Equity futures point to a down market open later this morning, but we’ll want to revisit futures as quarterly results from Home Depot (HD), Mosaic (MOS), Tyson Foods (TSN), and a few dozen other companies are reported. Because of the strong moves in both the S&P 500 and the Nasdaq Composite since the 2024 presidential election outcome, we would not be surprised to see traders and investors with short time horizons be profit takes especially as the Relative Strength Index (RSI) levels for both are bumping up against overbought levels.

While we wait for the October CPI and PPI reports to be published tomorrow and Thursday morning respectively, in addition to the October NFIB Small Business Optimism Index this morning brings two Fed speakers after the market open. Coming off last week’s Fed policy meeting and the lack of fresh data, odds are they will largely reiterate Fed Chair Powell’s comments. The same is likely true when Philly Fed President Patrick Harker speaks at 5 PM ET today.

In our view comments from the Fed speakers starting tomorrow through the end of the week will be far more constructive about what’s next for Fed rate cuts. We say this because the October inflation data will be published as will the October Retail Sales and Industrial Production data. The core inflation figures will tell us if the upward trend seen in recent data has abated; if not, that data would suggest the Fed may have some serious thinking about its December policy meeting.

The market has dialed back expectations for rate cuts over the coming quarters, now seeing four 25-basis point rate cuts being delivered by the end of 2025, down from that many by mid-2025. What’s in play, however, is whether the Fed will cut interest rates again in December after delivering 75-basis points in cuts between its September and November policy meetings. As of now, the CME FedWatch Tool shows the market pricing in a 69% chance the Fed will deliver yet another rate cut, but even that percentage has slipped over the last few weeks. We’ll be keeping an eye on 10-year Treasury yields as that data is published and Fed speakers make the rounds.

As we put more distance from Election Day and President-elect Donald Trump appoints cabinet positions, investors will start to focus on Trump’s economic policies and what they could mean for inflation and Fed monetary policy. Reports point to Trump nominating China hawks Senator Marco Rubio and Congressman Mike Waltz for secretary of state and national security advisor. Candidate Trump pledged to aggressively use tariffs, but whether those campaign trail promises are negotiating tools or become enacted policy will be determined in the coming months. This could inject a fresh wave of uncertainty into the market, something it and investors are not fond of.

Model Musings

Artificial Intelligence

“Salesforce Inc. plans to hire more than 1,000 workers to sell its new generative AI agent product. The hiring surge is aimed at capitalizing on “amazing momentum” for the new artificial intelligence product, Chief Executive Marc Benioff said in a message. “Agentforce became available just two weeks ago and we’re already hearing incredible feedback from our customers.” Read more here

Artificial Intelligence, CHIPs Act

“Tokyo Electron on Tuesday hiked its operating profit forecast for the year ending March 2025 by 8.5% to 680 billion yen ($4.42 billion) amid chip industry investment supported by the growth of artificial intelligence.” Read more here

Cash-Strapped Consumer

“There is pent up demand for projects… Our customers tell us that their lives are changing. Their families are growing. They’re upsizing, they’re downsizing. They need to move for a job. There is demand for remodeling, and they are putting it on hold until they see a more favorable financing environment. And so the demand is there, the question is, when it’s unlocked.” Home Depot customers have continued to put off projects, even though they’re in good financial shape, he said. About 90% of the company’s do-it-yourself customers own their homes.” Read more here

“Retail sales made during China’s annual Singles’ Day shopping event reportedly slowed again this year amid the country’s economic challenges and consumer skepticism about retailers’ promotions. While eCommerce platforms used to see growth in the double digits during Singles’ Day, more recent estimates put those figures in the low single digits… “ Read more here

Cybersecurity, Data Privacy

“The FBI is alerting companies that cybercriminals are using compromised U.S. and foreign government email addresses to send fraudulent emergency data requests. By sending these fraudulent requests to U.S.-based companies, the hackers are looking to gain access to the companies’ holdings of their customers’ personally identifying information (PII), the FBI said in a Nov. 4 Private Industry Notification.” Read more here

Digital Payments

“Pay-at-the-table technology allows customers to complete transactions at their dining table. As Roberts said, this can range from handheld point-of-sale (POS) devices carried by servers to standalone kiosks mounted at each table. These devices enable consumers to order and pay from the same screen.” Read more here

Safety & Security

“China on Tuesday debuted its latest model of stealth fighter jet and foreshadowed an ambitious pipeline of advanced drones, as Beijing displayed its determination to match American military might by investing heavily in the latest tech and forging ever-closer bonds with partners like Russia.” Read more here

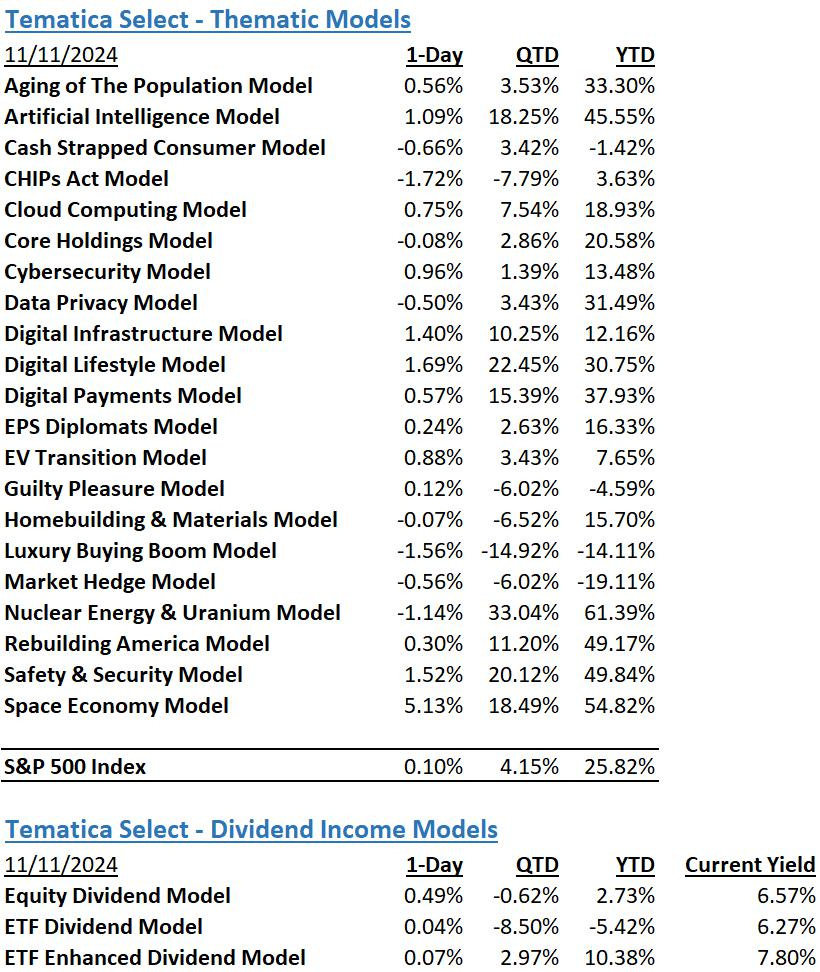

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumer – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption or destruction of data.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- Digital Infrastructure & Connectivity –The buildout and upgrading of our Networks, Data Storage Facilities, and Equipment.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- Digital Payments – This model focuses on companies benefitting from the accelerating structural adoption of digital payments and financial technology (FinTech).

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name says – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.