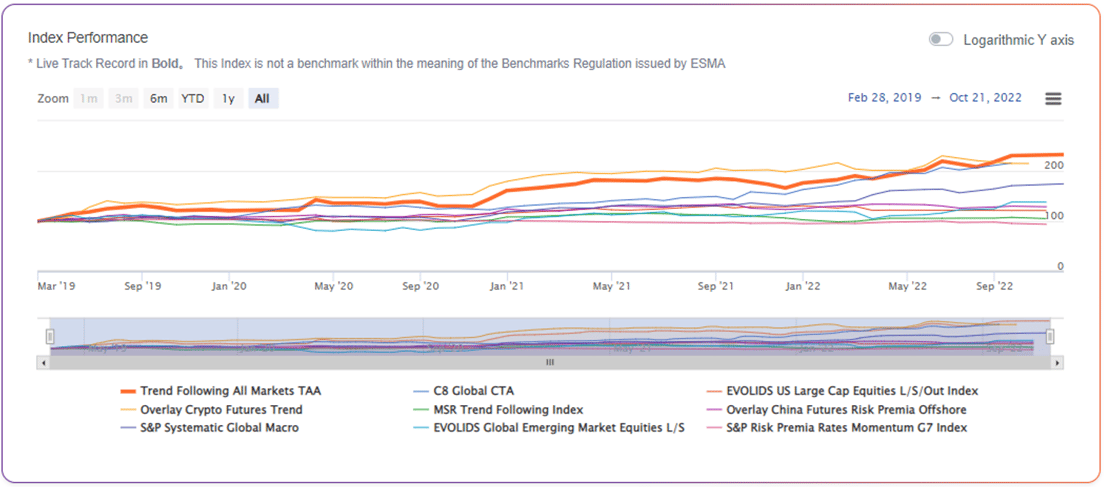

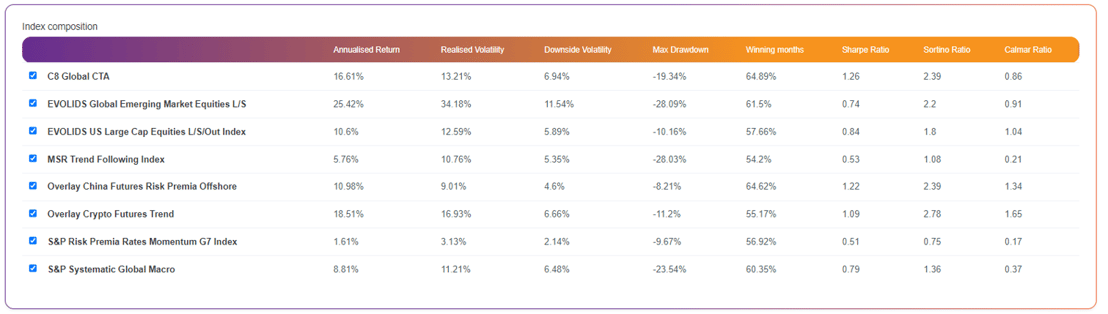

Trend-following can be extended into less traditional markets and approaches. On C8 Studio, we have a number of such indices. The charts below illustrates how diversification can be increased by adding Crypto Futures Trend, China Futures Access (via a total return swap) and specialist providers such as EVOLIDS, who combine trend and volatility indicators. |

|

|

|

|

|

|

Please speak to your C8 sales contact if you would like to explore any of the trend-following approaches above, or for a demonstration on C8 Studio of the ‘power of combination’. |

|

|