|

C8 Weekly Bulletin: Direct Indexing and Capturing EM Trends with EVOLIDS03 May 2023 |

|

One of our index providers, EVOLIDS, has produced a great piece on the advantages of Direct Indexing (available here as a PDF) which we are happy to share:

|

|

|

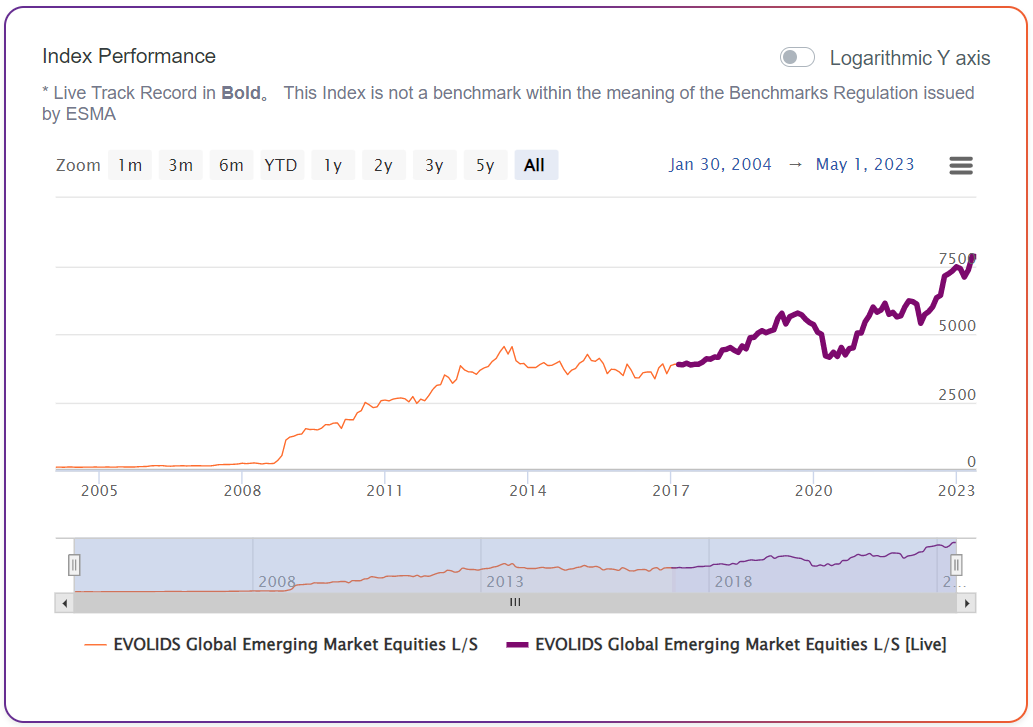

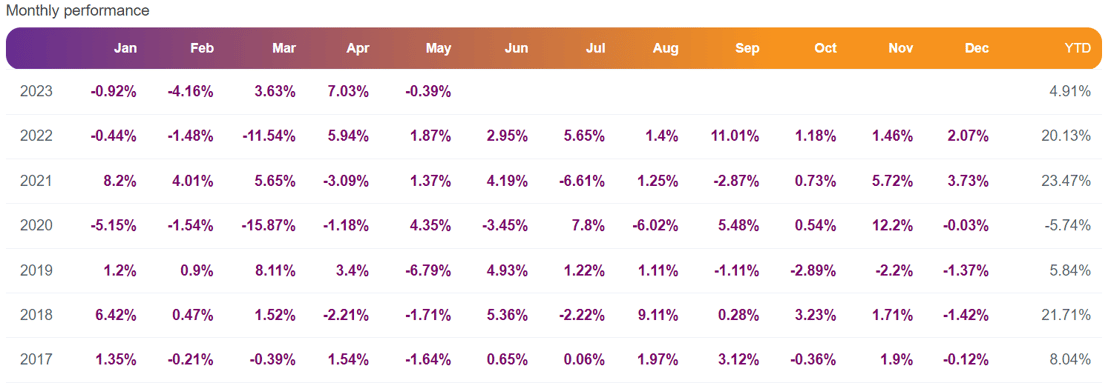

EVOLIDS Global Emerging Markets L/S |

|

Over the past year there has been increasing focus on opportunities in Emerging Market equities on the back of higher commodity prices, and inflation in developed markets. Access the EVOLIDS Global Emerging Markets Long/Short Index on C8 Studio to take advantage of this renewed volatility. The approach takes into account the risk in other markets, to assess the likely near-term trend in Emerging Markets (using futures or ETFs). The returns are unlevered. |

|

|

The index has been running live since 2017 and has averaged 12% per year since then. Performance is uncorrelated to the US S&P500 or, indeed, the global S&P1200. |

|

|

|