Market Recap

While yesterday was positive all around, it was more a case of markets stepping away from the ledge but having yet climbed back through the window. Trump stated he has “no intention” of firing fed chair Powell but conversations are still ongoing concerning a replacement and to what extent that person could shadow Powell as he serves out his term. Also, in what has become a familiar pattern of behavior, Trump has now walked back China tariffs to the 40%-50% range from last week’s 245%. With certain economic peril sidestepped, we saw a literal relief rally.

Mag 7 and Technology names were additive to overall broad market equity index results as the Dow rose 1.07%, the S&P 500 added 1.67% and the Nasdaq Composite gained 2.50%. Small caps participated as well as the Russell 2000 closed 1.53% higher. Sectors, led by Technology (2.90%), Consumer Discretionary (2.23%), and Communication Services (1.60%) were all higher except for Energy, and Consumer Staples, which fell 0.18% and 0.57%, respectively.

Gold is coming back to earth from its $3,500+ peak to close at $3,288/oz and we saw the Cboe Market Volatility Index (VIX) close at 28.45, a level we haven’t seen since the beginning of April which given the past few weeks seems like a decade ago. Even Bitcoin has regained some of its luster, closing in on the $94,000 threshold, moving higher this time.

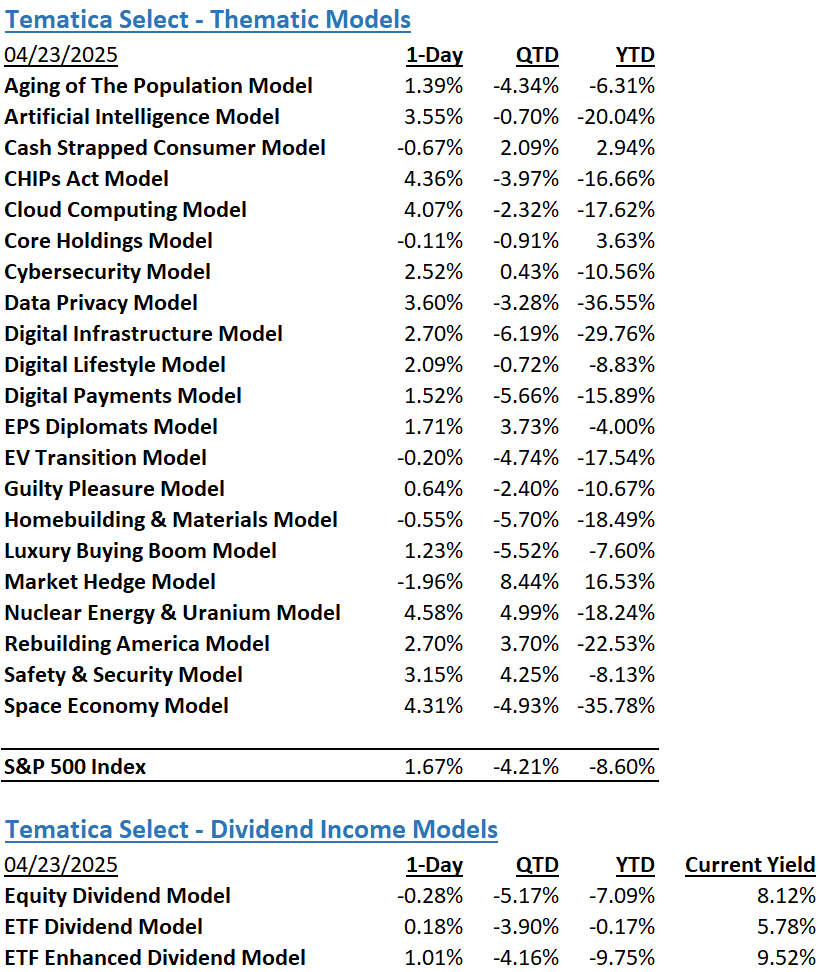

The Tematica Select Model Suite saw mostly positive results with leadership coming from Nuclear Energy & Uranium, CHIPs Act, Space Economy, and Cloud Computing. Core Holdings saw some light profit-taking, as did EV Transition, Homebuilding & Materials, and Cash Strapped Consumer.

China & the European Union Push Back on Trade Talk Progress

Futures point to US equity markets fading more of yesterday morning’s sharp move higher today following sobering comments from China and the European Union over the prospect of trade talks. The initial jump in stocks yesterday following comments by President Trump that China tariffs would drop “substantially” pending talks with Beijing, but early today China’s Ministry of Commerce Spokesperson He Yadong shared that “At present, there are absolutely no negotiations on the economy and trade between China and the US…” Comments from Pascal Donohoe, president of the Eurogroup and finance minister of Ireland also tossed some cold water on US trade talks with the European Union – “I do believe an agreement can be reached, but at the same time, I do know we have lots of work that we have to do in order to get to that point…”

Our initial take on Trump’s potential rollback of China tariffs is that they would still be higher than they were a few months ago, leading them to remain a headwind to corporate earnings, granted a potentially smaller one. With any hoped-for progress on trade talks poised to take time, quarterly earnings reports this morning from PepsiCo (PEP), Merck (MRK), and others are building on revised guidance from Kimberly Clark (KMB) on Monday that showed the impact on tariffs on its business.

Kimberly Clark cut its 2025 profit guidance citing $300 million in new costs from tariffs, resulting from a charge tied to a recent licensing deal and $200 million in estimated additional costs for tariffs implemented to date. Merck lowered its full-year profit guidance, and PepsiCo shared that global trade developments will increase its supply chain costs. Helen of Troy (HELE) pulled its forward guidance sharing that “Due to evolving global tariff policies and the related business and macroeconomic uncertainty” it is “not providing an outlook for fiscal 2026 at this time.”

As the velocity of March quarter earnings builds today and next week, investors should brace for more comments like this and the impact on S&P 500 EPS expectations for the current quarter as well as those for 2025. We continue to think this will force a re-think in EPS growth expectations and the size of valuation metrics investors are willing to apply to that market barometer. Perhaps for those who were nimble enough to utilize Tematica’s Market Hedge model, now isn’t the time to exit it?

Also poised to weigh on the tech sector today, while DRAM supplier SK Hynix (HXSCF) posted consensus topping quarterly results early this morning, the company warned that macroeconomic uncertainties including US tariff policy have created demand volatility that will impact the second half of the year. However, SK still sees demand from consumer electronics (PCs, smartphones, tablets), benefitting from the launch of new products that feature AI functionalities this year.

Good for our AI and Digital Infrastructure models, but those comments also set up quarterly earnings from Intel (INTC) after today’s market close. Leading into those results other reports indicate Intel will announce a large round of layoffs, potentially more than 20% of its headcount. Expectations call for the company to deliver a fourth consecutive drop in revenue, but we’ve seen new management teams deliver “kitchen sink” guidance as they take the reins and reset expectations. We’ll be interested in new CEO Lip-Bu Tan’s turnaround plans as it looks to catch up with others like Nvidia (NVDA), Marvell (MRVL), and Qualcomm (QCOM) that have been eating Intel’s lunch.

We’ll also be listening to the next round of Fed speakers following the data contained in yesterday’s April Flash PMI and Beige Book reports. The preliminary PMI data showed a sharp pick up in prices due to… you guessed it… tariffs”

Average prices charged for goods and services rose in April at the sharpest rate for 13 months, increasing especially steeply in manufacturing (where the rate of inflation hit a 29-month high) but also picking up further pace in services(where the rate of inflation struck a seven-month high).

Higher charges were attributed to rising costs, linked widely in turn to tariffs, rising import prices, and increased labor costs.

Meanwhile, the Fed Beige Book found that businesses dealing with the early stages of President Donald Trump’s tariffs are looking for ways to pass increasing costs onto consumers.

What we see in those reports does not suggest upcoming Fed speakers will offer any softer language compared to Fed Chair Powell’s recent comments about the potential prospect for rate cuts absent a collapse in the economy. The two reports from yesterday painted the picture of a slower-growing economy, but still a growing one.

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumers – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- Digital Infrastructure & Connectivity – Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.