Market Recap

Four of the Mag 7 names showed up in the top 10 detractors from performance for the S&P 500, contributing to -121% of that index’s result. Despite this, broad equity indexes ended yesterday ahead, with the Russell 2000 adding 1.41%, the Dow gaining 0.71%, the SP 500 rising 0.39% and the Nasdaq Composite closing 0.19% higher. Looking at the S&P 500 index, the list of top 10 contributors to return, while led by Nvidia (NVDA) had a good mix of sector names represented, including Amgen (AMGN), Costco (COST), Visa (V), and JP Morgan Chase (JPM).

Sector-wise, Materials, Consumer Discretionary, and Communication Services posted the only negative results due to their respective Mag 7 components closing lower, at least for the last two mentioned. The remaining sector results ranged from 0.07% (Industrials) to 1.57% (Real Estate). Volatility retreated as the Cboe Market Volatility Index (VIX) settled down 8.37% to 15.77 while gold was nudged higher to $2,865/oz. Oil priced just over 2% lower as markets reacted to Tuesday’s EIA update that US reserves were unexpectedly high.

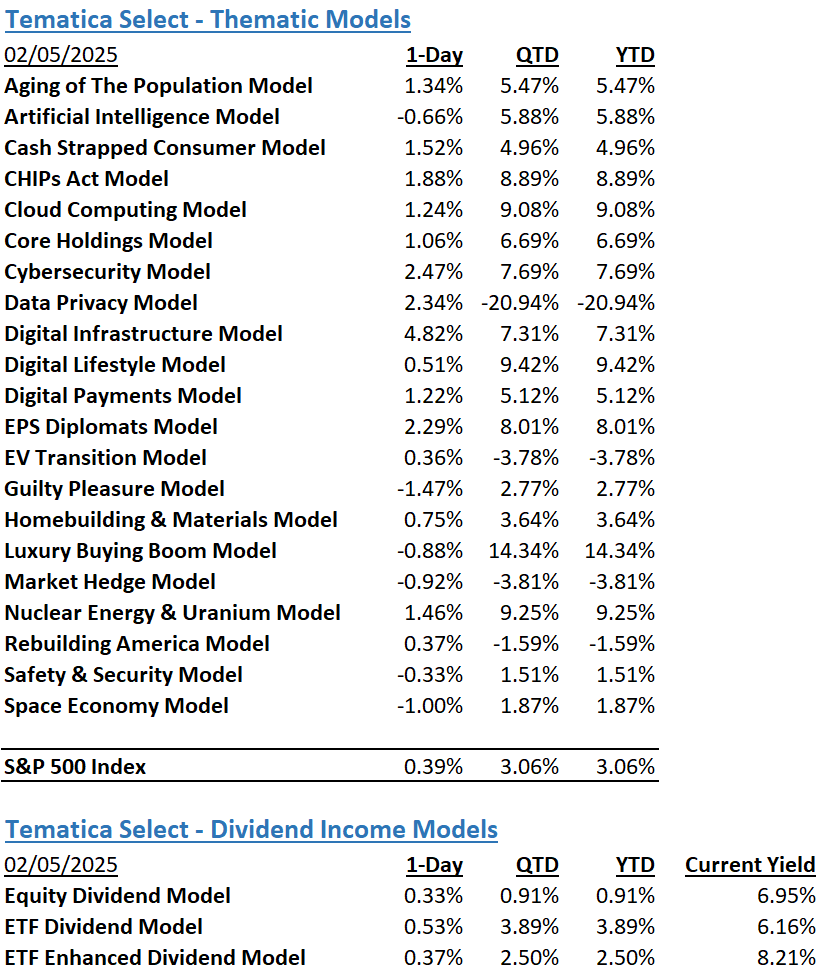

From a Tematica model perspective, the market’s reaction to Alphabet’s (GOOG, GOOGL) earnings helped guide AI lower but a number of other technology-oriented strategies posted healthy gains, including Digital Infrastructure, Cybersecurity, Data Privacy, Cloud Computing, CHIPs Act, and what passes for tech adjacent these days, Nuclear Energy & Uranium. Aside from technology-focused strategies, EPS Diplomats and Cash Strapped Consumer also participated in yesterday’s bounce.

Apple Sourcing Changes and Why Fed Speakers May Lean More Hawkish

Futures point to equities making further gains when the market opens later this morning. Sizing up those futures, however, we find those for the S&P 500 are, at least of this writing, ahead of those for the Nasdaq Composite. The reason likely stems from the downward pull from the shares of Arm Holdings (ARM) and Skyworks (SWKS) following their quarterly results last night.

Arm delivered a solid beat for its December quarter and highlighted how AI demand is driving strong momentum across Arm’s ecosystem. The company guided current quarter revenue to $1.175-$1.275 billion, implying year-on-year growth of 32% at the midpoint but the range for that guidance was wider than usual due to timing uncertainties around large licensing deals. While the market may not like that we find the company’s comment that “advances in AI, both for training and inference, are going to increase the demand for compute in the AI Cloud” to be very supportive of our AI, Cloud Computing, and Digital Infrastructure models.

Turning to Skyworks, its shares plunged more than 20% in post-market trading last night, after the company reported a greater-than-anticipated fall in quarterly revenue and forecasted a mid-to-high teens sequential decline in sales from its biggest segment. That key end market is smartphones where Apple (AAPL) is a top customer. Sizing up that outlook against others, including competitor Qorvo (QRVO) we have ask whether it is the market or simply Skyworks losing market share inside its largest customer? Earnings call comments about the move from sole sourcing by Skyworks on key programs to dual source points to the latter. Longer-term Apple intends to leverage its Apple Silicon efforts to bring at least some of its RF chip needs in-house.

With little in the way of fresh economic data today, while the market waits for Friday’s January Employment Report investors will be focusing on quarterly results from Hershey Foods (HSY), Hilton (HLT), Honeywell (HON), Peloton (PTON), Roblox (RBLX) and Yum! Brands (YUM) this morning. Also catching their attention after yesterday’s stronger-than-expected ADP Employment Report will be comments from multiple Fed speakers. Given the favorable employment data also seen in yesterday’s ISM Service PMI and prices that remain elevated, odds are the comments will skew more hawkish than not.

Continuing the earnings deluge, after the market close Amazon (AMZN), Affirm (AFRM), Cloudflare (NET), Fortinet (FTNT), and Lumentum (LITE) will report, bringing more than a few helpful data points for some of our targeted exposure models seen below.

Based on the figures we saw from ADP this week, but also data contained in various January PMI reports, we see a good chance for an upside surprise in Friday’s January Employment Report. As of this morning, the market consensus sees 170,000 jobs being added, down from the 256,000 created in December. If our thinking is correct, tomorrow’s report would not only lead to a positive revision in initial GDP forecasts for the current quarter, it would also be another that says the Fed is in no rush to deliver its next rate cut. While the CME Fed Watch Tool indicates the market still sees a rate cut in June, it looks increasingly likely to us that timing will slip into 2H 2025.

Model Signals

Aging of the Population

The number of family caregivers who support older relatives in either home-based or residential care settings increased by 32% between 2011 and 2022 — a sharp rise that can be attributed to an increase in the number of caregivers living with recipients. Researchers also say this could be partially tied to rising preferences for aging in place. Read more here

Artificial Intelligence

McDonald’s has announced a multi-year extension of its partnership with artificial intelligence company Cognizant, which was first signed in 2017. According to the companies, McDonald’s will leverage Cognizant’s technology to enhance labor and operational efficiencies by supporting the chain’s global finance systems and human capital management, including payroll processing, franchisee management, data management, and legal applications. Read more here

Over the next three years, 92 percent of companies plan to increase their AI investments. But while nearly all companies are investing in AI, only 1 percent of leaders call their companies “mature” on the deployment spectrum, meaning that AI is fully integrated into workflows and drives substantial business outcomes. Read more here

Artificial Intelligence, Cloud Computing, Digital Infrastructure

Google plans to increase capital investments to $75 billion this year in an effort to expand its AI and cloud capacity, CEO Sundar Pichai said Tuesday in the company’s Q4 2024 earnings report. The company spent $52.5 billion in capital expenditures in 2024. Google will direct the majority of its growing CapEx to relieving capacity bottlenecks through upgrades to infrastructure, including cloud servers and data centers… Read more here

On Alphabet’s earnings call with Wall Street analysts, the company said 4.4 million software developers now using Google’s Gemini AI training model, double the number from six months ago.

But management said Google ended 2024 with “more (AI) demand than capacity.” Read more here

Cash-Strapped Consumer

While 21% of overall credit users reported that they would not have been able to afford essential expenses without using credit, this number jumps dramatically for those living paycheck to paycheck with difficulty paying bills. A staggering 43% of credit users in this group said they could not afford essential expenses without credit. Read more here

The first month of the year is often slower for retailers following the busy holiday season, but Costco’s strong results keep proving that it is no ordinary retailer. The warehouse club has been firing on all cylinders lately, attracting budget-conscious shoppers across the income spectrum. Read more here

Cadbury-parent Mondelēz International forecast a bigger-than-estimated drop in its annual profit on Tuesday, signaling pressures from higher costs, including from surging cocoa prices, sending its shares down nearly 6% after the bell. Prices of cocoa — a key ingredient in chocolate — have increased relentlessly over the past year, forcing companies such as Mondelez to hike prices of their products. That has pushed budget-strained consumers, who were already grappling with a cost-of-living crisis, toward cheaper alternatives. Read more here

Cybersecurity, Data Privacy

Food delivery company GrubHub disclosed a data breach impacting the personal information of an undisclosed number of customers, merchants, and drivers after attackers breached its systems using a service provider account… depending on the affected individual, the attackers gained access to names, email addresses, and phone numbers, as well as partial payment card information (including card type and last four digits of the card number)… Read more here

64% of financial institutions said their organization had experienced cybersecurity incidents in the past 12 months. Researchers found that 71% of respondents reported zero-day attacks as the key concern to safeguarding applications and APIs, followed by dwell time (43%) and lack of visibility into the application layer (38%). Read more here

Nuclear Energy & Uranium

Arizona Public Service, Salt River Project and Tucson Electric Power on Feb. 5 jointly announced that they have been monitoring emerging nuclear technologies and have a shared interest in evaluating their potential, in response to growing power demand around the state. Read more here

Southeast Asia’s only nuclear power plant, completed four decades ago in Bataan, about 40 miles from the Philippine capital Manila, was built in the 1970s but left idle due to safety concerns and corruption. It has never produced a single watt of energy. Now the Philippines and other countries in fast-growing Southeast Asia are looking to develop nuclear energy in their quest for cleaner and more reliable energy. Read more here

Safety & Security

“The Kingdom allocated approximately $78 billion to the military sector in the 2025 budget, which constitutes 21% of total government spending and 7.1% of Saudi Arabia’s gross product,”…The statement further noted that the Kingdom has witnessed a 4.5 percent annual defense growth since 1960, adding that it has become the fifth largest defense spender worldwide and the largest in the Arab world. Read more here

As the Philippines beefs up its defensive posture, pivoting from internal security to territorial defense, the government has lined up a series of acquisitions in line with the new plans… Funding comes from the 2025 national budget that President Ferdinand Marcos signed into law Dec. 30, 2024. It included 271.9 billion pesos (US$4.65 billion) for the Department of National Defense (DND), a 12.3% hike compared to a year earlier. Read more here

The combination of Russia’s war of aggression in Ukraine, instability in the Middle East and broader global power shifts means that Europe must take greater responsibility for its own security. The European Commission estimates that an additional €500bn in defence investment is needed over the next decade. Read more here

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumers – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

- Digital Infrastructure & Connectivity – Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Model Musings

Aging of the Population

The number of family caregivers who support older relatives in either home-based or residential care settings increased by 32% between 2011 and 2022 — a sharp rise that can be attributed to an increase in the number of caregivers living with recipients. Researchers also say this could be partially tied to rising preferences for aging in place. Read more here

Artificial Intelligence

McDonald’s has announced a multi-year extension of its partnership with artificial intelligence company Cognizant, which was first signed in 2017. According to the companies, McDonald’s will leverage Cognizant’s technology to enhance labor and operational efficiencies by supporting the chain’s global finance systems and human capital management, including payroll processing, franchisee management, data management, and legal applications. Read more here

Over the next three years, 92 percent of companies plan to increase their AI investments. But while nearly all companies are investing in AI, only 1 percent of leaders call their companies “mature” on the deployment spectrum, meaning that AI is fully integrated into workflows and drives substantial business outcomes. Read more here

Artificial Intelligence, Cloud Computing, Digital Infrastructure

Google plans to increase capital investments to $75 billion this year in an effort to expand its AI and cloud capacity, CEO Sundar Pichai said Tuesday in the company’s Q4 2024 earnings report. The company spent $52.5 billion in capital expenditures in 2024. Google will direct the majority of its growing CapEx to relieving capacity bottlenecks through upgrades to infrastructure, including cloud servers and data centers… Read more here

On Alphabet’s earnings call with Wall Street analysts, the company said 4.4 million software developers now using Google’s Gemini AI training model, double the number from six months ago. But management said Google ended 2024 with “more (AI) demand than capacity.” Read more here

Cash-Strapped Consumer

While 21% of overall credit users reported that they would not have been able to afford essential expenses without using credit, this number jumps dramatically for those living paycheck to paycheck with difficulty paying bills. A staggering 43% of credit users in this group said they could not afford essential expenses without credit. Read more here

The first month of the year is often slower for retailers following the busy holiday season, but Costco’s strong results keep proving that it is no ordinary retailer. The warehouse club has been firing on all cylinders lately, attracting budget-conscious shoppers across the income spectrum. Read more here

Cybersecurity, Data Privacy

Food delivery company GrubHub disclosed a data breach impacting the personal information of an undisclosed number of customers, merchants, and drivers after attackers breached its systems using a service provider account… depending on the affected individual, the attackers gained access to names, email addresses, and phone numbers, as well as partial payment card information (including card type and last four digits of the card number)… Read more here

64% of financial institutions said their organization had experienced cybersecurity incidents in the past 12 months. Researchers found that 71% of respondents reported zero-day attacks as the key concern to safeguarding applications and APIs, followed by dwell time (43%) and lack of visibility into the application layer (38%). Read more here

Nuclear Energy & Uranium

Arizona Public Service, Salt River Project and Tucson Electric Power on Feb. 5 jointly announced that they have been monitoring emerging nuclear technologies and have a shared interest in evaluating their potential, in response to growing power demand around the state. Read more here

Southeast Asia’s only nuclear power plant, completed four decades ago in Bataan, about 40 miles from the Philippine capital Manila, was built in the 1970s but left idle due to safety concerns and corruption. It has never produced a single watt of energy. Now the Philippines and other countries in fast-growing Southeast Asia are looking to develop nuclear energy in their quest for cleaner and more reliable energy. Read more here

Safety & Security

“The Kingdom allocated approximately $78 billion to the military sector in the 2025 budget, which constitutes 21% of total government spending and 7.1% of Saudi Arabia’s gross product,”…The statement further noted that the Kingdom has witnessed a 4.5 percent annual defense growth since 1960, adding that it has become the fifth largest defense spender worldwide and the largest in the Arab world. Read more here

As the Philippines beefs up its defensive posture, pivoting from internal security to territorial defense, the government has lined up a series of acquisitions in line with the new plans… Funding comes from the 2025 national budget that President Ferdinand Marcos signed into law Dec. 30, 2024. It included 271.9 billion pesos (US$4.65 billion) for the Department of National Defense (DND), a 12.3% hike compared to a year earlier. Read more here

The combination of Russia’s war of aggression in Ukraine, instability in the Middle East and broader global power shifts means that Europe must take greater responsibility for its own security. The European Commission estimates that an additional €500bn in defence investment is needed over the next decade. Read more here

Model Table

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumers – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

- Digital Infrastructure & Connectivity – Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.