Taking Private Equity Metrics From Efficient Alpha Capital

We are also delighted to add two Indices from Efficient Alpha Capital (EAC) this month. Efficient Alpha was founded in 2016 by Doug Scherrer. Doug has over a decade of Private Equity investment experience: beginning at General Atlantic, one of the largest ‘growth equity’ investment firms in the world, and more recently at ClearLight Partners, a lower-middle market buyout fund based in Southern California. In between his time at those two firms, Doug was the Chief Financial Officer of Nubank, a Fintech start-up based in Brazil, which today is the largest digital bank in the world with over 25 million customers.

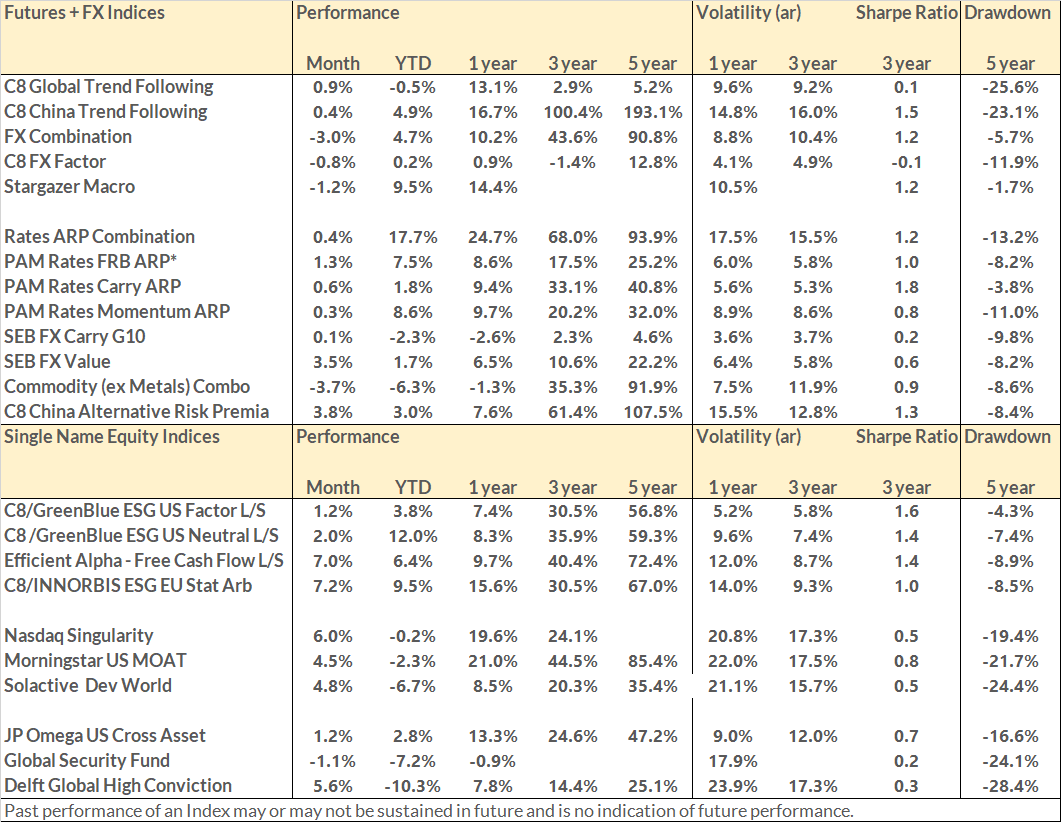

EAC investment strategies are based on the powerful idea that fundamental financial methodologies used to evaluate Private Equity investments can also be applied to the public markets. Two Indices from EAC are available on C8 Studio:

- Free Cash Flow: Private Equity investors are generally attracted to companies that generate strong Free Cash Flow. These companies tend to have high profit margins, low working capital requirements, and low capital expenditures – and also tend to be more resilient amidst volatile macroeconomic conditions.

- Deferred Revenue: Deferred Revenue is created on a company’s balance sheet when it receives an “upfront” payment from a customer. Private Equity funds like to invest in this type of company for two main reasons. First, upfront payments result in improved cash flow generation. Second, being able to charge customers prior to the delivery of a product/ service is generally a ‘signal’ of a company’s competitive differentiation.

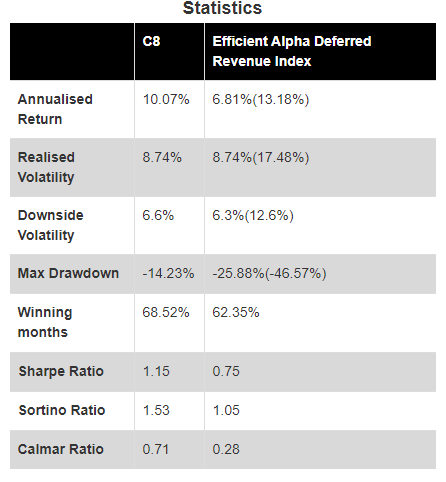

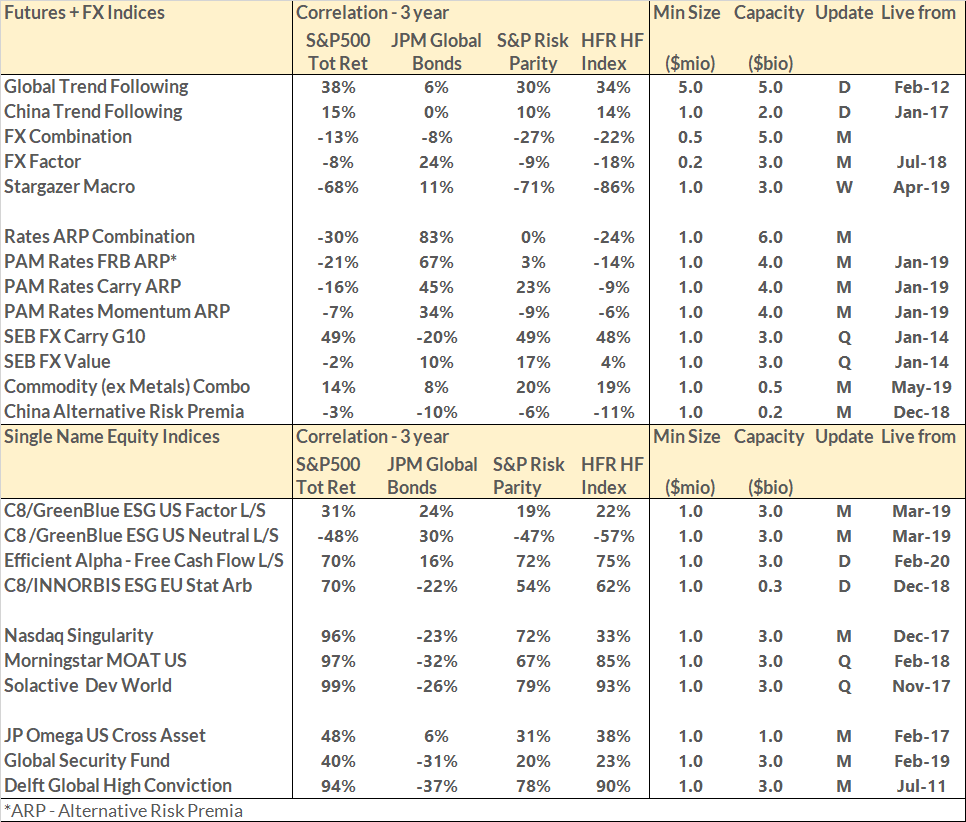

With the help of index provider S-Network, EAC has created two portfolios based on these Private Equity metrics. C8 has then taken these portfolios and added a quantitative equity L/S overlay strategy. This overlay weights the portfolio by factors such as growth, size and value, rather than market cap, and adds a leveraged Long/Short element (with the short the S&P 500 TRI). The combination of this high-quality equity portfolio and the quant overlay would have generated consistently good performance over the 12 year sample period – strong returns with low volatility. We show the performance below:

C8/ Efficient Alpha – Free Cash Flow