C8 Monthly Update – September 2019 |

|

|

|

C8 announce a collaboration with Morningstar |

|

We are excited to announce a collaboration with Morningstar to host their indices on the C8 platform. This provides a cutting-edge way for asset owners to track Morningstar Indices. No longer do Morningstar Indices need to be packaged into an ETF, structured note or fund. Using the C8 platform, it is straightforward for an asset owner to track their chosen Morningstar Index by trading the underlying equities, using their own broker. Not only is this cheaper than a structured product or ETF but the asset manager can customise the composition of the index as required, whether due to their investment process or due to regulation. The asset manager keeps full control of their capital, and owns the underlying shares, giving full transparency and having less liquidity risk than an ETF. To quote Morningstar: “Transparent methodologies, objective rules, and a name that evokes trust and confidence among investors worldwide make Morningstar® Indexes perfect vehicles for a range of investment applications. Morningstar Indexes balance market coverage with liquidity and optimally rebalance holdings to minimize turnover. Asset management firms work with our team of experts to create distinct, investor-focused products based on our indexes. Morningstar Indexes also serve as precise benchmarks for evaluating performance, supporting asset allocation strategies, and putting global markets into context.” https://indexes.morningstar.com/ Apart from the classic passive equity indices across the world’s major equity markets, we highlight here a couple of their active indices, which leverage the well-known research capabilities of Morningstar, and provide some exciting new investment approaches on the C8 platform. |

|

|

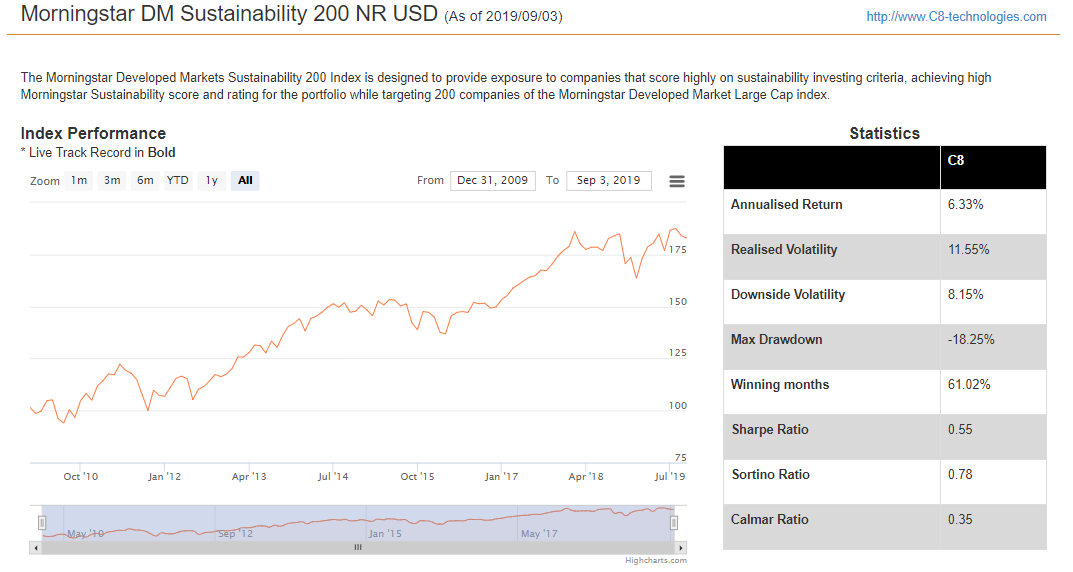

The Morningstar Sustainability index (see US index above) utilises Sustainalytics ESG (Environmental, Social and Governance) methodology to generate a portfolio of sustainable stocks. Sustainalytics (https://www.sustainalytics.com/ ) is a global leader in ESG and Corporate Governance research and ratings and winner, last month, of this year’s award for the best ESG research from Environmental Finance magazine. |

|

|

One of the major advantages of using the C8 platform is the full transparency of equity holdings. This transparency, of course, fits perfectly with the ESG philosophy, removing the risk that a sub-allocation will include inappropriate holdings. Therefore, we are pleased to be adding additional sustainable indices to the platform. |

|

|

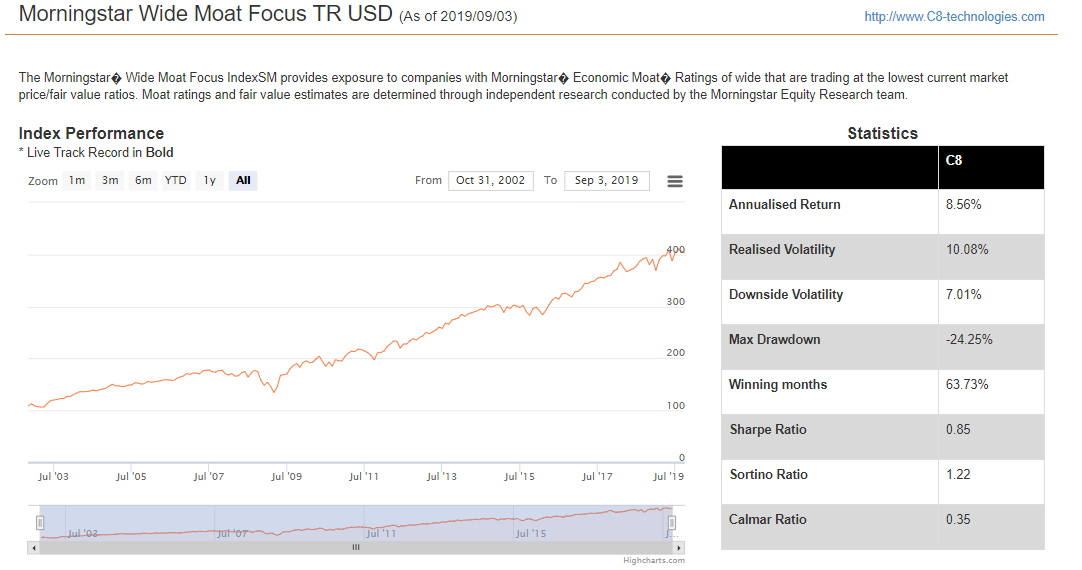

A second example is the MOAT Indices (see US Index above). ‘Economic Moat’ is a term used by Warren Buffett to advocate his investment philosophy, which relates to a company’s ability to sustain a competitive advantage. He said last year “The most important thing [is] trying to find a business with a wide and long-lasting moat around it… protecting a terrific economic castle with an honest lord in charge of the castle”. Five criteria are used by Morningstar to judge this advantage: Network Effect, High Switching Cost, Cost Advantage, Intangible Assets (i.e. branding) and Efficient Scale. The Index is rebalanced quarterly with the Index allocated to companies that Morningstar believes possess this sustainable competitive advantage and, just as importantly, are among the most attractively priced of those companies. |

Next StepsApart from Morningstar Indices being available on the platform, one of C8’s next steps will be to take some of the Morningstar equity index portfolios, and combine them with our Factor or StatArb framework. We believe there is great potential from combining a high quality portfolio with modern investment techniques, as we have already discovered with the C8/ GreenBlue ESG Indices. |

|

|

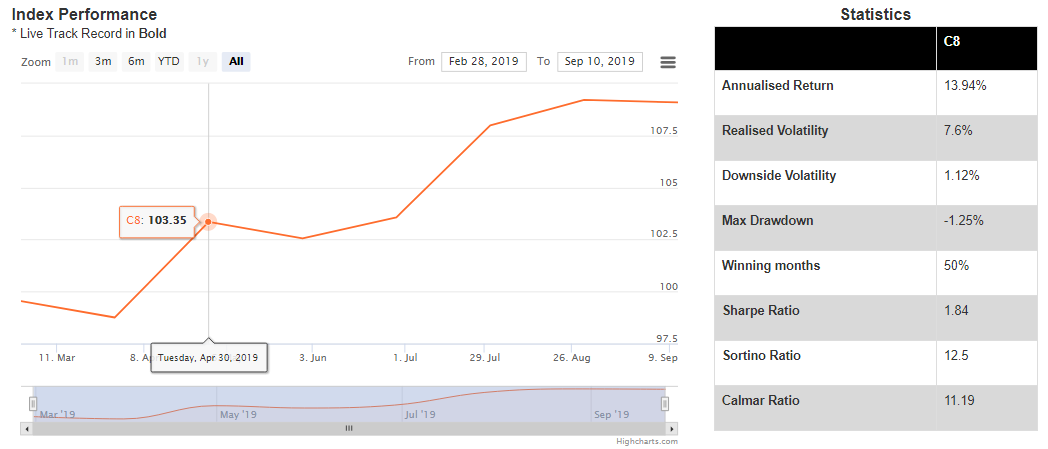

An ethical Defence and Security Index?We have added a new index to the C8 platform, the Global Defence and Security Index, which focuses on defence and cyber-security companies. The investment process uses an ethical screening, to ensure that all companies comply with international conventions from the UN and other organisations, as well as a more traditional top-down investment approach, when selecting companies for the portfolio. The reality is that in an unstable world, the demand for security is likely to rise, whilst adding an ethical filter brings a new dimension to this investment process. In addition, to quote BOE Governor, Mark Carney “past instances of very low rates have tended to coincide with high risk events such as war, financial crisis, and breaks in the monetary regime”. The Defence and Security Index can act as a natural hedge to these potential events. The Index has been traded live since February, and has made a strong start, up 14%. |

|

|

One other positive take away is that, by being on the C8 platform, the GDS fund managers can now reach a global audience from their base in Sweden. As the re-balancing trades related to the Index is under the full control of our clients, the operational risks are sharply reduced as no sub-allocation of capital is necessary. This make it straightforward for our clients to access idiosyncratic investment approaches from across the globe. Using the C8 platform also solves a re-occurring problem for new funds, where the minimum ticket size from a potential investor would lead to the investor breaking their fund concentration limits, thus preventing the allocation. With the C8 platform, an asset owner trades the underlying assets of the Index themselves, removing this concentration limit constraint. |

|

|

|

Thanks for reading, The C8 Team |

|

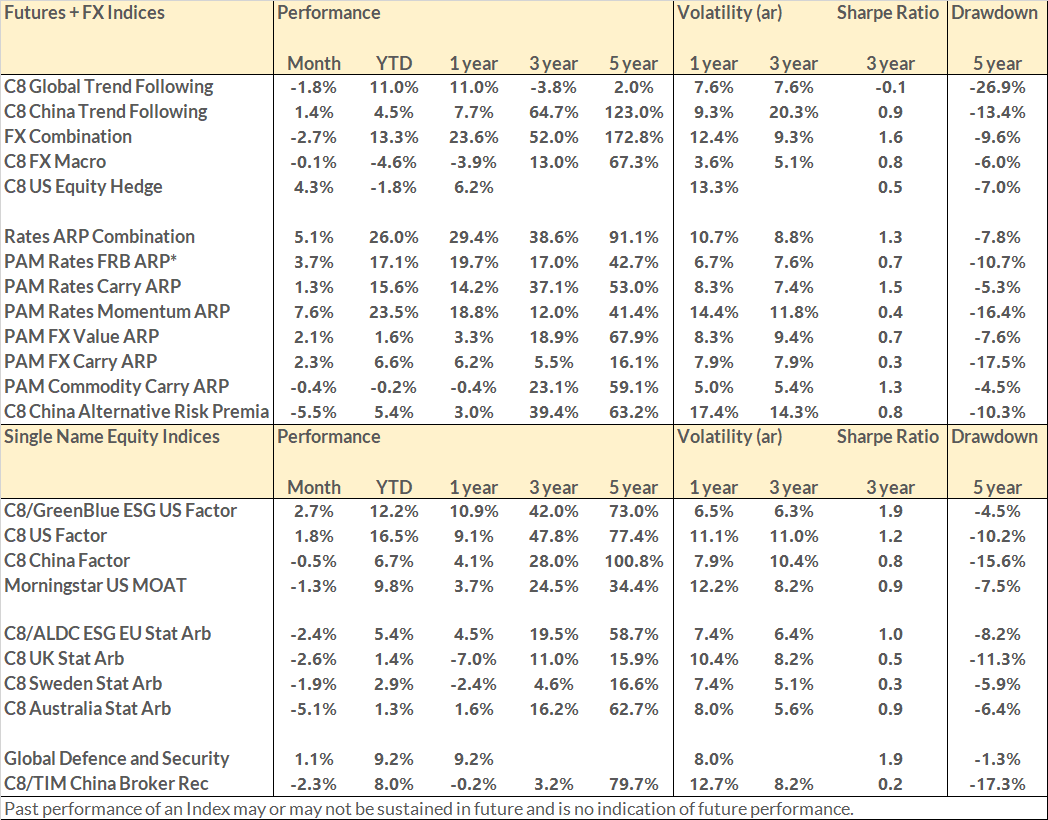

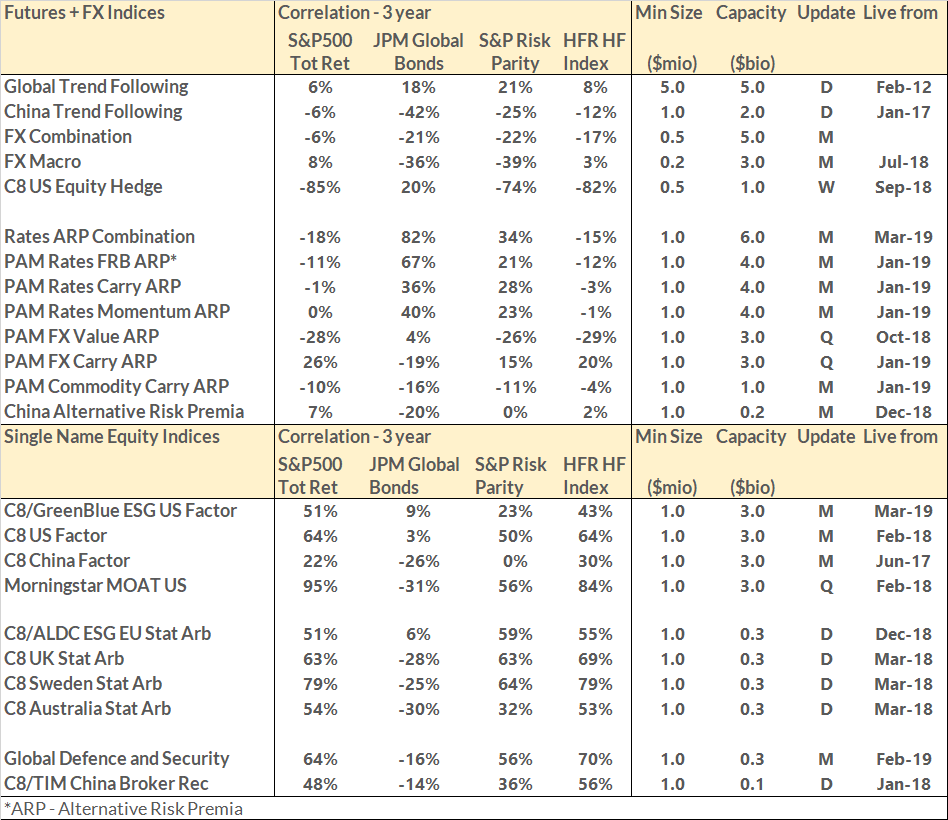

August PerformanceAugust was a difficult month for equity markets, whilst fixed income rallied to multi-year highs. This can be seen in the relative performance of the Indices, though a notable exception was a further gain in the C8/ GreenBlue US Equity ESG Factor Index. The combination of FX indices gave back some of its recent strong gains, but remains up 13% ytd. However, the real standout performers were Rates Alternative Risk Premia, with the combination of Rates premia now up 26% ytd. |

|

|

|

|

|

|

| C8 Technologies, Michelin House, 81 Fulham Road, London, Greater London SW3 6RD, +44 (0) 20 3826 0045 |

|