C8 Weekly Bulletin: Return to Income

24 January 20223

|

Whilst the New Year’s recovery in stock markets has grabbed much of the headlines, we also note that last year’s fixed income sell-off has created opportunities in income products. This week we illustrate this using C8 Studio, with income-generating indices from Vettafi. |

Income Returns are Back |

|

|

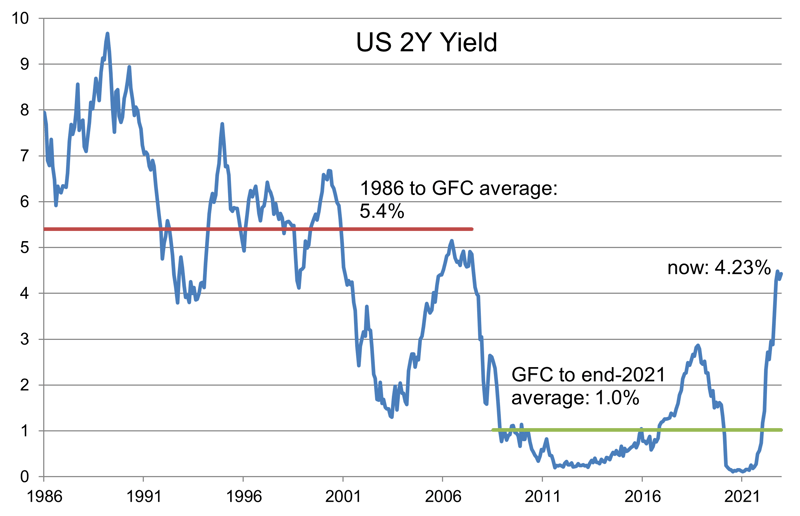

Years of central banks buying back their own bonds (as well as negative interest rates in Europe) pushed up global equities prices, driven by sharply lower fixed income yields around the world. The creditable aim to reinvigorate the world economy after the shock of the Global Financial, and subsequent EUR, crisis became entrenched as central banks realised that monetary financing could persist in a generally deflationary environment. This was aided by the academic support of Modern Monetary Theory (MMT aka the Magic Money Tree). Given the appeal of the ‘free lunch’, it was, unsurprisingly, difficult for central banks to resist QE with each economic shock, even as the world economy improved more generally. Last year proved to be the watershed as global inflation rose sharply, driven by the combination of post-Covid demand and the supply shock from the Russian invasion of Ukraine. This forced most central banks to normalise interest rates last year, creating an opportunity for investors to generate income in 2023. |

|

|

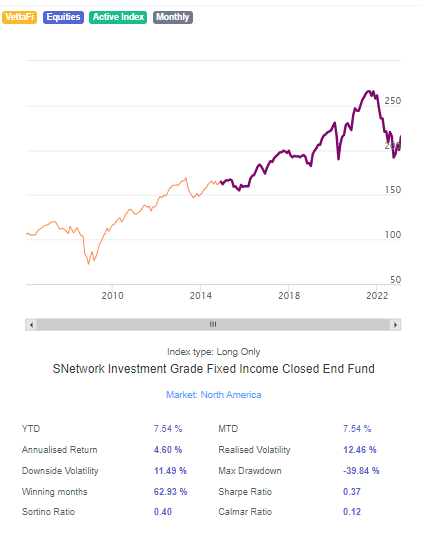

VettaFi S-Network composite index of Investment Grade Fixed Income Funds gives a good illustration of the potential, after an almost 40% drop from October 2021 to Sep 2022. This index has risen 7.5% this year but, just as importantly, it is currently yielding 8.8%. |

|

|

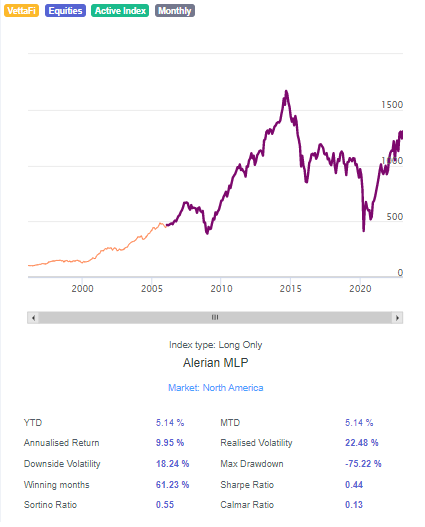

VettaFi Alerian MLP index is the leading gauge of energy infrastructure Master Limited Partnerships which had been hit by both low yields and a low oil price. Both these factors have reversed sharply since the 2020 lows. The MLP index has risen by 5.1% since the start of the year, with plenty of yield provided by a current running yield of 7.7% (even though 69% of the companies in the index are investment grade). |

|

|

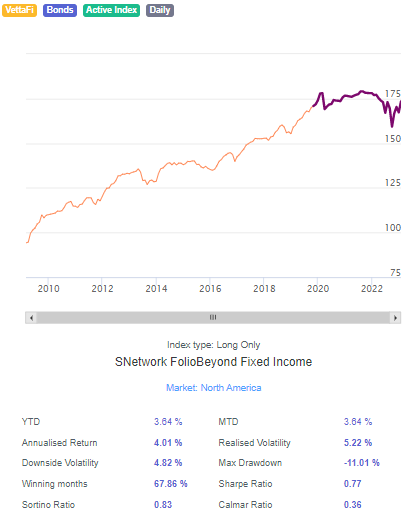

VettaFi S-Network Folio Beyond Fixed Income index provides an optimised, factor-based, multi-sector fixed income strategy that aims to outperform the commonly followed Bloomberg Barclays Aggregate Bond Index. The model optimises portfolios across a full range of 23 best-of-breed fixed income sector ETFs to maximise returns subject to a volatility target in line with its benchmark. The aim being to capture significant asset allocation alpha without taking additional risk. In this aim, the index has been successful, with a maximum drawdown of 11% whilst the index is now only 3.3% below the Q3 2021 highs (whilst also now benefiting from higher yields). |

|

|