C8 Bulletin: MI2 Joins C8 StudioThe C8 Bulletin is back after a summer break, and we are delighted to announce that Macro Intelligence 2 Partners have added their Macro Alpha index to C8 Studio. MI2 Partners is known for its rigorous and data-driven macroeconomic analysis, in particular its proprietary leading indicator models. These models meant that MI2 were well ahead of market consensus in forecasting the sharp pick-up in global inflation last year. The team continuously monitor and interpret global economic trends, monetary policies, fiscal developments, and geopolitical events to provide clients with valuable insights into market dynamics. In addition, for anyone wishing to gain a strong insight into current macro trends and opportunities, MI2 are holding their investor conference in Vail at the end of the month. Vail is beautiful to visit in the Fall, but we note that there are also some excellent value virtual passes available on the link below: |

|

|

|

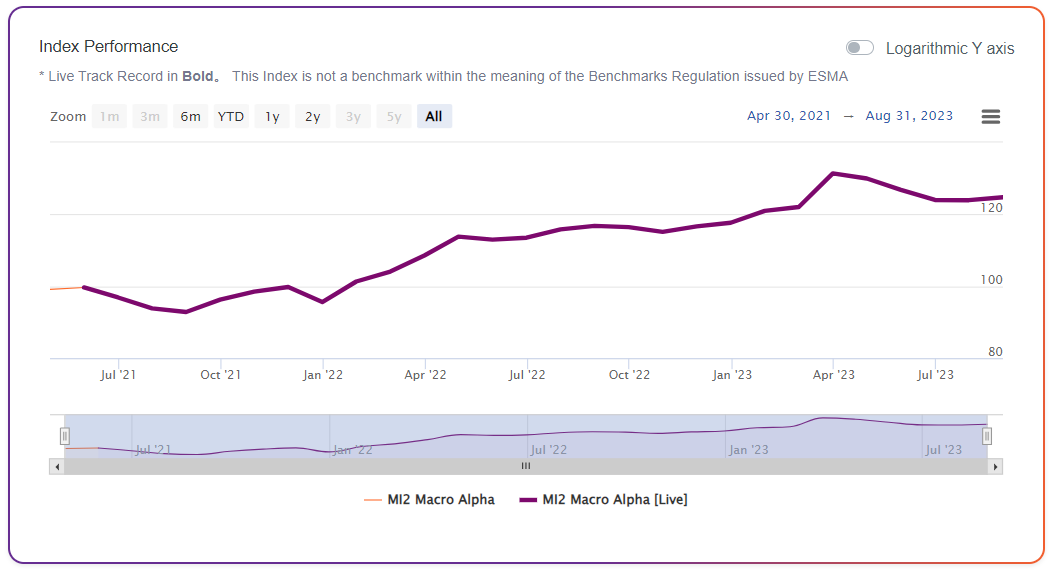

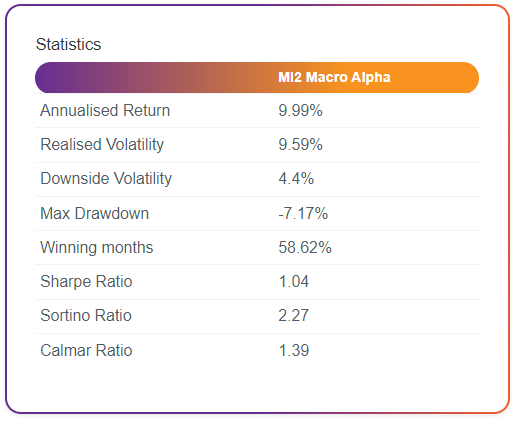

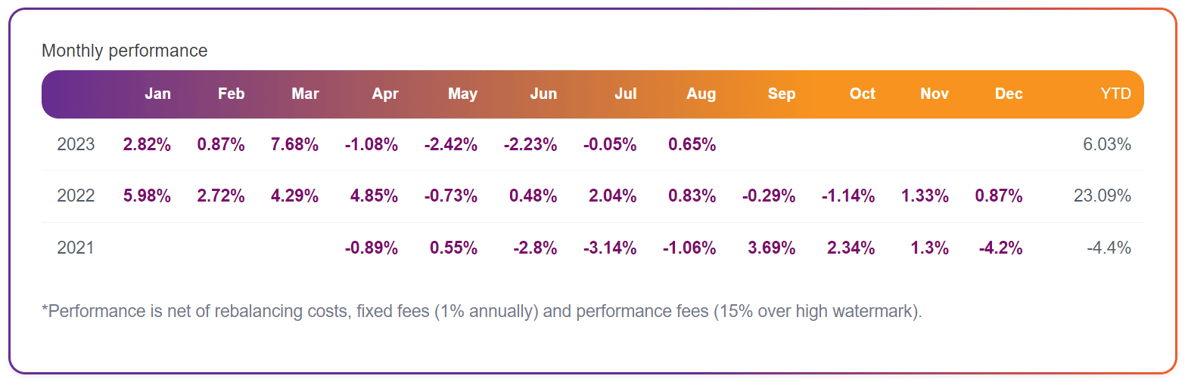

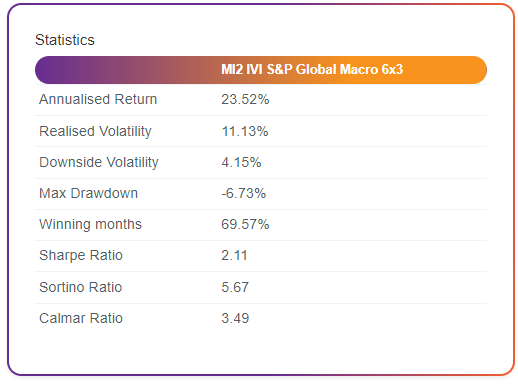

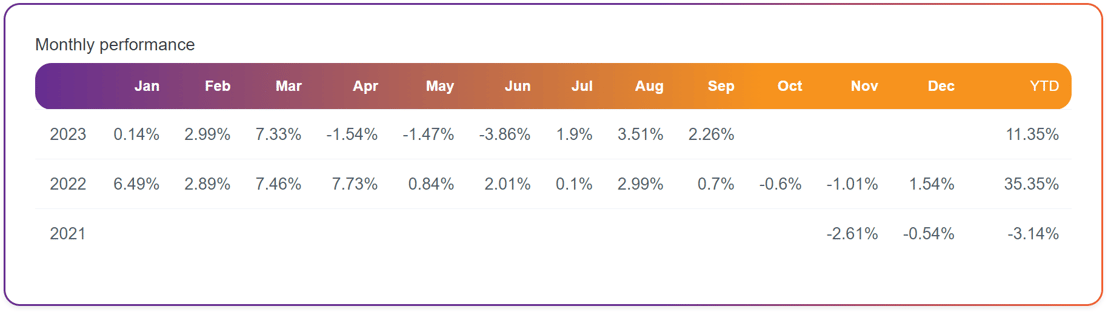

The Macro Alpha strategy is deeply rooted in MI2’s macroeconomic insights. These directional strategies encompass a broad range of asset classes. The strategy aims to optimize risk-adjusted returns by dynamically-adjusting portfolios based on changing macroeconomic conditions. Please find below the performance since launch in April 2021: |

|

|

|

|

|

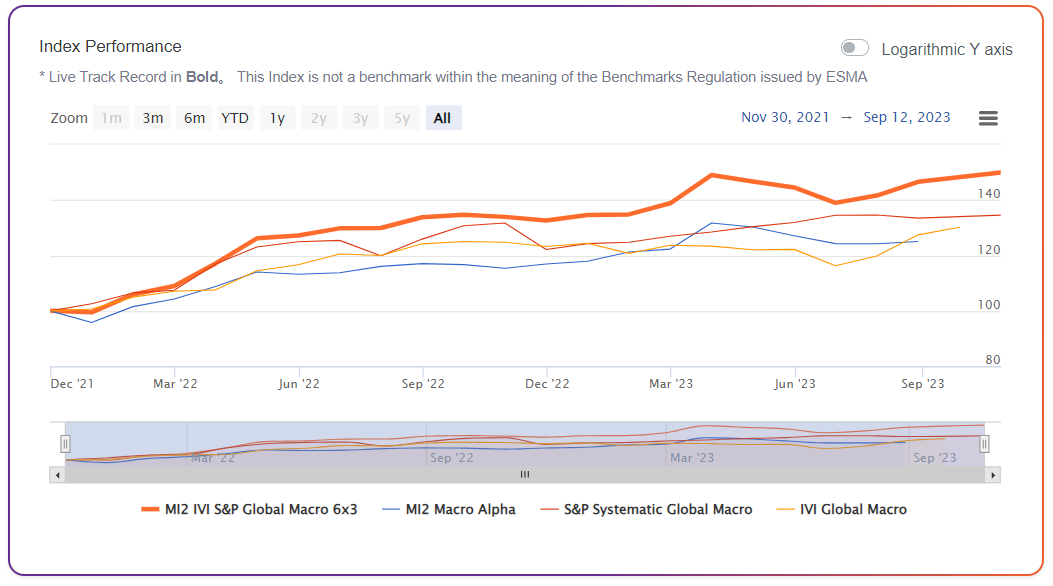

Global Macro Combination |

|

As regular readers know, a C8 Bulletin never seems complete without illustrating the ‘Power of Combination’ on C8 Studio. Taking three of our Global Macro contributers (including MI2), combining using our proprietary Tactical Asset Allocation, would have produced a 24% annual gain with 11% volatility and, notably, a 40% negative correlation to the S&P over the past two years. Of course, macro returns have benefited from the general instability in markets over this period, but the negative correlation does illustrate how Global Macro acts as a good complement to long equity portfolios. |

|

|

|