FOLIOBEYOND COMMENTARY ON DYNAMIC ASSET ALLOCATION

The recent movement in rates has partly upended various investment approaches in the fixed income world. The decades-long bull market had led portfolio managers to expect a good portion of total return from being indexed to long duration benchmarks. Momentum models based on historical returns were biased by taking data points from a falling rate environment. The challenge going forward is how to adjust the investment management process of a fixed income portfolio in a potentially rising rate environment with dynamic shifts in the shape of the yield curve.

We believe fixed income strategies should continue to be part of a long-term portfolio but with a greater emphasis on dynamic sector allocation. Passive indexing exposes investors to significant duration risk relative to current yield levels offered in the generic government and investment grade sectors. One of the primary goals going forward should be to manage sector exposures dynamically without making risky macro calls. A multifactor modeling approach offers an attractive solution that can produce additional price gains to supplement income generated from fixed income portfolios. This type of approach will also opportunistically adjust duration exposure at the appropriate time to take advantage of higher yields at the longer end of the curve.

Certain fixed income sectors still provide respectable income levels with some potential price appreciation. These opportunities should be considered in the context of these sectors’ individual risk levels and correlation benefits in a diversified portfolio. Floating rate instruments will provide rising rates protection, but the impact of longer spread duration risk should be accounted for as well. Adding Treasury Inflation Protected Securities (“TIPs”) for inflation protection may not provide the desired effect. How much inflation is priced into the TIPs market vis-à-vis current CPI expectations? Are investors comfortable with the underlying rate duration exposure in longer maturity TIPs? These types of fundamental questions need to be addressed before their inclusion in a portfolio.

Liquidity is another major factor that needs to be considered in creating a dynamic fixed income portfolio. Trading individual CUSIP bonds can often be challenging, especially in a volatile market environment. Sector ETFs have gained popularity and offer significant liquidity, even in stressed market environments. By properly utilizing the right mix of ETFs, sector rebalancing is greatly facilitated with minimal transaction costs.

FolioBeyond’s model-based tactical approach offers an attractive solution for a meaningful portion of a fixed income portfolio. Its multifactor model captures relative value relationships and risk differentials to provide optimized portfolio allocations using a subset of 23 liquid sector ETFs. Its algorithmic approach seeks to be at the efficient frontier of the fixed income market with proper risk constraints incorporated into the optimization. This process has a high likelihood of generating attractive sector allocation alpha to supplement the current environment’s lower yield levels. The good news is that volatility creates opportunities, and a systematic approach should be able to capture these inefficiencies in a timely manner.

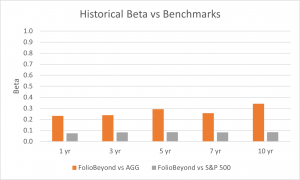

FolioBeyond’s dynamic asset allocation approach also provides highly uncorrelated returns versus standard benchmarks. The chart below shows the historical betas of our strategy relative to the S&P 500 and the Bloomberg Barclays U.S. Aggregate Bond Index (“AGG”). During the past 10 years, the beta to the S&P 500 has been negligible, averaging 0.08. Although high yield corporate bond exposures are included in the FolioBeyond strategy, our model portfolio optimization process practically eliminates any long-term beta to the stock market.

While the beta to AGG is higher, it is still relatively low (10-year average of 0.34) in comparison to many other fixed income strategies. This is again due to the dynamic rebalancing process built into the algorithm that optimizes asset allocation alpha by capturing the major components of value and risk.

Please contact us to explore how our optimized portfolio solutions can help you manage your overall fixed income portfolio in the current environment.

Yung Lim

Chief Executive Officer

Co-Chief Investment Officer

ylim@foliobeyond.com

(W) 212-397-7539

(C) 917-892-9075