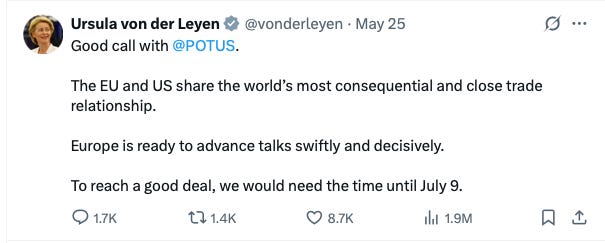

Coming off yesterday’s Memorial Day holiday, one that had the US stock market closed, futures are ripping higher this morning following President Trump delaying the introduction of 50% tariffs on EU imports until July 9. After complaining last week that trade talks with the EU were going nowhere, it appears Trump’s bombastic strategy to jumpstart those conversations by threatening those 50% tariffs starting June 1 worked. Over the weekend, President of the EU Commission Ursula Von der Leyen tweeted, “Good Call with @Potus… Europe is ready to advance talks swiftly and decisively.”

While the market enjoys this quick rebound, which should offset the market’s move lower last week, investors have a crammed schedule this week as we once again try to fit five days of data and developments into four. Looking at the economic data and earnings calendars, you’ll see it’s stacked toward the second half of the week, which also happens to be the end of May. Following the US-EU trade development, the two biggest pieces of economic data the market will face are the next iteration of the Fed’s monetary policy meeting minutes due Wednesday afternoon, and the April PCE Price Index data on Friday.

In terms of those market focal points, given the inflation findings in S&P Global’s Flash May PMI report as well as comments from a growing list of companies that price increases are on the way, we would once again argue their contents will skew more toward the rearview mirror than breaking new ground. To us, more meaningful data to watch will come in early June when we get ISM’s May PMI data and what it says about inflation, as well as the pace of job creation.

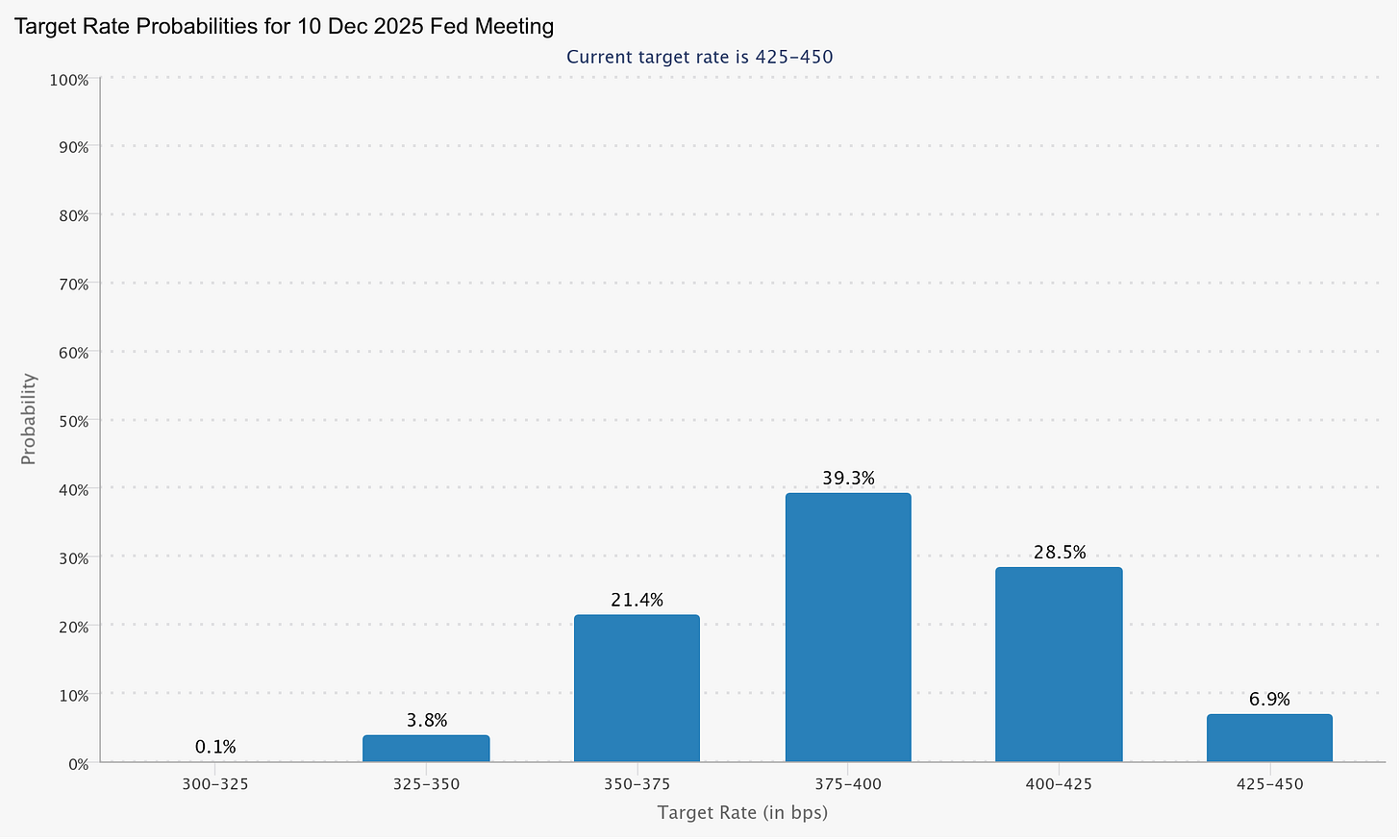

We’ve also started to see Fed officials telegraph rate cuts are likely off the table at least until the Fed’s September policy meeting. While that strongly implies a rate cut is off the table following the central bank’s next policy meeting, which concludes on June 18, it does mean we will be very interested in what its updated set of economic projections call for. Remember, the last set of those projections from March showed just two rate cuts penciled in for the year; as of now, the CME FedWatch Tool still shows the market expecting three.

The vacuum between those policy minutes and the April PCE Price Index data will be filled by a combination of quarterly earnings reports, including the one from market heavyweight Nvidia (NVDA), and the next wave of investor conferences. During those investor conference presentations, we’ll be interested in what management teams say not only about the current quarter but also how demand patterns, tariffs, and corresponding uncertainty are influencing their thoughts about 2H 2025.

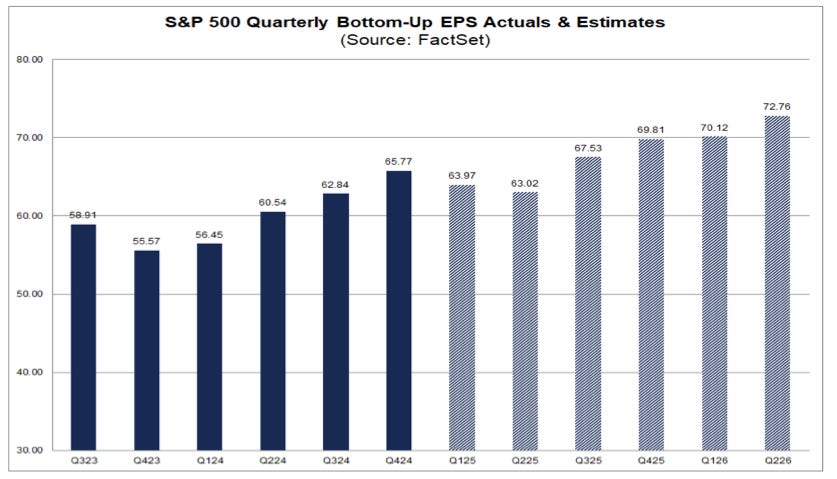

What we’ll be trying to ascertain ahead of the June quarter earnings season are the odds that the basket of companies that comprise the S&P 500 will deliver 8% EPS growth in 2H 2025 compared to 1H 2025? The answer will likely impact investor conversations around market multiples, but it will also be one that hinges on trade deals and the passage of Trump’s “big, beautiful bill”. For those, it means keeping eyes on Washington.

Nvidia shares are the second-largest component for the S&P 500 (~6% ) and the Nasdaq 100 (more than 11%), which means it will be one of the most closely watched reports in recent weeks, with ample eyes pouring over its guidance. While the signals we’ve shared for AI and data center point to robust activity, the question is once again whether Nvidia can not only top market consensus forecasts but also those stretch whisper figures, which tend to be a good deal higher than those consensus figures. When Nvidia missed whisper figures for its last quarter, the shares dropped 8% the next day and trended lower in subsequent days. Something to keep in mind as we watch the market rebound today.

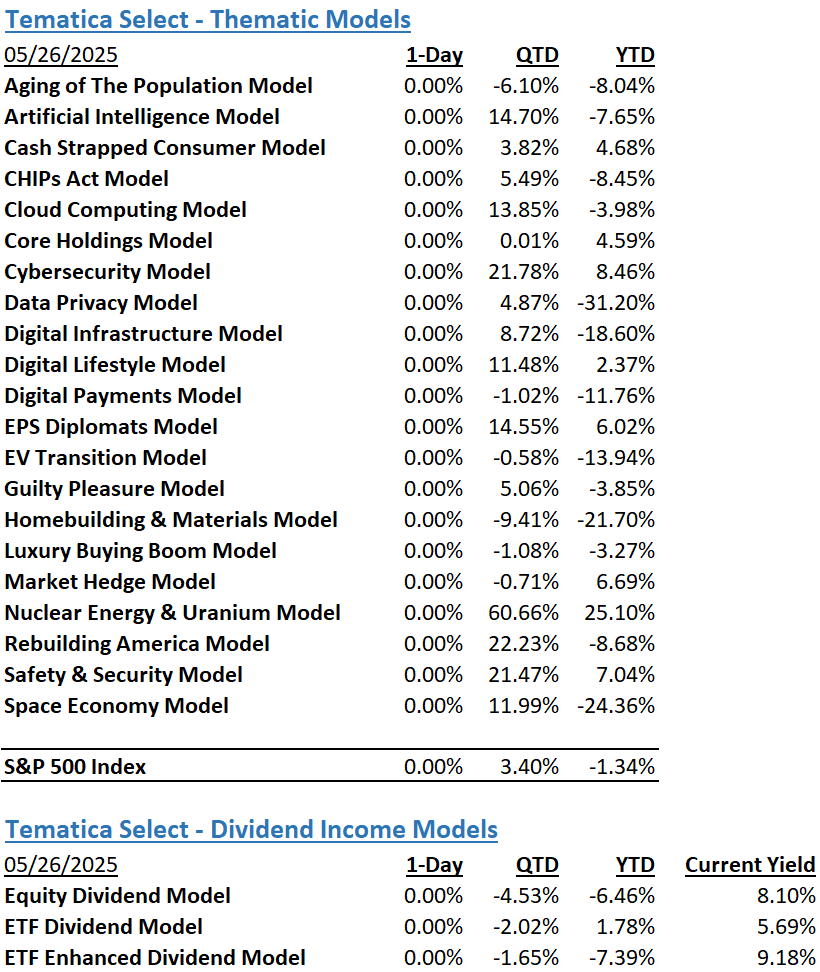

In addition to Nvidia, we will also be parsing results and comments from Elastic (ESTC), Marvell (MRVL), HP (HPQ), Dell (DELL), Best Buy (BBY), and Salesforce (CRM) about AI and data center, cloud, and AI PC demand. e.l.f. Beauty (ELF) shared last week that it will be boosting prices on some products, and with that in hand, we expect we will be hearing more of the same from other retailers next week. We also wouldn’t be shocked to see them follow in the footsteps of Ross Stores (ROST), American Eagle Outfitters (AEO), and others that withdrew their guidance. We’ll also be listening for comments about the use of markdowns and promotions, which could weigh on margins but also signal that consumers continue to tighten their belts. In Tematica speak, we’ll be looking for comments about our Artificial Intelligence, Digital Infrastructure, and Cash-Strapped Consumer strategies and models.

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumers – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- Digital Infrastructure & Connectivity – Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.