Equity futures point to a lower market open this morning amid renewed geopolitical tensions following reports that Ukrainian forces carried out their first strike on a border region in Russia using Western-supplied missiles as President Vladimir Putin approved an updated doctrine that lowered the use threshold for nuclear weapons. Under the new doctrine, Russia would consider using such weaponry if it — or its allies — were met “with the use of conventional weapons that created a critical threat to their sovereignty and (or) their territorial integrity.”

This as well as fresh strikes between Israel and Lebanon are lifting shares of defense companies found in our Safety & Security model and prompting, at least for now, a flight to safety. As we wait for Washington and other Western governments to respond, the market’s morning attention will shift to quarterly results from Lowe’s (LOW) and Walmart (WMT), and what they have to say about the consumer as we gear up for the holiday shopping season. Will it lean more toward a Cash-Strapped Consumer or Luxury Buying Boom? Guidance from Walmart but also next week from Abercrombie & Fitch (ANF), Best Buy (BBY), Kohl’s (KSS), Macy’s (M), and Nordstrom (JWN) will refine expectations ahead of the Black Friday-Cyber Monday shopping weekend.

In terms of today’s economic data, at 8:30 AM ET, the October Housing Starts and Building Permits report will be released. The market consensus calls for 1.34 million housing starts, down from 1.35 million but hurricane disruptions and the rebound in mortgage rates may translate into a somewhat larger sequential dip. We’ll be assessing the breakdown between single-family and multi-family categories for our Homebuilding & Materials model and the next update for the Atlanta Fed’s GDPNow model out later today. With the 2024 election behind us, in reviewing today’s Housing Starts figures and other housing data to come, we’ll be looking to see if Redfin’s (RFDN) findings calling for a pick up in moving amid US residents unfold.

Goldman vs. BofA on the S&P 500

Finally, we are seeing a difference of opinion emerge on Wall Street when it comes to the S&P 500. While Bank of America (BAC) says it is statistically expensive by almost every measure, Goldman Sachs (GS) sees that market benchmark hitting 6,500 by year-end 2025. Goldman sees “the recent broadening in U.S. earnings growth would continue in 2025 as the Federal Reserve cuts interest rates into next year and as business cycle indicators improve further.”

As we think about the probability of Goldman’s forecast, the question we’re pondering is how much more earnings growth the basket of S&P 500 companies would have to deliver next year so its P/E valuation isn’t stretched. The latest 2025 consensus EPS figure for the S&P 500 stands at $274.92, up 14.6% year over year, but that equates to a P/E valuation of 23.6x based on Goldman’s year-end 2025 target. The performance of the economy, the pace of Fed rate cuts, geopolitical tensions, and Trump administration policies will be factors that determine the likelihood of Goldman’s forecast.

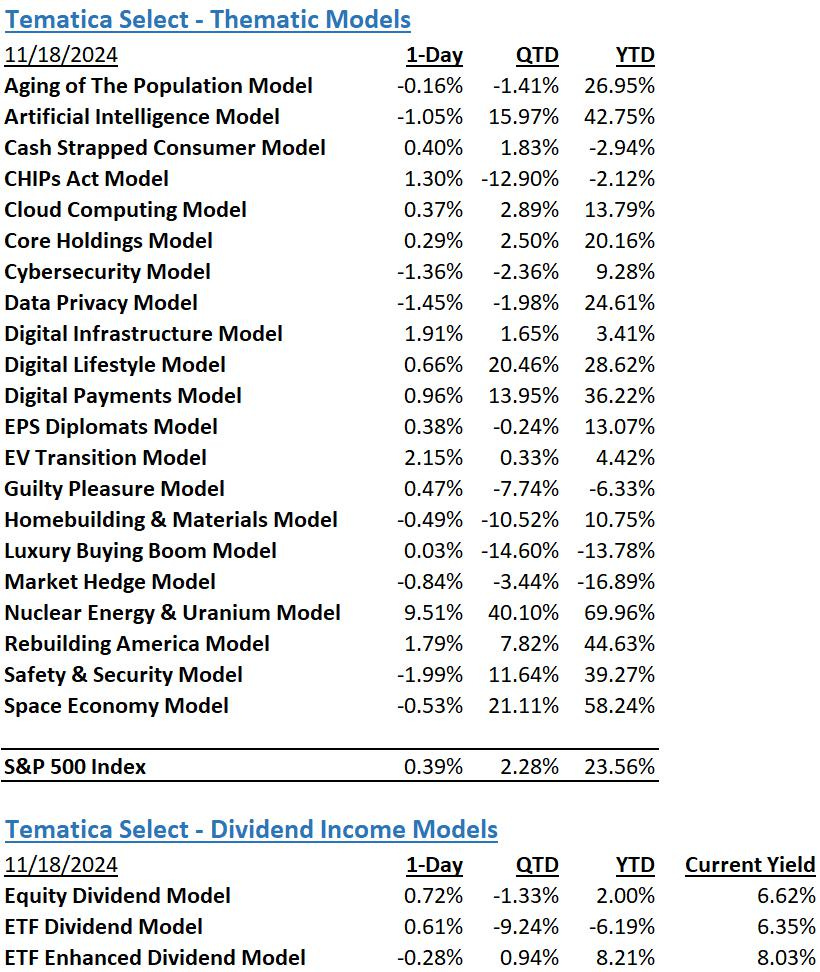

As those factors play out, we’ll stick to thematic and targeted exposure models that benefit from structural tailwinds. See more below.

Model Signals

Artificial Intelligence

Artificial Intelligence, Digital Lifestyle

“OpenAI is set to launch “Operator,” a groundbreaking AI agent capable of independently browsing the web and completing online transactions. Planned for a January release, the autonomous system will handle tasks from product research to purchases, potentially transforming eCommerce interactions. The move aligns with similar developments from Anthropic and Salesforce, signaling an industry shift toward AI agents that can execute complex tasks with minimal human oversight.” Read more here

“The accelerating competition in consumer AI apps signals a high-stakes battle for customer attention and wallets as companies race to convert casual users into paying subscribers through features like chatbots, photo editing and writing assistance.” Read more here

Cash-Strapped Consumer

“Most cardholders say their outstanding credit balance is either holding constant or increasing. Overall, 25% said their outstanding balance increased over the last year, while 55% said it stayed about the same. Just 21% said that it decreased. Financially struggling consumers were the most likely to see their credit card debt grow. Among cardholders living paycheck to paycheck with issues paying bills, 34% said their outstanding balances increased. For those paycheck-to-paycheck cardholders without difficulties paying their bills, 30% said the same.” Read more here

Cybersecurity, Digital Privacy

“T-Mobile’s network was reportedly breached in a massive Chinese cyber-espionage operation that targeted multiple US and international telecom companies… The breach is part of a larger campaign that has also affected other US telecom companies, including Verizon, AT&T, and Lumen Technologies, with hackers obtaining information from systems used for court-authorized wiretapping.” Read more here

Digital Lifestyle

“Select Audi owners will soon be able to use their Galaxy smartphones to lock, unlock and start their vehicles, without needing a physical key. Samsung Wallet now supports Digital Key for Audi to enable these capabilities, Samsung Electronics said in a Friday (Nov. 15) press release. The Digital Key functionality for select Audi vehicles will launch this month in Europe and then expand globally, according to the release.” Read more here

“More than 60 million households around the globe tuned into the much-touted boxing match between retired boxing legend Mike Tyson and social-media star Jake Paul, according to Netflix. “It was a record-breaking night for Netflix,” peaking at 65 million concurrent streams, Netflix stated Saturday in a news release.” Read more here

Digital Payments

“Stolen or falsified credentials now account for 41% of fraud cases measured — a very high share given the variety of tactics fraudsters use. That’s nearly twice as prevalent as the next most common type, fraudulent transactions, which account for 24%. Additionally, approximately seven in eight FIs report increased credential-based fraud instances. Given this atmosphere, it is likely no coincidence that FIs exhibit urgency to adopt innovative solutions like tap-to-authenticate metal payment cards.” Read more here

EV Transition

“Lucid, which has begun taking orders for its coming $90,000 version of the new electric SUV called the Gravity, aims to bring out a more affordable midsize vehicle to compete against the Tesla Model Y in late 2026. That vehicle is said to cost less than $50,000, but a cheap EV is something Rawlinson said he would only support by licensing his technology to another company.” Read more here

“Tesla has slashed the base monthly Model Y lease price – the latest of a series of incentives to help the automaker attempt to deliver a record number of vehicles this quarter. Last month, Tesla said that it still plans to be marginally up on deliveries this year despite being down for the first 9 months. It would require the automaker to deliver a record number of more than 515,000 vehicles in Q4. That’s ~30,000 more vehicles than Tesla’s last record quarter, which was Q4 2023.” Read more here

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumer – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- Digital Infrastructure & Connectivity –The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- Digital Payments – This model focuses on companies benefitting from the accelerating structural adoption of digital payments and financial technology (FinTech).

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.