|

15 November 2022 |

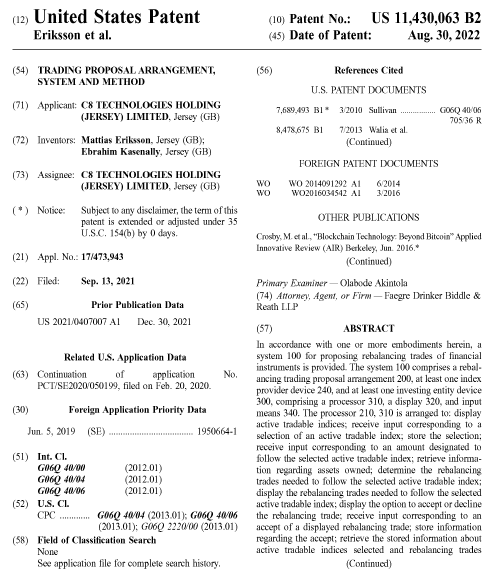

US Patent Granted |

|

C8, the pioneering fintech platform that offers investors the ability to use direct indexing across all liquid asset classes and investment styles, announces that the US Patent Office has issued a patent on C8’s ground-breaking end-to-end platforms, C8 Studio and C8 Wealth, for Direct Indexing. |

|

C8 Studio is a fully transparent, end-to-end solution. The asset owner can:

Transparency is achieved by use of a blockchain solution, so that index providers have full visibility of the usage of their indices and investors have full visibility on when indices are rebalanced by the index providers. |

|

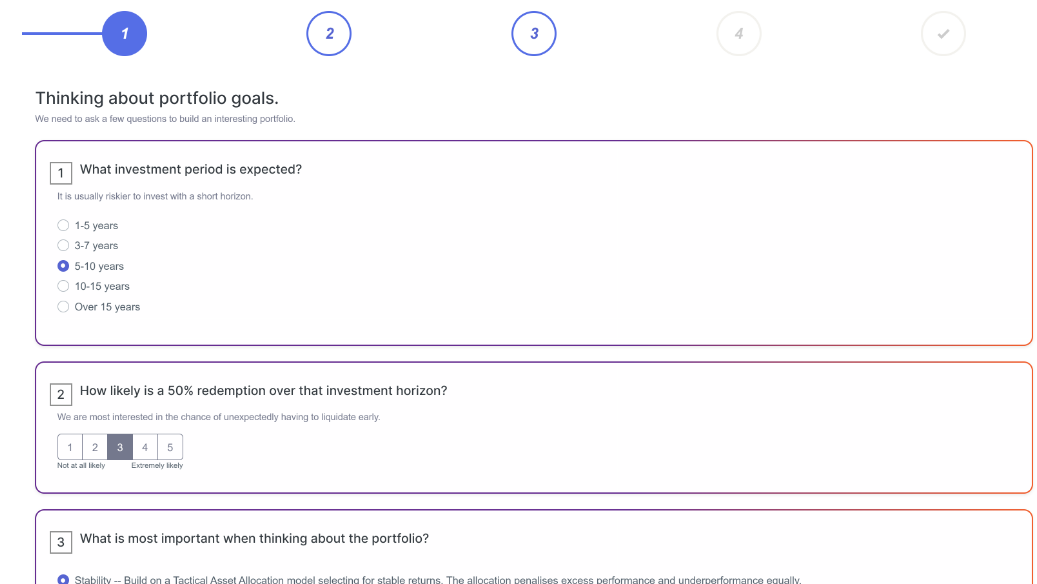

C8 Wealth brings the first end-to-end indexing platform to advisors starting with risk managed profiling; |

|

|

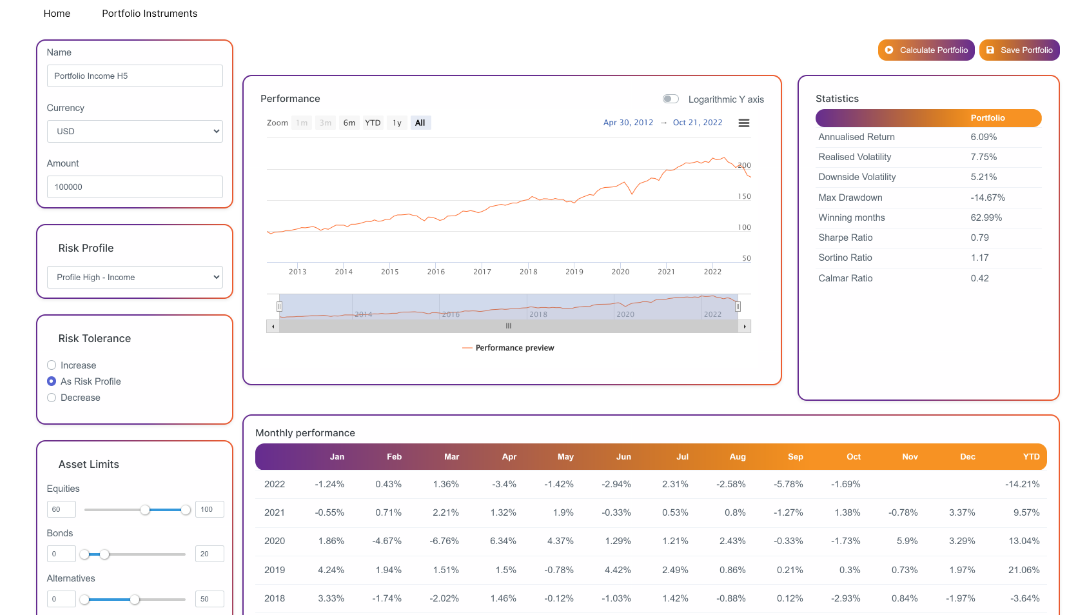

Advisors can then select from hundreds of index strategies to customize their own model portfolios with C8 Analytics. Advisors and clients can build optimal portfolio blends that meet their risk profile requirements. |

|

|

|