Market Wrap/Today’s Outlook

So, who knew postponing Tariff-ageddon would lead to one of the best one day rallies in US market history? A relief to be sure but Nasdaq Composite up 12.16%, S&P 500 adding 9.52%, Russell 2000 jumping 8.85%, and the Dow closing 7.87%? To be clear, yesterday was not in anyone’s cards. Still, sectors were up across the board, led by Technology (13.43%) and Consumer Discretionary (10.89%) which were buoyed by their Mag 7 constituents contributing to 43% and 48% of sector results, respectively. Remaining sectors posted gains ranging from 3.88% (Consumer Staples) to 8.88% (Industrials).

The Cboe Market Volatility index (VIX) fell 36% which is another relief but yesterday’s close still sees the VIX at a 33 handle, just over double its long-term average. As far as volatility is concerned, a 90-day reprieve is just that, a reprieve.

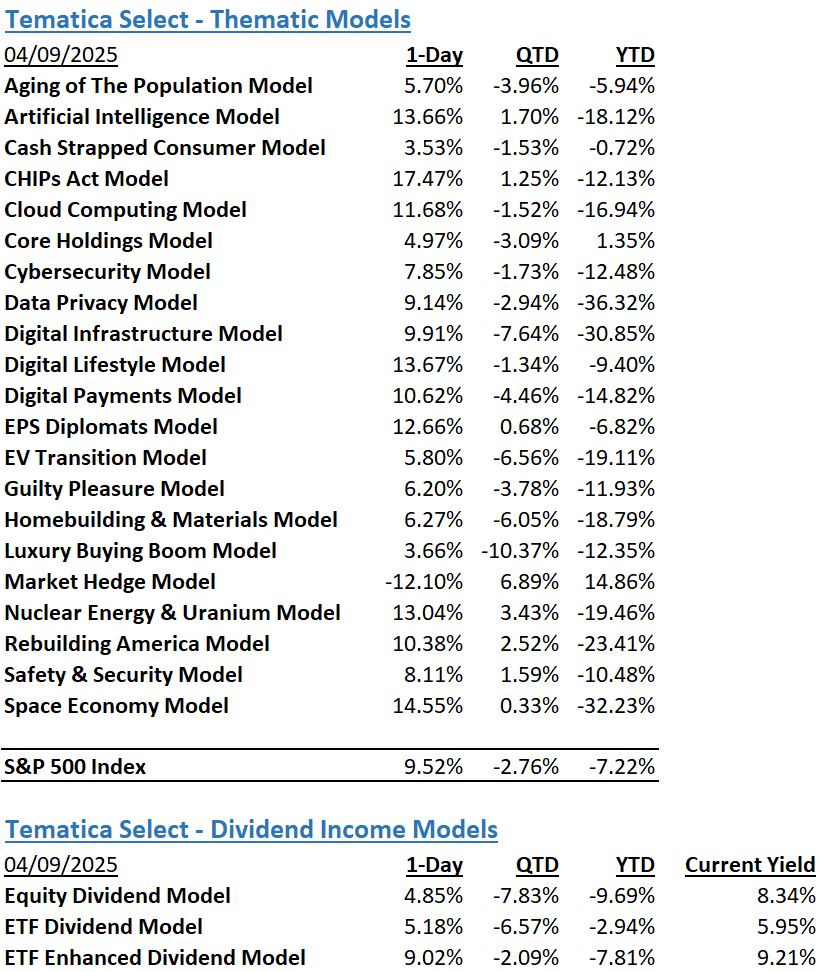

Needless to say, the Tematica Select Model Suite had a stellar day. We saw Market Hedge give back about a third of it’s YTD returns which leaves that strategy “only” 22% above the S&P 500. Similarly, double digit single day returns for roughly half of our targeted exposure strategies were great to see but didn’t erase the YTD underperformance we’ve seen so far in 2025. Some final caveats about sounding the “all-clear” come from Goldman Sachs (GS), who rescinded their 65% chance of a recession in 2025 call but only took it back to their previous 45% chance, and JP Morgan (JPM) who maintains their 60% chance of a US recession, which also includes provisions for Trump easing pressure on China.

So far this morning, futures have resumed their trend of downward pressure. It seems like some of yesterday’s price action may be attributed to short covering and ultimately any fundamental rationale for the recent meltdown has only shifted further out but not really changed. This morning we’ll see the latest updates on CPI where the top line figure is expected to have moderated slightly, to 2.6%. Given the current tariff environment, this update is good to know but we doubt anyone will be finding it particularly useful as a forecasting tool. Initial and continuing claims will also be updated, with continuing claim expected to have dropped slightly and initial claims adding about 6,000 to sit at 225,000 for the observation week ending April 5.

While the pause button has been mashed, markets are still working out the potential effect of 125% tariffs on China which have not been included in the pause, not to mention the 10% blanket tariff applied to everyone else. Did we mention that Canada tariffs were also not impacted by yesterday’s about face? We expect that calculus to continue to play out in today’s trading. Don’t forget, as smart as all these analysts and their models are, the hard truth is that nobody has a crystal ball and all they can do is crunch what data they have when they get it. In this environment, that can lead to some, uh, interesting times.

The Strategies Behind Our Thematic Models

- Aging of the Population – Capturing the demographic wave of the aging population and the changing demands it brings with it.

- Artificial Intelligence – Software, chips, and related companies that facilitate the collection and analysis of large data sets and autonomous generation of solutions given non-machine language prompts.

- Cash Strapped Consumers – Companies poised to benefit as consumers stretch the disposable spending dollars they do have.

- CHIPs Act – Capturing the reshoring of the US semiconductor industry and the $52.7 billion poised to be spent on semiconductor manufacturing.

- Cloud Computing – Companies that provide hardware and services that enhance the cloud computing experience for users, such as co-location, security, and edge computing.

- Core Holdings – Companies that reflect economic activity and are large enough to not get pushed around by day-to-day market trends. Low-beta, large-cap names able to better withstand economic turmoil.

- Cybersecurity – Companies that focus on protecting against the penetration of digital networks and the theft, ransom, corruption, or destruction of data.

- Data Privacy & Digital Identity – Companies providing the tools and services that verify authorized users and safeguard personal data privacy.

- Digital Infrastructure & Connectivity – Companies that are integral to the development and the buildout of the infrastructure that supports our increasingly connected world.

- Digital Lifestyle – The companies behind our increasingly connected lives.

- EPS Diplomats – Profitable large capitalization companies proven to produce above-average EPS growth and provide investors with the benefit of multiple expansion.

- EV Transition – Capturing the transition to EVs and related infrastructure from combustion engine vehicles.

- Guilty Pleasure – Companies that produce/provide food and drink products that consumers tend to enjoy regardless of the economic environment and potential long-term health hazards associated with excessive consumption.

- Homebuilding & Materials – Ranging from homebuilders to key building product companies that serve the housing market, this model looks to capture the rising demand for housing, one that should benefit as the Fed returns monetary policy to more normalized levels.

- Market Hedge Model – This basket of daily reset swap-based broad market inverse ETFs protects in the face of market pullbacks, overbought market technicals, and other drivers of market volatility.

- Nuclear Energy & Uranium – Companies that either build and maintain nuclear power plants or are involved in the production of uranium.

- Luxury Buying Boom – Tapping into aspirational buying and affluent buyers amid rising global wealth.

- Rebuilding America – Turning the focused spending on rebuilding US infrastructure into revenue and profits.

- Safety & Security – Targeted exposure to companies that provide goods and services primarily to the Defense and security sectors of the economy.

- Space Economy – Companies that focus on the launch and operation of satellite networks.

The Strategies Behind Our Dividend Income Models

- Monthly Dividend Model – Pretty much what the name indicates – this model invests in companies that pay monthly dividends to shareholders.

- ETF Dividend Model – High-yielding ETFs that provide a range of exposures from domestic equities, international equities, emerging market equities, MLPS, and REITs.

- ETF Enhanced Dividend Model – A group of high-yielding ETFs that utilize options to enhance yield through collecting option income.

Don’t be a stranger

Thanks for reading and if you have a suggestion for an article or book we should read, or a stream we should catch, email us at info@tematicaresearch.com. The same email works if you want to know more about our thematic and targeted exposure models listed above.