Market Wrap

We saw a social media post yesterday that read, “My portfolio’s pronouns are was/were” (h/t @dougboneparth). Monday was an admittedly tough start to the week, but honestly, with headlines stating we haven’t seen the Nasdaq Composite move like this since 2022, some perspective comes into focus. Let’s not forget that from the 2022 depths of 10,321.39 (10/14/22) to the February 14, 2025 close of 20,026.77, the Nasdaq Composite is up about 94%. Our point is that a 4% down day, while painful is just that, painful, and not portfolio destroying. To be clear, we are not saying that everything is hunky-dory, however, moves that bring relatively high valuations like the S&P 500 trading at 21x forward earnings back down toward a more historical average of 18x aren’t the worst thing in the world.

Aside from the Nasdaq Composite’s 4% drop, The Russell 2000 fell 2.72%, the S&P 500 shed 2.70% and the Dow closed 2.08% lower. As with last week’s declines these moves were not wholesale selloffs. The SPX advance/decline line was tilted in favor of declines 347/156 but just over 60% of yesterday’s move can be attributed to all Mag 7 names (including both share classes of Alphabet, GOOG and GOOGL), Eli Lilly and Company (LLY) and Broadcom (AVGO). In fact those tickers filled all the slots in the top 10 detractors from return for the index and make up 34% of the index as well. Gainer had some strong results, like Regeneron Pharmaceuticals (REGN) adding 5.27%, Nextera Energy (NEE) gaining 4.57%, and CME Group (CME) rising 3.03% but didn’t have enough presence to offset yesterday’s losers.

Looking at sectors, we again saw mixed results, with 5 of 11 sectors posting gains led by Consumer Staples (1.62%). The 6 remaining sectors however, constitute just under 75% of the weight of the S&P 500, led by Technology (-3.99%) which on it’s own makes up 30% of the index. Again, the pain is hitting specific sectors and doesn’t represent widespread panic.

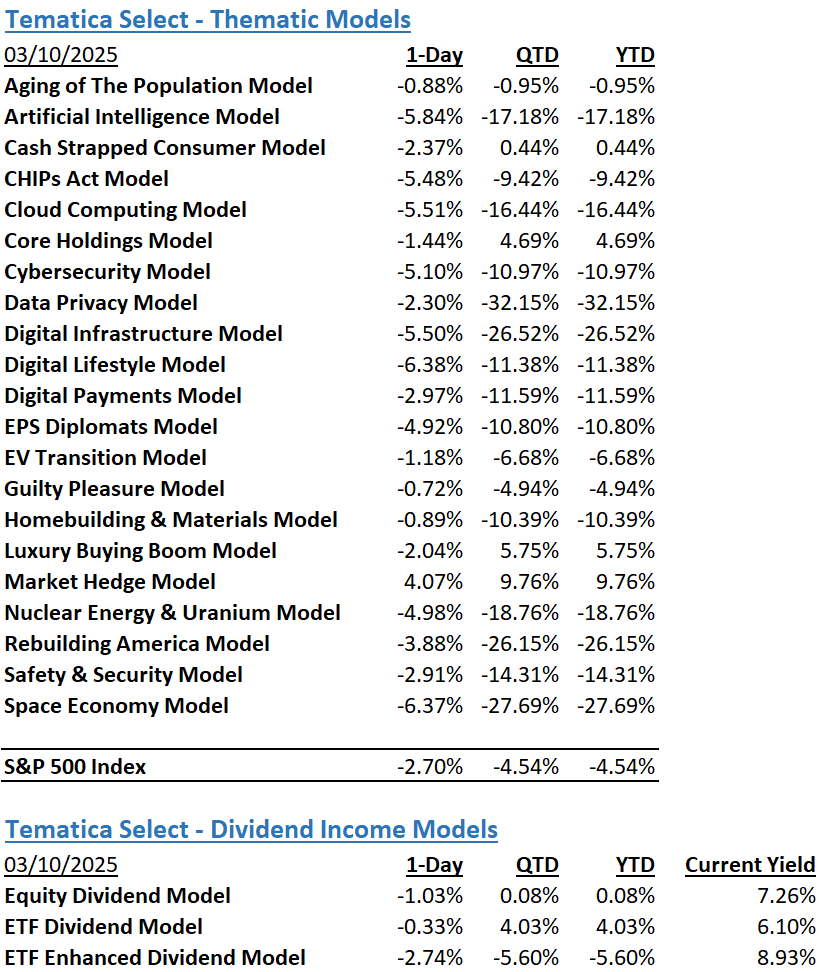

The Tematica Select Model Suite had one clear saving grace yesterday and that was Market Hedge. Still, we saw models like Core Holdings outpace broad equity indexes and other relative strength from Guilty Pleasure as compared to the Consumer Discretionary sector. Space Economy suffered due to Intuitive Machines’ (LUNR) recent successive moon landing failure which resulted in a 22.69% share price drop yesterday which also put pressure on other model names.

Is the US Economy Ready for a Detox?

Goldman Sachs (GS-US) issued a note on Friday that laid out some sobering numbers, including lowering the company’s estimate of S&P 500 index earnings per share by 2-3%. This forecast is predicated on the 25% and additional 10% tariffs levied on Canada and Mexico, and China, respectively, remaining in place. Given the rhetoric at the end of last week and over the weekend regarding an economic “detox” and “transition period”, we are just hoping that these economic “cures” don’t end up doing more harm than good.

Last night, futures were pointing to another soft open but so far this morning, we’re seeing S&P 500 and Nasdaq 100 eMini contracts up about 0.20%. Looking ahead a little, investors may find some refuge in this week’s CPI and PPI updates in that consensus estimates for both are calling for steady or slightly lower results as the most previous release. Still, with what seems to be a fairly resolute Fed and an administration effectively forcing an intervention on the US, not to mention global economy, it seems more likely that markets may have some more repricing in their near term future. Our only hope is that investors are able to reset the table without flipping it over.

Last week’s earnings releases were consumer heavy, and there are more retailers waiting in the wings. Kohl’s (KSS), Dick’s Sporting Goods (DKS), American Eagle Outfitters (AEO), Groupon (GRPN), Vera Bradley (VRA), Ulta Beauty (ULTA), and Dollar General (DG) are on deck this week but at this point, expectations are that regardless of the quarter’s results guidance is expected to be lowered.

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumers – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

- Digital Infrastructure & Connectivity – Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.