| We follow-up from last week’s piece by IVI Capital on US debt dynamics, with an interesting analysis from Boutique CIO on the overly optimistic forecasts of US earnings recovery later in the year. Lower earnings growth drive a lower US equity risk premium, with market expectations of US Fed funds peaking above 5% this year.

Boutique CIO (https://www.boutiquecio.com/) works closely with C8 Technologies in the US. With decades of investment management experience, Boutique CIO offers discretionary portfolio management covering equity, fixed income, long-short equity, option hedging, and thematic strategies. The firm also provides investment strategy, market research, investment committee management, and outsourced Chief Investment Officer (OCIO) solutions to advisors and planners, through the Boutique CIO ecosystem. Please find their full analysis below:

Quarterly Earnings Growth Estimates Forecast to Rebound Strongly in 2023

- For Q4 2022, SP500 earnings are seen contracting -3% and again by -5% in Q1 2023 and by -3% in Q2 2023. Analyst forecast strong growth in Q4, expecting H2 to propel CY 23 earnings towards a 2% gain for the year.

- An earnings reacceleration in the face of rising rates and a slowing economy seems unlikely. Though our expectation of a lower USD by Q4 23 will add currency gains (+5%) for multinationals.

- For many firms, Fed policy of lowering inflation will transmit via weaker pricing power and falling margins, most likely leading to lower earnings. This remains a key concern for equity investors for the remainder of this year.

|

|

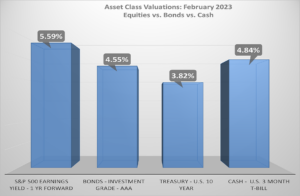

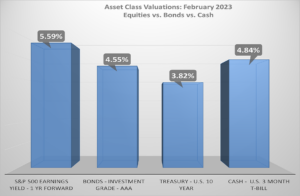

Asset Class Valuations – TINA is no more, with 5% Fed funds rate looming

- With U.S. 3 month to 12 month Treasury Bill yielding 4.8% to 5%, TINA is no more. PE multiples near 18x are priced for ‘no landing’ or immaculate disinflation which seems a low probability.

- Risk reward is against equities with S&P500 offering a historically low risk premium versus cash. Risk assets from equities to high yield bonds likely need to re-rate lower given cash yields at 5%.

We have moved!

After four good years in Michelin House, South Kensington, C8 have now moved to larger offices at 186 Regent Street. Please stop by!

C8 Technologies, 186 Regent Street, London, W1B 5TW, UK

Unsubscribe

|

|

|