Market Recap

If you had taken a bearish stance ahead of yesterday’s open based on pre-market broad equity futures, you would have been right, up until about 1:00 pm. In fact, while markets opened lower, they essentially spent the bulk of the day grinding higher. UnitedHealth Group (UNH) had a strong 8%+ day, contributing to just under 40% of the S&P 500 index’s 0.09% gain and about 100% of the Dow’s 0.32% rise. Mag 7 names took supporting cast roles yesterday, showing up in only 3 slots of the top ten contributors to return for holdings of the SPDR S&P 500 ETF Trust (SPY). The advance decline line for those names was 258/245, and the Dow 14/16, so overall, a mixed day. The Nasdaq Composite eked out a 0.09% gain, and small caps lost ground as the Russell 2000 closed 0.42% lower.

Sectors were largely positive, although Technology and Consumer Discretionary slipped 0.14% and 0.23%, respectively, dragged lower by Mag 7 constituents Apple (AAPL) and Tesla (TSLA). Energy led the way lower, dropping 1.30% as demand forecasts eased. The remaining sectors saw gains ranging from 0.06% (Financials) to 0.96% (Healthcare,courtesy of UnitedHealth Group). Despite Friday’s US debt downgrade, Gold held steady, picking up about $18 to close at $3.222.30/oz, and while some are calling for the 10-year yield to climb to 5% by year’s end, that benchmark only picked up 1 basis point (0.01%) to 4.45%.

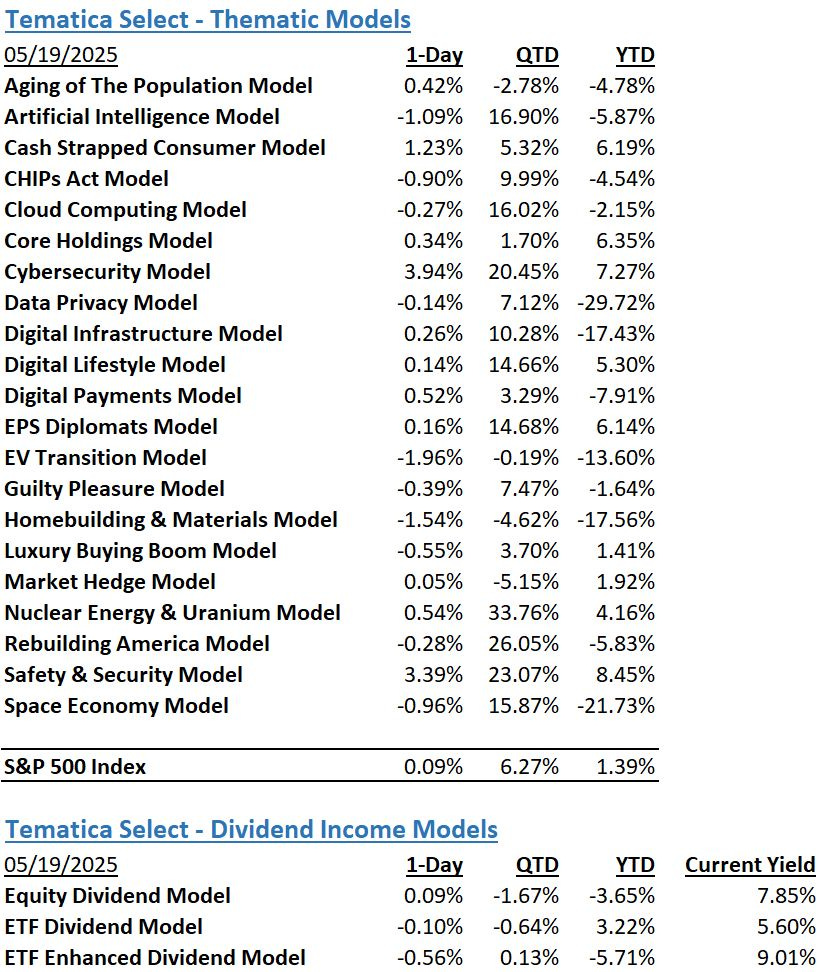

The Tematica Select Model Suite experienced a mixed day with leadership Coming from Cybersecurity and Safety & Security as well as Cash Strapped Consumer. Laggards included EV Transition and Homebuilding & Materials. With a number of retailers reporting this week, we’ll be keeping an eye on Core Holdings, Guilty Pleasure, and Luxury Buying Boom as well as Digital Lifestyle and of course, Digital Payments.

Home Depot & Homebuilding Earnings, May Flash PMI Coming Soon

Dip buyers returned yesterday to drive another positive day in US equity markets, extending the S&P 500’s winning streak to six consecutive days. That move also landed the S&P 500’s relative strength index (RSI) at 69.97, knocking on the door of being overbought. With an empty slate of economic data for today, the known catalyst is quarterly results from Home Depot (HD) and, to a lesser extent building products company Eagle Materials (EXP) and homebuilder Hovnanian (HOV). Because spring is a seasonally strong season for Home Depot and homebuilders, those results will be a closely watched barometer for consumer spending.

Comments about tariffs, margins, and pricing from Home Depot will be in focus, while pricing, the use of incentives and margins will be focal points inside Hovnanian’s results. Because Home Depot sources products from Mexico, Canada, China, India and other countries, its comments about tariffs should be insightful, and we suspect it is likely to reiterate Walmart’s (WMT) comments about pending price increases. Insights from Hovnanian should shape expectations for quarterly results from Toll Brothers (TOL) after today’s market close, while those from Eagle Materials should do the same for James Hardie’s (JHX). We’ll be drinking in those comments and revisiting not only our Cash-Strapped Consumer model, but also Homebuilding & Materials as well.

We also have another round of Fed speakers today which given a lack of fresh data, are likely to reiterate the slow your rate cut expectations roll comments yesterday from Atlanta Fed President Raphael Bostic and New York Fed chief John Williams. Both telegraphed investors should not expect a rate cut from the central bank until at least September. Williams summed it up rather well and put a new spin on Fed Chair Powell’s “data dependent” line when he said, “It’s going to be a process of collecting data, getting a better picture, and watching things as they develop.”

That reaffirms our view that upcoming data and how it re-shapes inflation and GDP expectations will be closely watched. With only a few pieces of April economic data left, we are seeing various rolling Fed member bank rolling GDP forecasts coalesce around a 2.3% – 2.4% figure for the current quarter. Such figures suggest the US economy is not being overly impacted by tariffs, and needs saving by the Fed. However, we do have a longer data road ahead to the Fed’s next set of updated economic projections it will share alongside its June policy meeting. We continue to think those projections could be a headwind for a market that continues to see the Fed delivering three rate cuts this year. That concern has us eagerly awaiting the May Flash PMI report that will be published later this week.

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumers – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- Digital Infrastructure & Connectivity – Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.