Market Wrap

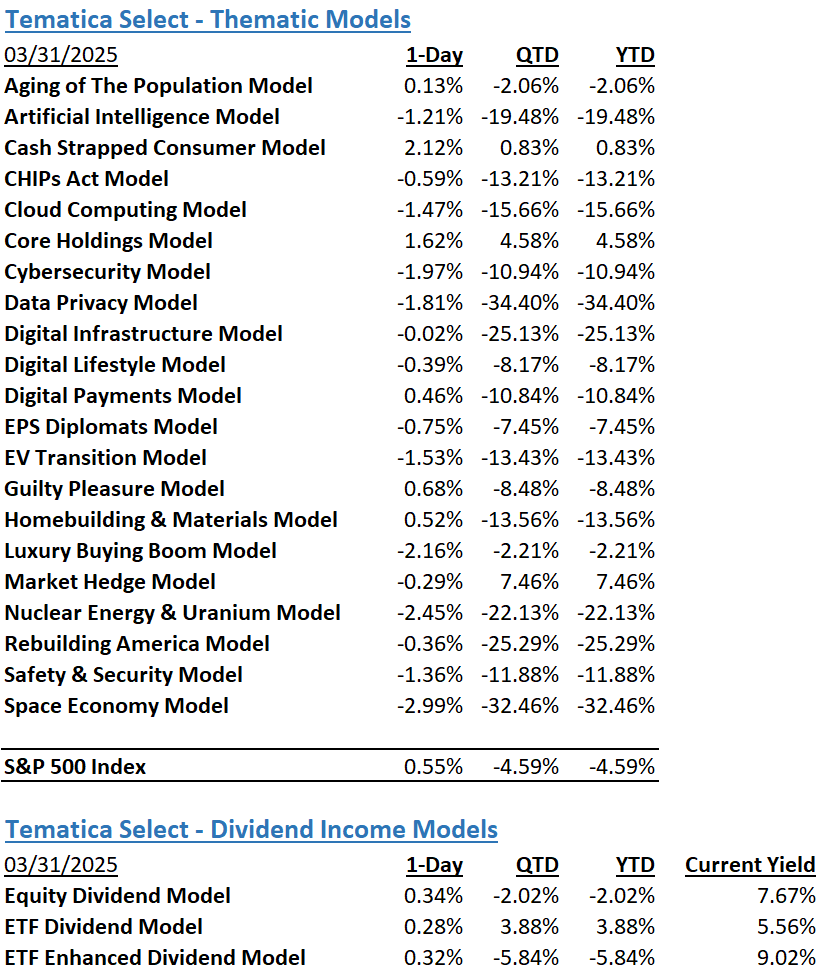

Given the “full steam ahead” on tariffs signaling from the White House markets surprisingly ended yesterday higher. Pre-market futures pointed to a rough open but aside from Small Caps falling 0.56% and some mild Mag 7 weakness which helped the Nasdaq Composite shed a mere 0.14%, the S&P 500 gained 0.55% and the Dow closed 1.00% higher. Sectors were up across the board, led by Consumer Staples (1.57%) and Financials (1.22%). We saw relative weakness in Technology (0.05%) which was held back by continued reduced sentiment in the AI and data center trade as evidenced by a down day from Microsoft (MSFT), Nvidia (NVDA), Palantir Technologies (PLTR), and Broadcom (AVGO), to name a few.

Also surprising, given yesterday’s equity price action was the Cboe Market Volatility (VIX) index edging higher to close at 22.28 and gold picking up almost $30 to hit $3.123.20/oz. Similarly, despite a recent rating agency warning on U.S. credit quality from Moody’s, the 10-year treasury index saw slightly stronger bids, pushing the yield lower to 4.21%.

Oil price action has been interesting lately, which yesterday included a report showing that US crude oil production hit a 15-month low in January. This, coupled with expectations of Trump’s controls on Russian Oil and his recent threats against Iran saw West Texas Crude (WTI) rise 3.00% and Brent Light Sweet (BRENT) gain 1.51%.

The Tematica Select Model Suite saw leadership from Cash Strapped Consumer, Guilty Pleasure, and Core Holdings strategies. While not falling out of bed per se, Nuclear Energy & Uranium, and Space Economy lagged to close out the quarter.

Tariff Clarity? More Earnings Pre-Announcements? Powell?

With one day to go before President Trump unveils his reciprocal tariffs, futures point to a mixed start for Q2 2025. While Trump claims to have settled on his tariff plan, reports as to what the president could announce, reportedly at 3 PM ET in the White House Rose Garden continue to vacillate between 20% global tariffs on virtually all imports to more targeted tariffs.

Our take is the situation is fluid, and the outcome will likely hinge on last-minute deal-making attempts that would allow Trump to claim some victory on the trade front. How all of this comes together and what it means for the market is very much TBD, but in our mind, what is just as important will be the response from those getting slapped with these tariffs. Then it becomes a question of whether Trump opts to escalate tariffs further. If you’re a public company that has just closed its books and is getting ready to issue June quarter guidance and possibly update your outlook for 2025, what’s to come has the potential to determine if your guidance meets, beats, or falls short of market expectations.

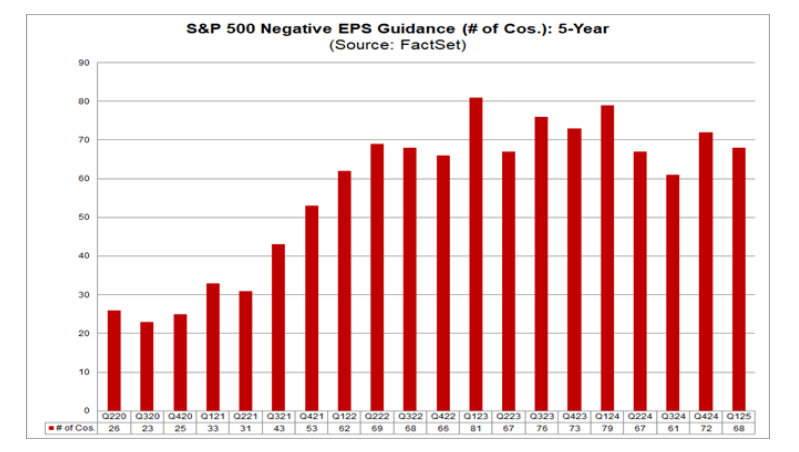

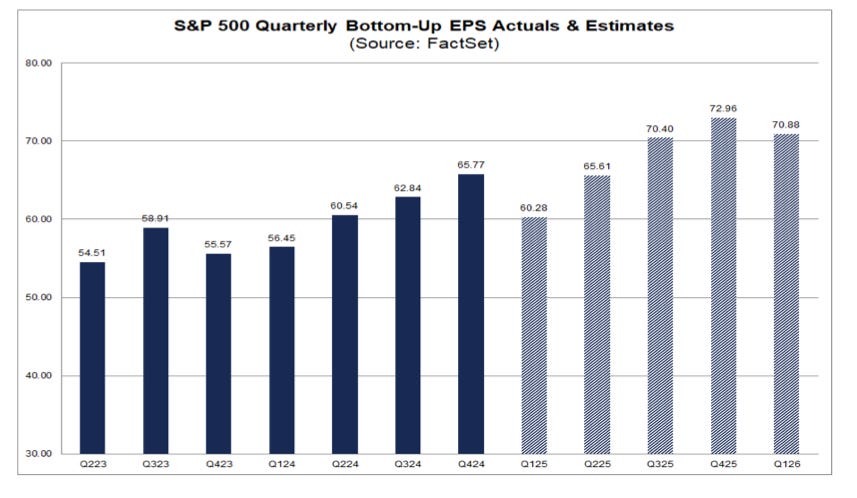

Data from FactSet shows that overall, 107 S&P 500 companies have issued quarterly EPS guidance for the first quarter. Of those companies, 68 have issued negative EPS guidance and 39 have issued positive EPS guidance. While a tad higher compared to the 5-year average, what is announced in the next few days could lead to even more negative earnings pre-announcements and fuel more questions about S&P 500 EPS growth prospects. Typically, when that happens, folks also question the market multiple, and for reference, the S&P 500 closed last night at 20.8x expected 2025 EPS of $269.92. For inquiring minds, that’s a 7% premium to the average peak P/E multiple for the S&P 500 over the 2000-2024 period sans the pandemic and matches the average peak P/E multiple for the 2015-2024 period also sans 2020.

Because we are in the often cited “quiet period” ahead of the March quarter earnings deluge and only one Fed official poised to speak today, it’s a good bet all eyes will be on the day’s economic releases. Those include S&P Global’s (SPGI) Final US March Manufacturing PMI, the more closely followed ISM March Manufacturing PMI, and the February JOLTs and Construction Spending Reports.

For our money, the focus will be on the March Manufacturing PMI reports and how they compare to the data found in the February reports. When reviewing the February data, the concern was a pull forward in demand given the expected Trump tariffs at the time on Canada, Mexico, and China. With Trump touting April 2 as “Liberation Day” during March, it’s quite possible the March data doesn’t fall as much as some might expect and it could surprise to the upside, likely due to more sales pulling forward ahead of unknown tariffs.

The big reveal to us will be in the new order dynamics as well as those for employment and inflation. On the one hand, because the US manufacturing economy is responsible for ~15% of GDP, what we see in the March Services PMI reports for those figures will be even more revealing. However, what we see in the data will influence GDP expectations for the March quarter. Given the Atlanta Fed’s GDPNow model at -2.8% for Q1 2025 and the New York Fed’s Nowcast model at 2.86%, it’s safe to say expectations are currently all over the map. It will start the process of refining expectations for what we could see in ADP’s March Employment Report tomorrow, Friday’s March Employment Report, and what Fed Chair Powell could say late Friday morning.

We’ll have more to share on Thursday as some of these puzzle pieces start to come together.

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumers – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- Digital Infrastructure & Connectivity – Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.