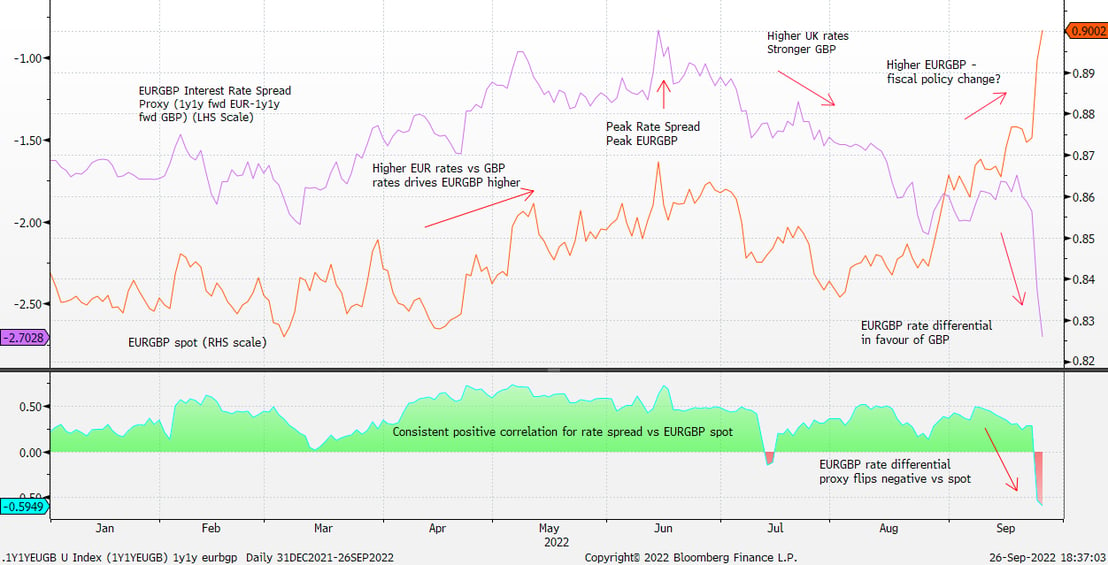

At IVI Capital, we spent much of 2021 and early 2022 focused on the risks associated with an extremely dovish stance of US monetary policy in the face of continued fiscal expansion. The Fed pre-determined that inflation would be “transitory” but realised in late 2021 that inflation would be both persistent and elevated, driving a hawkish pivot into a rate hiking cycle of unprecedented rapidity. This materially strengthened the dollar, tightening financial conditions both domestically and overseas. Countries that hiked rates early and hard (such as Mexico and Brazil) protected their currencies. Those that did not (Japan, UK, Europe) have seen weakening currencies exacerbating imported inflation costs, especially around energy which worsened after the Russian invasion of Ukraine.

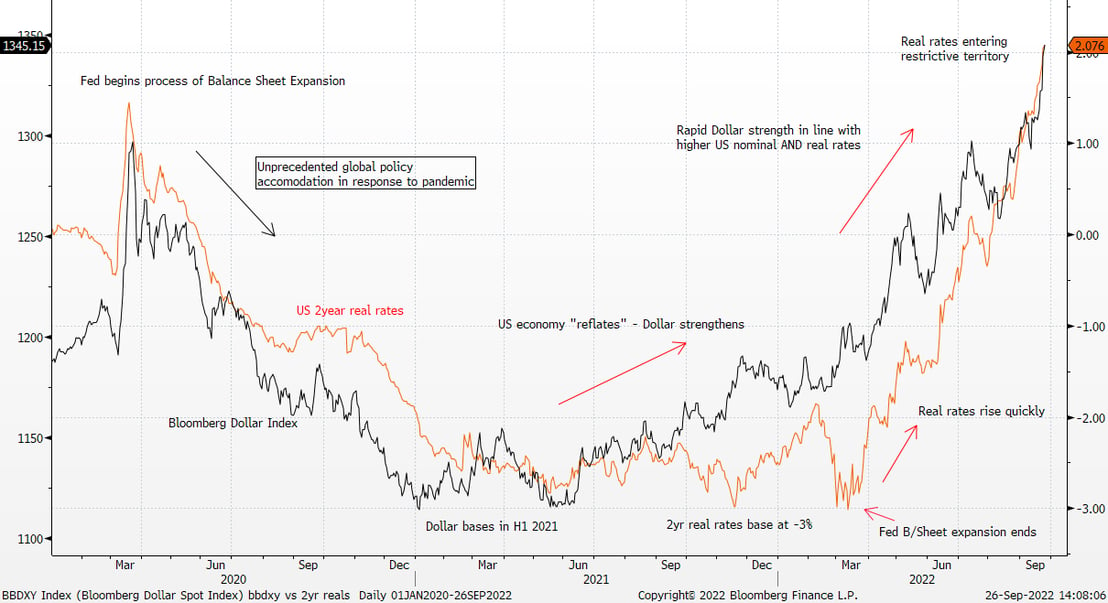

The Fed is expected to hike another 125bps by end 2022, but is this realistic given the outlook of slowing global growth? One of the many indicators we watch is the US 2 year yield adjusted for inflation (real yields). Since March 2022 when the Fed finally stopped expanding its balance sheet, 2 year US real yields have rallied from -3.0% to +2.1%! The chart below illustrates the strong correlation between the 2 year reals and the Broad Bloomberg Dollar Index which has been the key driver of the risk-reductive tone. This is a breath-taking pace of policy tightening.