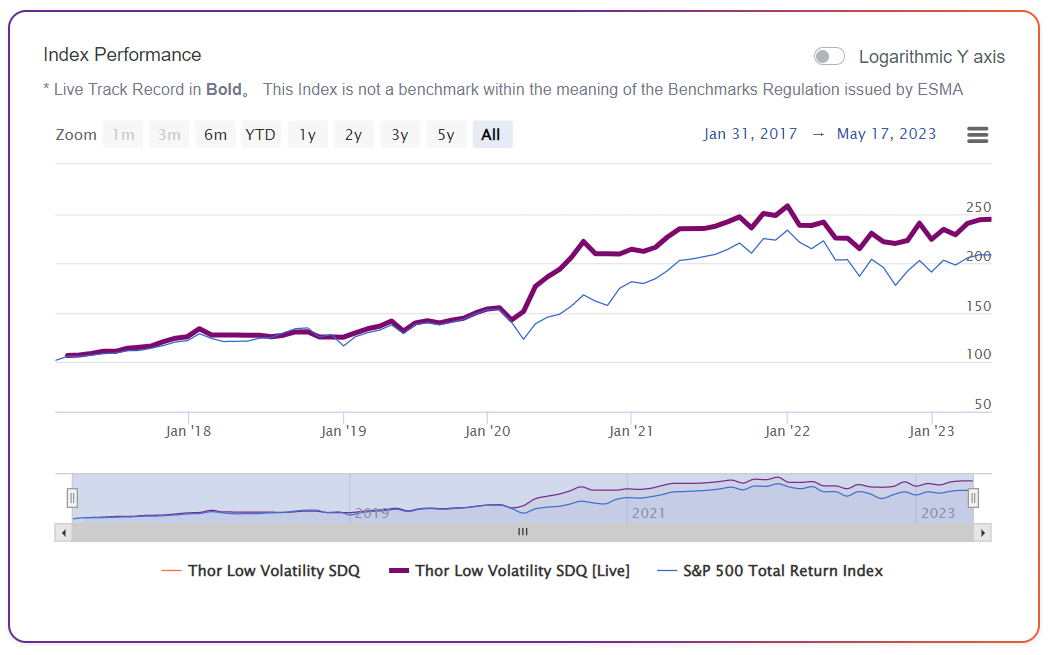

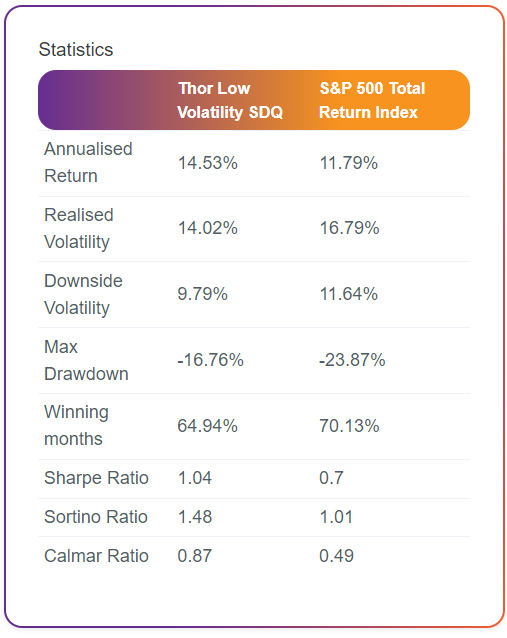

C8 Technologies is pleased to announce that five indices derived from Thor Financial Technologies will now be available through the C8 platform. The strategies will be available to C8 clients to be accessed through direct indexing and will be fully included in C8 studio and thus available to be combined with other strategies and allocations optimized to create complete portfolio solutions for clients. The indices are: Thor All Asset, Thor Low Volatility SDQ, Thor Sector 100, Thor ESG 100, and Thor Diversified Bond. Thor Financial Technologies, LLC provides solutions that enables advisors to deploy their client portfolios in a more intelligent way with a main focus on managing risk.

“Thor has grown nicely by creating solutions that financial advisors see value in. Now Thor users can utilize C8 Technology to create custom blends (UMAs) or invest directly in the underlying securities with our Direct Indexing tools, says Craig Cmiel, Head of C8 US. Our international clients now have access to Thor via our global platform.”

Brad Roth, CIO at Thor commented that “We are excited to partner with C8 Technologies. Their ability to offer advisors the ability to quickly utilize best in class managers and offer an optimized blend of their strategies will lead to innovative portfolio offerings for investors”.