C8 Update – New US Index Provider Special + Crypto Trading Enabled – Mar 2021 |

|

|

Four New US Index Providers Added to C8 Studio |

|

We opened our US office in New York last November, where we have been encouraged that the direct indexing (DI) concept has been in use in managed account platforms for some time. As regular readers will know, direct indexing allows the investor to track an index using the underlying instruments, rather than having the index wrapped in a fund or ETF. The C8 solution is the next generation in direct indexing, where our technology solution allows the investor to use direct indexing whilst maintaining control of their own capital, as our software allows the investor to execute on their own account, with their own broker. With the DI concept already known in the US, we have seen considerable interest from US index providers to join our platform. In the last few months, we have added Alpha Vee, Efficient Alpha, S-Network, MSR, Pegassets and IDX. We have discussed Alpha Vee and Efficient Alpha in previous Updates, so this month we turn our attention to the latter four new additions. We would be delighted to provide more information on any of the new index providers discussed below. |

S-NetworkS-Network is a publisher and developer of proprietary and custom indexes, specialising in smart beta and thematic indexes. There are now 22 indexes on the C8 platform from S-Network, and their recently-merged partner, Alerian. They are working with groups such as Entelligent, with their Smart Climate Risk indexes, which seeks to identify companies making the most progress to reduce carbon emissions. The Smart Climate 50 index (below) uses Entelligent’s Smart Climate methodology to the select the best 50 stocks with respect to superior governance and climate risk exposures. Their board chairman is a Nobel Peace Prize recipient, for his work on the IPCC, so Entelligent’s ESG credentials are not in doubt. |

|

|

Or, in fixed income, FolioBeyond have developed a factor-based, multi-sector fixed income strategy by dynamically allocating across 23 bond sector ETFs. The strategy is designed to capture significant asset allocation alpha without taking additional volatility risk. |

|

|

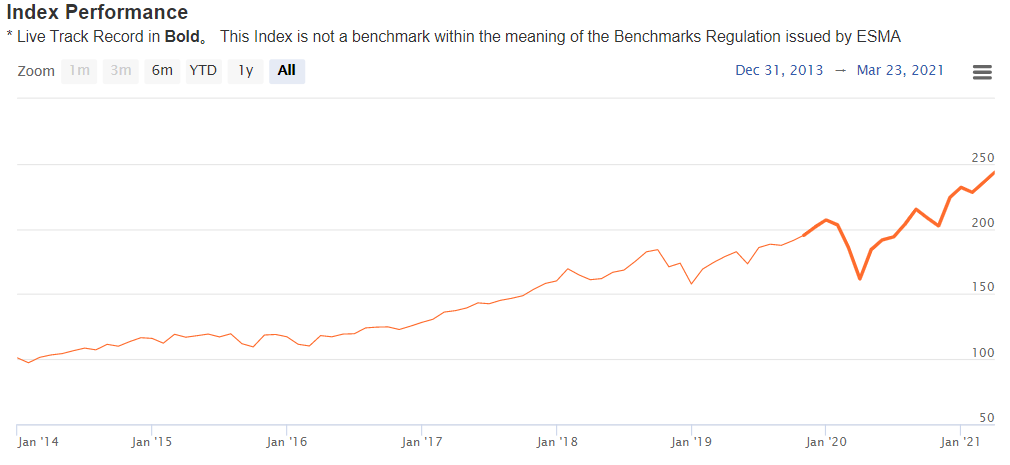

Or, a focus on dividend yield, with the ‘S-Network Durable Dividends US Large Cap Index’ choosing 100 stocks from the S-Network US Large/ Mid-cap 1000 that have both high dividend yield and strong growth in cashflow and EBITDA: |

|

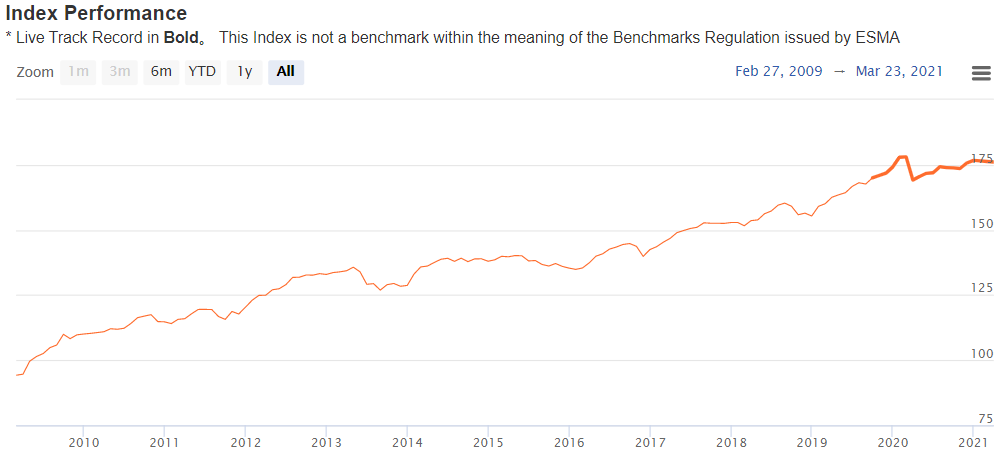

MSRMSR’s focus is on liquid alternatives such as risk parity, risk premia and other classic futures markets strategies. A good example is their ‘Systematic Global Macro Index’ which applies risk parity, trend following and market reversal strategies across major equity and fixed income futures markets: |

|

|

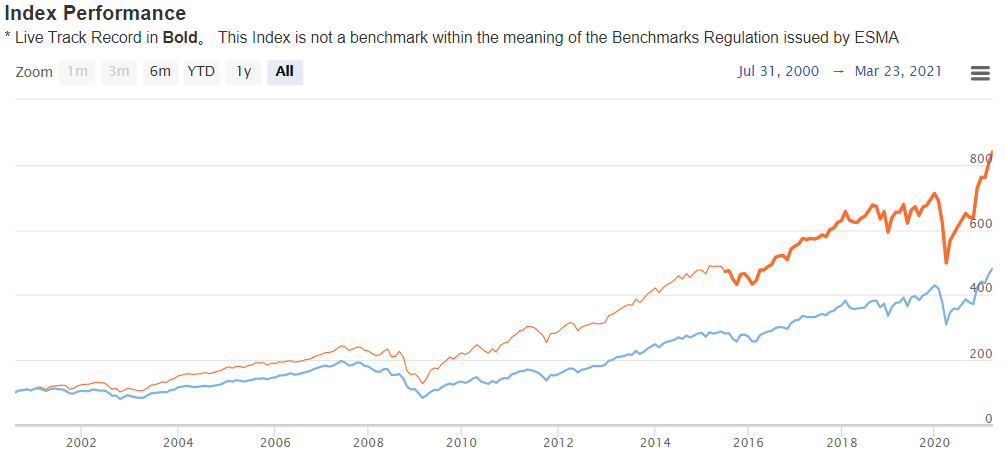

Or, their recently released China Trend-Plus Index which applies MSR’s proprietary trend-following model to a variety of Chinese commodity and equity markets. The model also allocates 20% to a long-only, risk parity position in three equity index contracts. As we discussed in last October’s Update, with regard to our C8 China indexes, we expect that this index will also be available to non-Chinese investors later this year, when Chinese futures markets open up to foreign participation: |

|

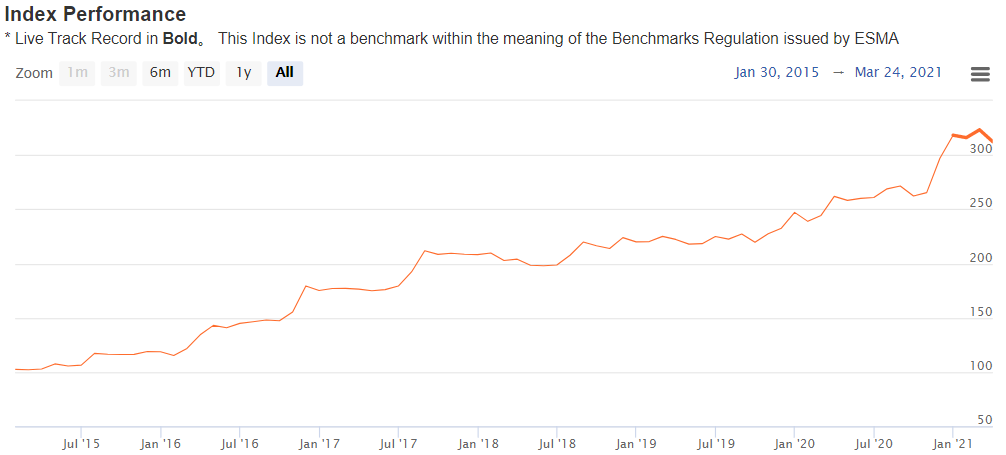

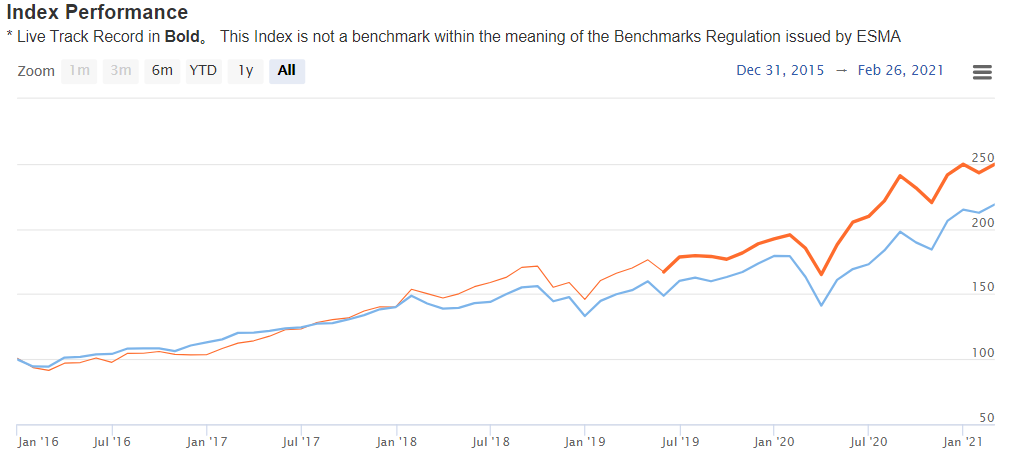

PegassetsWe have added ‘Pegassets US Large Cap Equity Index’, based on an area of AI called ‘Ensemble Methods’. This methodology looks across a series of underlying predictive engines, and identifies areas of agreement, thereby improving the overall predictive power. The Pegassets index produces a 50-stock “best ideas” portfolio, which as the chart below illustrates, outperformed the S&P 500 by 10 percentage points in 2020: |

|

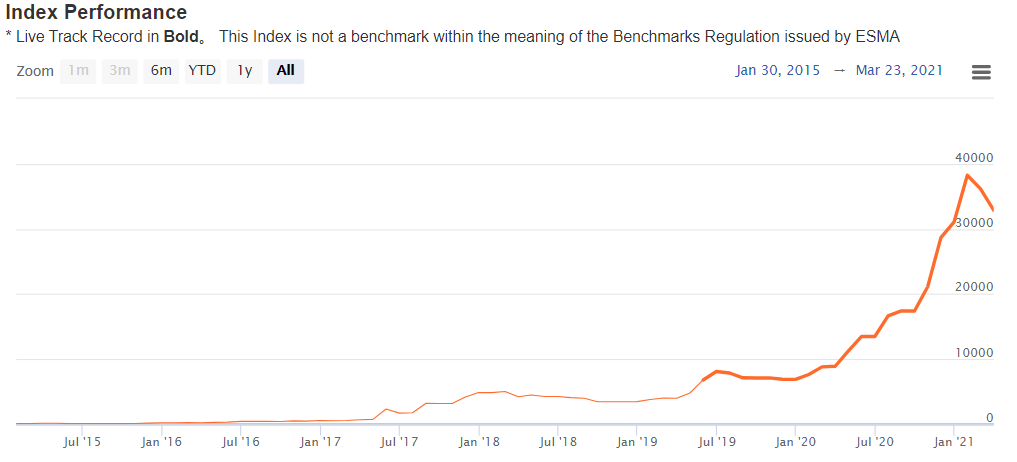

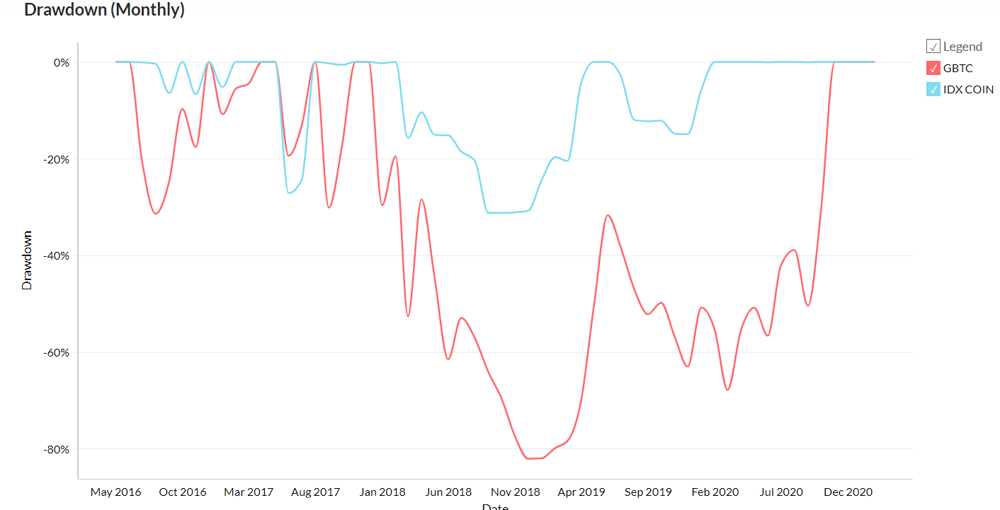

IDXFinally, we have added the first external crypto trading index to the platform, to join C8’s newly-launched Bitcoin trend-following index. The IDC COIN index seeks to provide upside participation to Bitcoin via the Grayscale Bitcoin Trust while limiting drawdowns and downside volatility. The index has successfully limited drawdowns since the index went live in June 2019 (see second chart): |

|

|

|

|

C8 Enables Connectivity to Binance for Crypto Direct IndexingThe IDC COIN Index above is based on trading shares in the Grayscale Bitcoin Trust (GBTC). However, for those already active in crypto, C8 has now enabled connectivity to Binance, with other exchanges to follow. C8 have added our first crypto indexes to the platform, including C8 Crypto Futures Trend. Investors can now trade directly in crypto currencies via the C8 platform, as well as via GBTC or CME futures. |

|

|

Podcast Next Week: Ned Davis/Day Hagen/C8 – 31 MarchBe Aggressive or Get Defensive? Using Smart Sector to Objectively Decide.On Wednesday, March 31st, 2021 – 10am EST, 3pm GMT, 4pm CET The stock market continues to trade near all-time highs, but with elevated valuations and optimistic sentiment. How should one position a portfolio in this environment? We will review the risk management and sector allocation indicators within the Smart Sector® strategy to address the following:

Join our presenters; Don Hagan, Partner, Co-Founder and CIO of Day Hagan Asset Management, Brian Sanborn, SVP of Wealth Management Solutions, NDR, and William Herkelrath, Regional Manager, C8 Technologies. |

|

|

Podcast Replay: TSC Water Risk Index |

|

As discussed in the podcast, the TSC Water Risk Index for US and Europe are both available to trade on the C8 platform, . The TSC Water Risk Index went live in January 2021 through a partnership between Thomas Schumann Capital and Anatase Ltd, a consultancy specialising in index development. Robin Amlot of IBS Intelligence spoke to Thomas Schumann of Thomas Schumann Capital and Markus Barth of Anatase Ltd about their commitment to increasing water security through responsible investing. |

|

|

|

Thanks for your interest, The C8 Team |