|

C8’s Weekly Bulletin: Giving Investors an Edge31 October 2022 |

|

This week’s Fed meeting will be watched closely for hints of a policy pivot following reports that some officials favour slower policy tightening and amidst a revival in global risk appetite. In this Bulletin we take a look at the recovery in the performance of ‘long only’ strategies on the C8 platform. |

Trick or Treat for ‘Long Only’? |

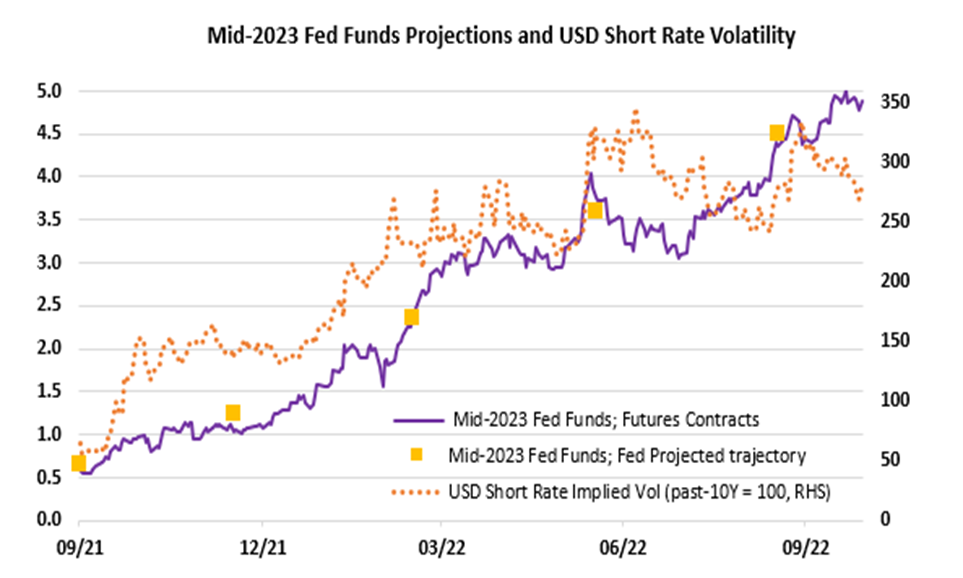

Fed meets amid elevated policy uncertaintyWednesday’s Fed policy decision and press conference will be watched closely for hints of a softening in the Fed’s policy approach to policy tightening. In the wake of media reports hinting at small rate hikes the S&P has climbed 6.3% and high yield corporate bond yields have slumped by 60bps. An outright policy U-turn (or ‘policy pivot’) is very unlikely but the Fed is clearly now better-placed than it was at the Sep meet. Core PCE readings are only modestly ahead of Fed projections while inflationary pressures from commodity prices have eased. Moreover, the USD short debt markets have already fully priced in the Fed’s warnings of higher rates into 2023. However, uncertainty over the policy outlook is still at elevated levels (as demonstrated by option implied volatilities – see chart below). A Fed bid simply to reinforce the credibility of (and market confidence in) its forecast policy trajectory would be welcomed by investors and keep the door open for a ‘long only’ strategy recovery. |

|

|

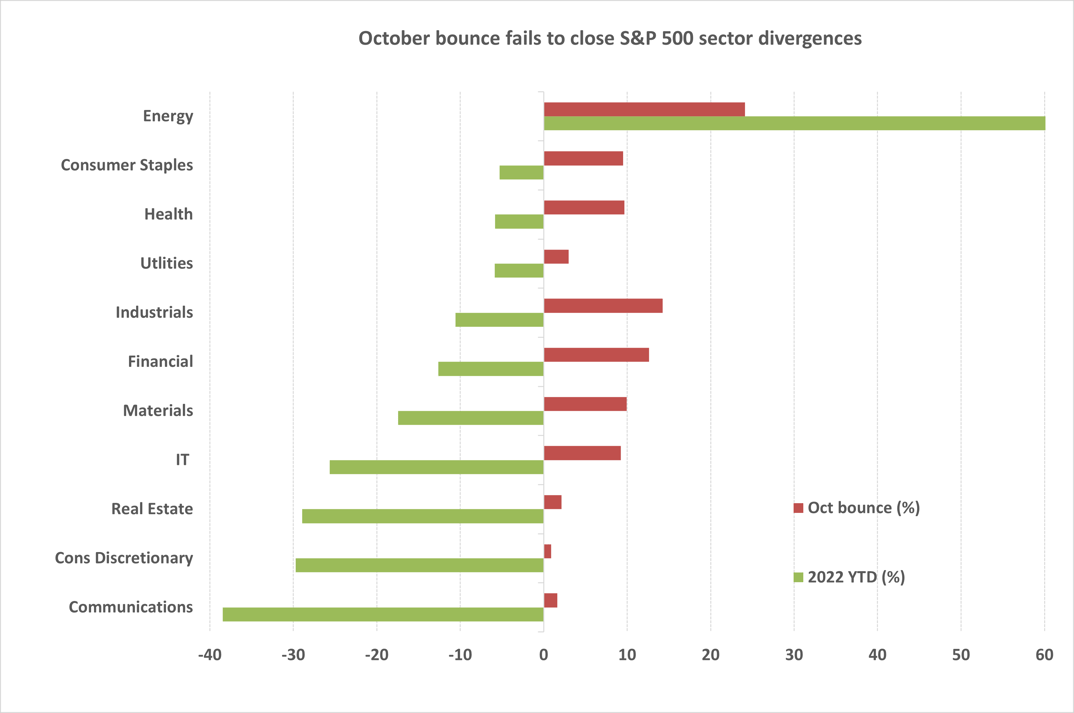

The October S&P 500 had broad participation with all of the major sectoral indices posted gains in the month. However, these gains failed to significantly narrow the divergences in performance of Q1-Q3 – underlying the importance of sector weighting, alongside market timing, in driving total returns. |

|

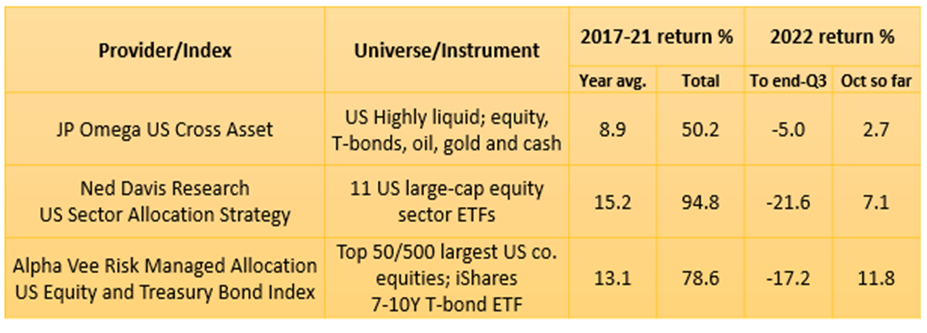

‘Long Only’ on the C8 PlatformThe C8 platform has a broad range of ‘long only’ strategies, both developed in-house and from external providers. In the table below, we highlight the October bounce-back for some of the external provider indices in the context of Q1-Q3 losses and 2017-21 gains (more detailed analytics can be found on the C8 website). In the latest month, both JP Omega and Alpha Vee strategies have been able to recover over the half of the losses sustained over Q1-Q3 . In the case of JP Omega these losses were rather modest in any case – reflecting an allocation process that aims to pre-emptively manage risk levels. The Ned Davis US Sector Allocation Strategy invests purely in large-cap equity sector ETFs and has thus seen a more volatile year than cross-asset strategies. The Strategy outperformed the overall S&P 500 index over the first three quarters of Q3 (-21.6% vs -24.8% for the index) and broadly matched the October index bounce. |

|

|