Market Wrap

Apparently, whisper numbers are still a thing because, in an overall flat-to-down day in broad equity indexes, the Technology sector stood out. The sector gained 1.09% ahead of Nvidia’s (NVDA) evening earnings announcement which saw them beat estimates by about $0.04 (more below). Of that 1.09%, Nvidia, Broadcom (AVGO), and Intuit(INTU) combined to contribute to just under 90% of the sector’s result with Broadcom trading higher on AI enthusiasm and Intuit rallying on a strong earnings surprise from the latest quarterly update.

Other positive sectors included Utilities (0.42%) and, squeaking into positive territory, Industrials adding 0.06%. The remaining sectors saw drops ranging between 0.05% (Materials) and 1.91% (Consumer Staples). Staples continued to be weighed down by Walmart’s (WMT) most recent earnings release and updated guidance. Broad market equity indexes played out along tech exposure lines with the Dow losing 0.43%, the S&P 500 coming in essentially flat, up 0.01%, and the Nasdaq Composite rising 0.26%. Small caps closed 0.19% higher.

Crypto continues to come under pressure as Bitcoin (BTC) continued to get further away from $90,000 but not in the direction “Holders” would want. Gold was flat, seeing $2,916/oz, down a mere $2 at the close and the 10-year treasury saw prices firm up, slightly leaving yields at 4.25%. Despite the Trump administration’s full frontal assault on current EPA regulations, oil prices continue to ease, this time on reports of on-schedule production out of Kazakhstan despite a recent drone attack.

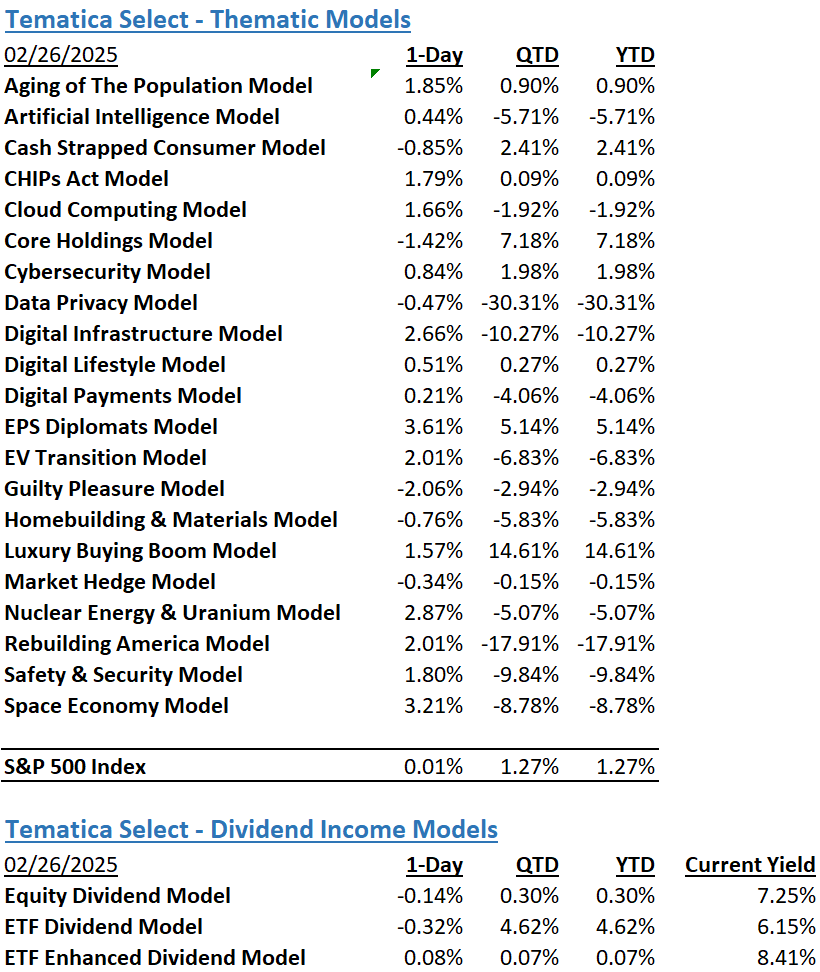

The Tematica Select Model Suite saw positive results in a broader swath of strategies than traditional sectors with the exception of Core Holdings and Guilty Pleasure, which both came under the same pressures as the broader Consumer Staples sector. Leadership in the suite came from EPS Diplomats, Safety & Security, and Nuclear Energy & Uranium.

Will the S&P 500’s Losing Streak Extend to Five Days?

Despite several attempts to move higher, yesterday the S&P 500 closed down for the fourth consecutive day keeping it between support at the 100-day moving average (5948.51) and resistance at the 50-day moving average (6,004.35). Equity futures suggest the S&P 500 is looking to snap that losing streak but barring any major economic data points out today, that effort will hinge on how the market interprets last night’s earnings report and guidance from Nvidia (NVDA) as well as today’s rash of reports.

While Nvidia’s results topped consensus expectations for its January quarter, led by the 93% year-over-year increase in its data center business, revenue for the quarter came up short compared to the whisper numbers making their rounds on Wall Street. While the top-line guidance for the current quarter was ahead of the market’s expectation and implied a whopping year-over-year growth of more than 65%, we’re going to see some EPS re-jiggering largely due to Nvidia’s gross margin guidance. The company sees its non-GAAP gross margin falling to 70.6%-71.0% in the current quarter, down from 73.5% in the January quarter and 75.0% the one before that.

What’s weighing on those margins at least in the near term is the ramp of Nvidia’s Blackwell solutions, which contributed $11 billion in the January quarter (28% of total sales). As production ramps, Nvidia’s management expects those margins will return to the mid-70s “later this year”, which means near-term meeting consumer demand trumps cost improvement efforts. Based on capacity constraint comments from Microsoft (MSFT), Amazon (AMZN), Meta (META), and Alphabet (GOOGL) about their cloud/data center businesses, we should not be surprised Nvidia is focused on meeting that demand in 1H 2025. But that means modestly lower margins.

Not what folks were looking for but not the worst problem either. While there is fodder for the Nvidia bulls and bears, when we reflect on numerous data points that confirm ramping AI adoption in the enterprise, including earnings call comments this week from Workday’s (WDAY) CEO Carl Eschenbach, the reality is we are still in the early innings when it comes to AI.

The comment from Eschenbach that stood out to us? AI is front and center in every conversation I have with customers, prospects, and partners. They want to move beyond incremental productivity gains.

Ramping to meet demand isn’t easy under normal conditions but when there is a sea change underway that drives explosive demand it’s even more challenging. If it sounds like we’re inclined to give Nvidia a pass, we are but only because of the rising AI adoption levels and capital spending to expand the digital infrastructure to support it. We continue to think rising AI adoption across consumers, enterprises, and other institutions (including local, state, and federal governments) to drive productivity and other efficiencies means we have a multi-year explosion of digital content creation and consumption ahead of us that will pressure data center and network capacity.

That leaves our Artificial Intelligence, Digital Infrastructure, and CHIPs Act models well-positioned for what’s ahead.

Back to today

Getting back to today, we have another wave of quarterly earnings to chew through. This morning that means reports from Bath & Body Works (BBWI), Good RX (GDRX), Hormel Foods (HRL), and JM Smucker (SJM). Consumer spending and food inflation will be top of mind as folks roll through those reports and earnings call comments. After today’s market close, comments from Dell (DELL) and HP (HPQ) will give some fresh color on the AI PC market ramp, while results from Elastic (ESTC) will give another perspective on AI adoption in the enterprise.

As it relates to our Homebuilding & Materials and Rebuilding America models, we’ll be interested in what Redfin (RDFN) and Tudor Perini (TPC) have to say. Sticky inflation, including tariffs on Canadian lumber, and the growing prospect the Fed will not deliver another rate cut this year have soured appetites for homebuilders. However, non-residential construction remains a bright spot given the number of mega projects announced in 2023 and 2024 slated to begin this year.

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumers – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

- Digital Infrastructure & Connectivity – Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.