In recent years, Artificial Intelligence (AI) has become a popular buzzword in the investment management industry. Especially since the pandemic, uncertainty and underperformance led many managers to look for enhanced information sources to improve their investment process. While this has sparked enormous interest in the adoption of advanced AI-powered predictive solutions, at the same time it has led the ‘AI’ keyword to be excessively used (and abused) for marketing and positioning purposes.

The harsh reality is that AI is way more than a buzzword, and calling a system “AI-powered” doesn’t really make it brighter. Integrating a robust AI-powered alpha discovery source into the investment process is a complex task. It is not just funding an AI internship or partnering with a well-known university; even creating an entire AI team implies waiting a long time for proven results (in addition to substantial investment in people and technology). And even if this is successful, well, market dynamics may change and send a specific AI-powered model awry.

Our work at Axyon AI, which started in 2015, has always been focused on looking at asset performance prediction from a learning perspective rather than a knowledge one. This means recognising that financial markets are probably one of the most complex systems created by humans and, peculiarly, one whose rules are changing every day by responding to enormously ramified behaviour and changing patterns.

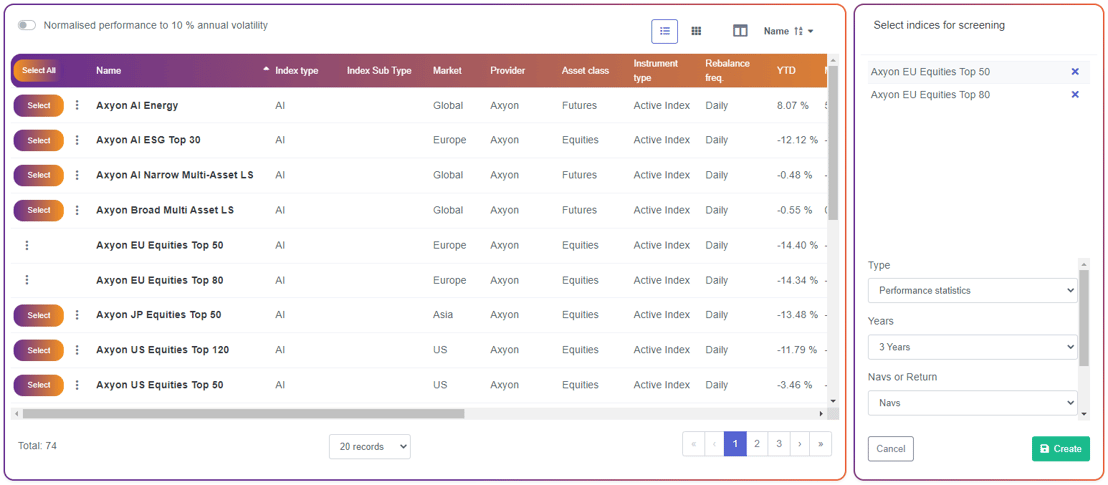

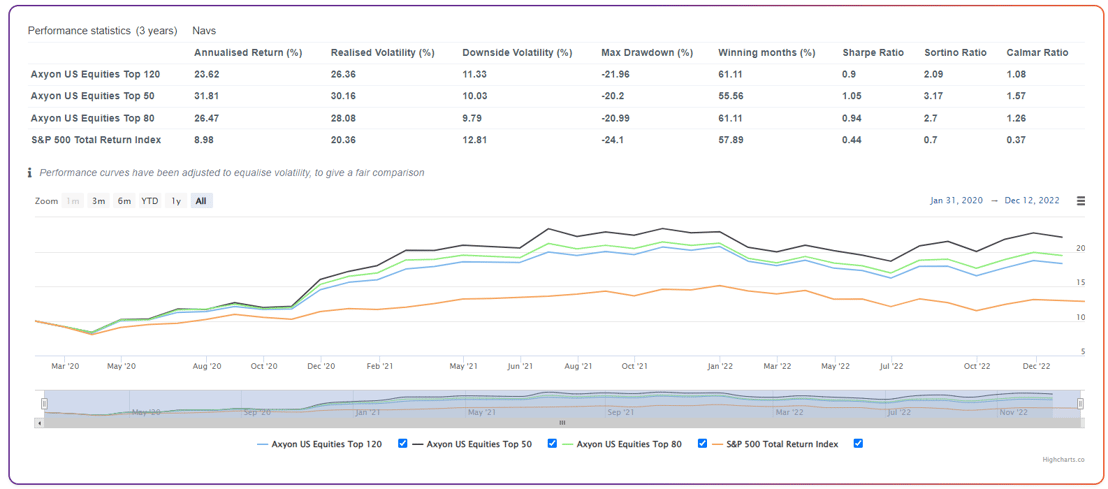

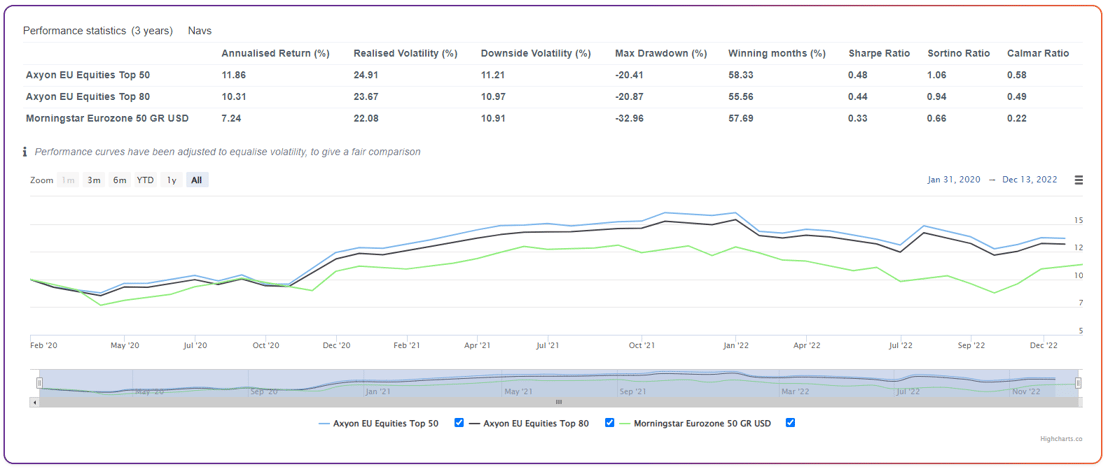

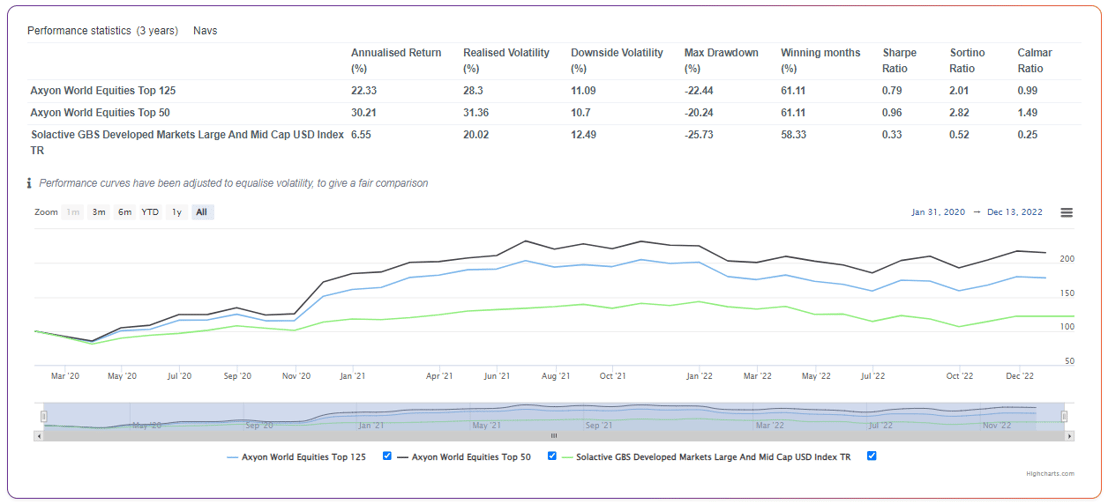

That is why we do not focus on developing one specific model. Our core efforts revolve around developing auto-ML technology capable of constantly adapting to ever-changing market conditions, and being able to integrate its predictions into fully-systematic indices. This allows clients and investors to add AI-powered alpha layers to their investment portfolios, while retaining complete control of risk, and it is made incredibly easy by the integration of Axyon AI’s indices into the C8 Studio platform.