C8 Weekly Bulletin: Giving Investors an Edge18 October 2022 |

|

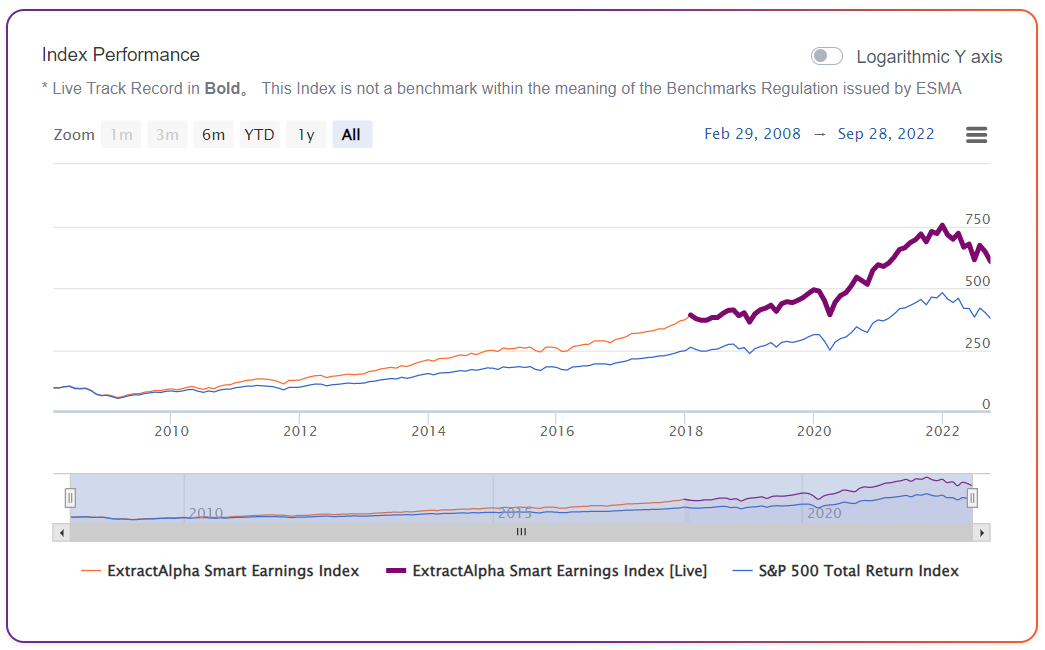

With the US Q3 earnings season now well underway, this week’s Bulletin is guest edited by one of C8’s index contributors – ExtractAlpha. Their Smart Earnings Index leverages their proprietary earnings and revenue forecasts – which both consistently outperform the Wall Street consensus. When their model predicts a ‘5% plus’ expected surprise on a stock, it is 75% accurate on the EPS and 85% accurate on the revenue surprise. The Index is a highly liquid strategy favouring large cap stocks and has delivered an annual return roughly 40% higher than that of the S&P500 over the past decade – and with similar volatility. |

|

|

US Earnings: the ExtractAlpha advantage |

|

The Q3 2022 earnings announcements are now coming in thick and fast – there will be over 1,800 between now and Thanksgiving and 1,250 in the next three weeks alone! ExtractAlpha looks at these corporate earnings through multiple lenses to generate alpha – analysing crowd and market expectations, sentiment from earnings calls, the skill of Wall Street analysts, company earnings history, peer group trends and earnings behaviours alongside digital and online customer activity. In our long-only portfolios (such as the ExtractAlpha Smart Earnings Index on C8 Studio), we look to overweight stocks with a high chance of a positive earnings beat and underweight stocks predicted to miss. Most of the major banks have already reported and, as our model predicted, both JPM and Bank of America delivered results ahead of consensus. The stock price response to BoA’s results underlined the importance of earnings surprises in driving stock returns. Our proprietary model, TrueBeats, predicted an EPS slightly ahead of the Wall Street consensus of $0.78 per share. The actual outturn of $0.81 saw the stock rally 6%, clearly outperforming the sector and the general market. Amongst the crowd yet to report are mega caps, with Tesla and IBM due later this week. Energy companies such as Exxon Mobil and Chevron report toward the end of October, alongside consumer demand plays such as Visa and Mastercard, Starbucks, Uber and UPS. Coming on Halloween is the one we all pay attention to – Berkshire Hathaway! Portfolio positioning in the ExtractAlpha Smart Earnings Index reflects a broad range of inputs – not just the proprietary quantitative earnings forecasts but analysis of earnings sentiments (applying natural language processing to earnings calls) and fundamentals. To highlight a few observations from our extensive dataset:

Indeed, separate to the Smart Earnings Index, TrueBeats EPS estimates add considerable value to US equity portfolio managers and analysts, by giving a truer reflection of the broader consensus on earnings. |

ExtractAlpha Indices on C8 Studio |

|

ExtractAlpha specializes in alternative data and quantitative research for systematic equity investing. Alongside the Smart Earnings Index, the C8 platform delivers the Digital Strength and Innovation Indices. |

|

|

|