Auto tariff headlines weighed on broader markets yesterday and regulatory-based China fears saw shares of Nvidia(NVDA) trade off. Despite these headwinds, the advance/decline line for holdings in the SPDR S&P 500 ETF Trust(SPY) was close to evenly split (269/234) and the Dow precisely split (15/15). Nvidia and its Mag 7 brethren filled out the top 10 detractors for performance in the S&P 500 with Broadcom (AVGO) and Eli Lilly (LLY) filling in the other two slots, accounting for 83% of the index’s 1.12% decline. Lack of tech exposure helped the Dow slip less, dropping 0.31% and overexposure helped the Nasdaq Composite shed 2.04% by the close. Small caps also fell as the Russell 2000 declined 1.03%.

Auto tariff headlines weighed on broader markets yesterday and regulatory-based China fears saw shares of Nvidia(NVDA) trade off. Despite these headwinds, the advance/decline line for holdings in the SPDR S&P 500 ETF Trust(SPY) was close to evenly split (269/234) and the Dow precisely split (15/15). Nvidia and its Mag 7 brethren filled out the top 10 detractors for performance in the S&P 500 with Broadcom (AVGO) and Eli Lilly (LLY) filling in the other two slots, accounting for 83% of the index’s 1.12% decline. Lack of tech exposure helped the Dow slip less, dropping 0.31% and overexposure helped the Nasdaq Composite shed 2.04% by the close. Small caps also fell as the Russell 2000 declined 1.03%.

Consumer Staples was the clear sector winner yesterday adding 1.32% as all but 4 names in the Consumer Staples Select Sector SPDR Fund (XLP) ended the day higher. Energy (0.59%), Utilities (0.52%) and Real Estate (0.29%) filled out the list of positive returning sectors and the remaining sectors saw results ranging from -0.06% (Materials) to -2.29%(Technology). The Cboe Market Volatility Index (VIX) gained 6.88% yesterday, closing at 18.33 and we saw gold effectively flat, rising a mere $0.41 to $3,020.50/oz.

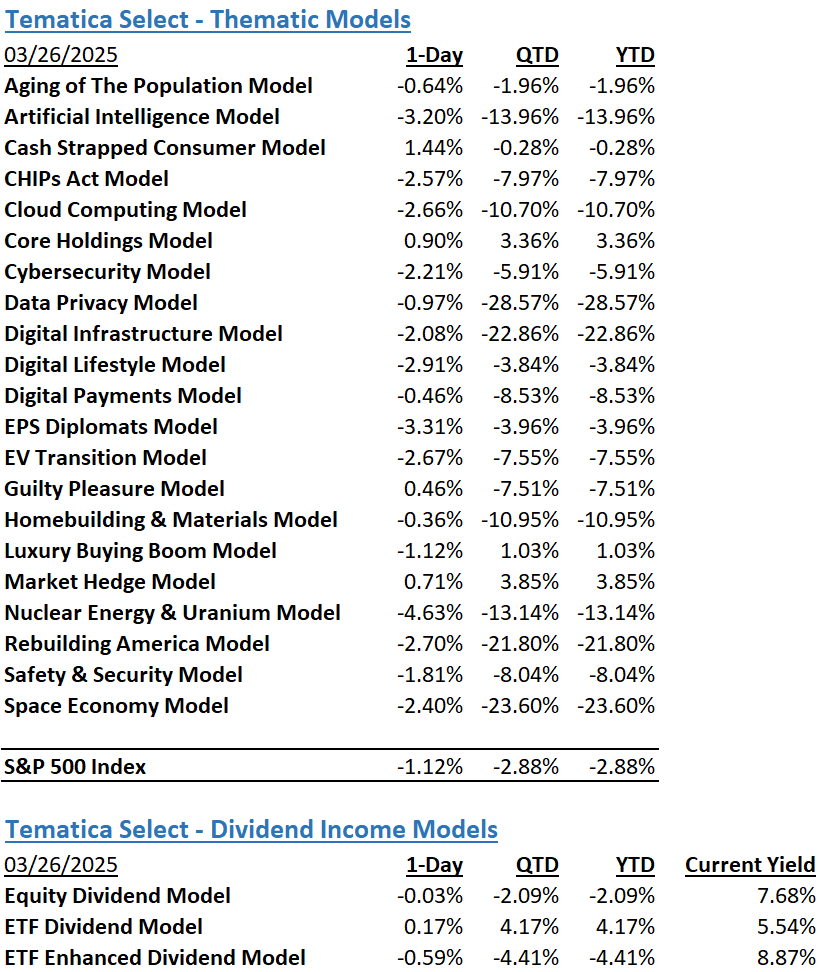

Market Hedge extended its quarter-to-date lead over the S&P 500 index to 5.00% but was not the only strategy to end the day higher. Positive strategies yesterday included Cash Strapped Consumer, Guilty Pleasure, and Core Holdings, each buoyed by various Consumer Staples names. Nuclear Energy & Uranium and AI ended lower as data center and AI buildout concerns flowed through both strategies.

Trump Auto Tariffs, Fed Speakers, CoreWeave’s IPO

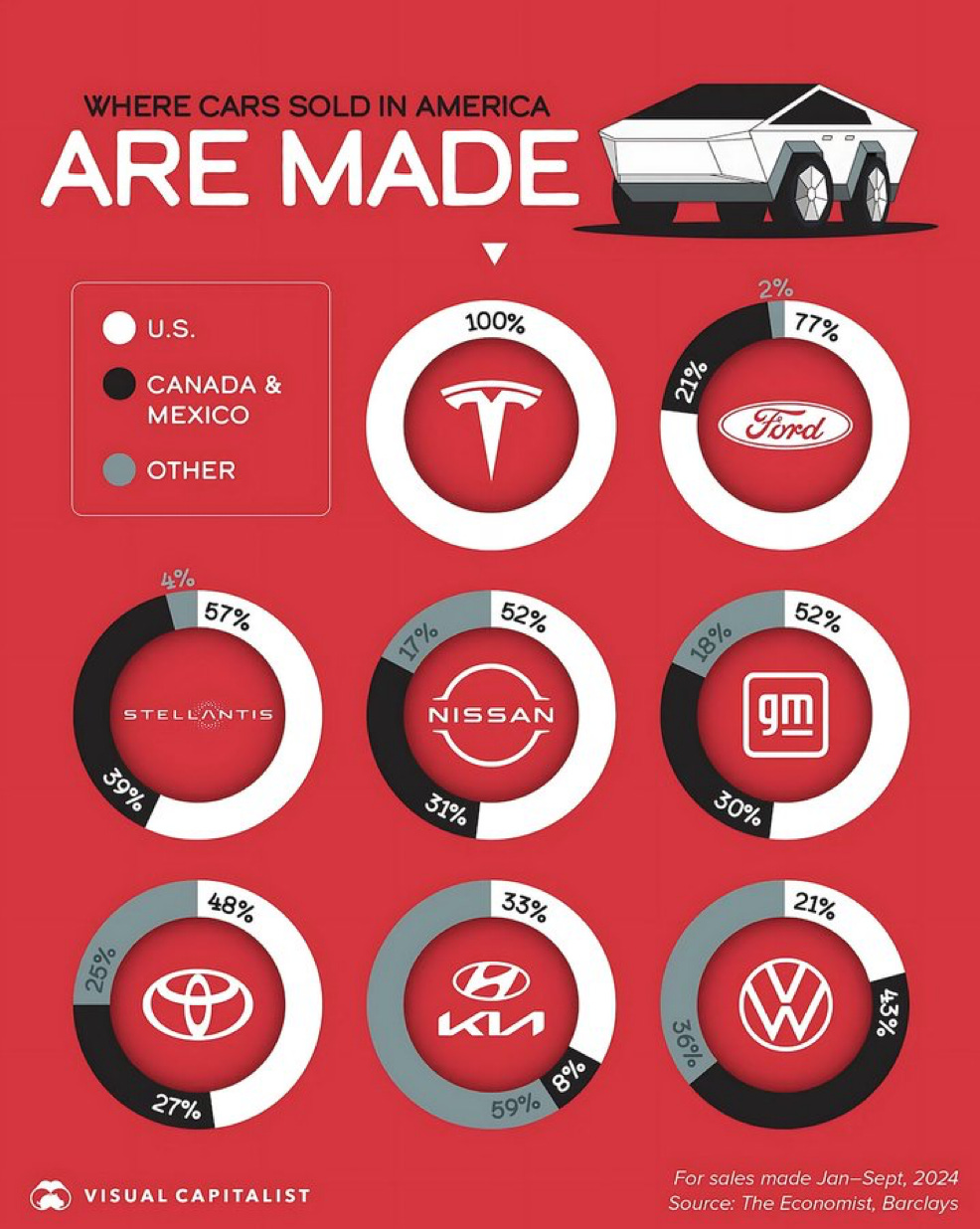

Early this morning, equity futures are mixed following President Trump’s announcing plans to impose 25% tariffs on “all cars that are not made in the United States” and “absolutely no tariff” for cars that are built in the US. That sure sounds to us like a stick designed to drive car companies to build autos in the US. While the initial thought may be about implications for Stellantis (STLA), Volkswagen (VWAGY) , and other Asian or European car companies, as we can see in the chart below, thanks to Visual Capitalist, GM (GM) and Ford Motor (F) won’t escape unscathed.

According to data from S&P Global Mobility, nearly half of new passenger vehicles sold in the U.S. in 2024 were assembled outside the US. And with tariffs expected on both finished automobiles as well as auto parts starting on April 3, it’s a pretty safe bet we will see car prices march higher.

Potentially aiming to soften the impact, Trump shared that his expected reciprocal tariffs slated for April 2 will be on all countries, but that they will be “very lenient.” Exactly what that means will be laid out next week, but the other outcome to all of this we’ll be watching for will be the response from Canada, Mexico, the European Union, and others. Trump has already suggested further tariffs would be imposed on the European Union and Canada if they worked together “to do economic harm” to the US. That sure sounds like the potential for tariff escalation to us, and that would only bring more uncertainty about the economy and prospects for corporate earnings.

S&P 500 price target cuts are starting

As the market works its way through the implications of Trump’s auto tariffs and waits to hear more about pending reciprocal ones over the coming days, today brings quarterly results this morning from Winnebago (WGO) and Lululemon Athletica (LULU). Comments from both will bring more color on the different aspects of consumer discretionary spending. With Lululemon, we suspect folks will be stacking up what is said against results and guidance from Nike (NKE) last week. The reason? To see if Nike is losing apparel market share the way it is in footwear.

Stepping back a bit on the earnings front, we are starting to see cuts to 2025 S&P 500 EPS expectations, which in turn are giving way to reduced price targets for that market barometer. Yesterday, Goldman Sachs (GS) cut its 2025 S&P 500 target to 6200 from 6500, but the slashing that got far more attention was the one from Barclays. The firm dropped its S&P 500 target for this year to 5900 from 6600.

Factoring in the potential impact of tariffs both on economic activity and corporate bottom lines, Barclays also reduced its 2025 S&P 500 EPS forecast to $262 from $271. That implies a P/E multiple of 22.5x to get Barclay’s revised target, which is not too far off the peak multiple for this year, but much higher than the average peak of 19.7x for the 2000-2024 time frame and the 21.4x average for the 10-year period between 2015-2024.

Do the math on that, and perhaps take another look at our Market Hedge model?

Who said two Fed rate cuts this year?

We’ve already shared our concern over June quarter guidance and implications for S&P 500 EPS expectations. Given the developments with Trump tariffs in the last 24 hours, and the renewed uncertainty they bring, more are likely to join us, and, in our view, it would be surprising if other Wall Street firms don’t revise their S&P 500 price targets. As they do, it’s likely to keep a lid on the market but it’s not the only potential headwind.

Some would say we are seeing an earlier-than-expected departure from last week’s updated set of economic projections that included two 25-basis point rate cuts for this year. Sparking that thought, earlier this week, Federal Reserve Bank of Atlanta President Raphael Bostic shared he sees just one rate cut this year. Much like we do, Bostic does not see a clear way to the Fed’s 2% inflation target ahead and he made his thinking very clear – “Because that’s being pushed back, I think the appropriate path for policy is also going to have to be pushed back.”

With those comments coming ahead of Trump’s auto tariff announcement, we’ll be curious to see what Fed speakers making the rounds today and tomorrow. We also think that between the inflation data contained in Monday’s Flash March PMI report and tariff developments, the market is going to look right through Friday’s PCE Price Index data for February.

CoreWeave and the IPO market

When Jefferies (JEF) reported its February quarter results last night, it shared the following:

There remains strong dialogue around potential investment banking transactions (capital raising and advisory) and our high-quality backlog continues to build. Its realization depends on confidence and visibility reemerging, which may be beginning.

We take that closing comment as a reference to the expected pricing of CoreWeave’s (CRWV) IPO slated for late today. The company is expected to offer 49 million shares with price talk between $47-$55 but coming into this week indications were the transaction was already oversubscribed. Because this offering will be closely tracked and could serve as a wedge to open the IPO window, there is more than a little pressure on the transaction’s pricing and the post-deal performance of CRWV shares. Waiting in the wings are Klarna, StubHub, and others, and let’s not forget what a rebound in activity means for companies like Goldman Sachs, JPMorgan Chase (JPM), and others.

Two other quick points to make. First, Nvidia has a stake in CoreWeave, which means a successful offering could perk up those shares. Second, as it relates to our Nuclear Energy & Uranium model, it looks like there will be a new candidate for us to consider. Nuclear power developer Terrestrial Energy Inc. plans to go public by merging with special purpose acquisition company HCM II Acquisition Corp. In a nod to small nuclear reactors, the combined entity expects to list on the Nasdaq under the symbol IMSR.

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumers – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

- Digital Infrastructure & Connectivity – Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.