C8 Monthly Update – June 2019 |

|

There are so many upcoming developments on the C8 platform, we have decided to launch a Monthly Update. |

|

|

New Look C8 WebsiteWe are excited to release our new website. Please check it out at: |

|

|

|

We are launching a new ESG IndexWith full transparency of underlying positions, the C8 platform is ideal for ESG (Environmental, Social and Governance) investing. No more unwanted surprises in your sub-allocations. The Good Governance strategy from GreenBlue Invest is the first of its kind to systematically select the 100 companies that rank the highest in terms of quality of Governance within the S&P 500 universe ex-tobacco, defence, and oil companies. Governance is measured with a proprietary methodology, the Stewardship model has been developed by Professor Cossin of IMD in Lausanne, Switzerland over the last 10 years. |

The Stewardship ModelProfessor Didier Cossin has developed the methodology executed by Stewardship and Governance Associates to establish stewardship scores:

|

|

|

|

The C8/ GreenBlue US ESG Factor Index This offering uses the stock selection produced by the Good Governance Strategy as a foundation portfolio for C8 Technologies’ quantitative factor models

|

C8 ESG Presentation – Zurich 13th JuneTo find out more, we are having an ESG presentation at 2pm in Zurich, on Thursday 13th June, directly after the TBLI ESG conference. We will be presenting with GreenBlue and with INNORBIS . INNORBIS have developed a dynamic analytical tool for sustainable development assessment, and is the backbone of our European ESG EU Stat Arb Index. Everyone is welcome to join us, please click the button below for full details and RSVP: |

|

Take full control of your investments with C8. Thanks for reading, The C8 Team |

|

|

|

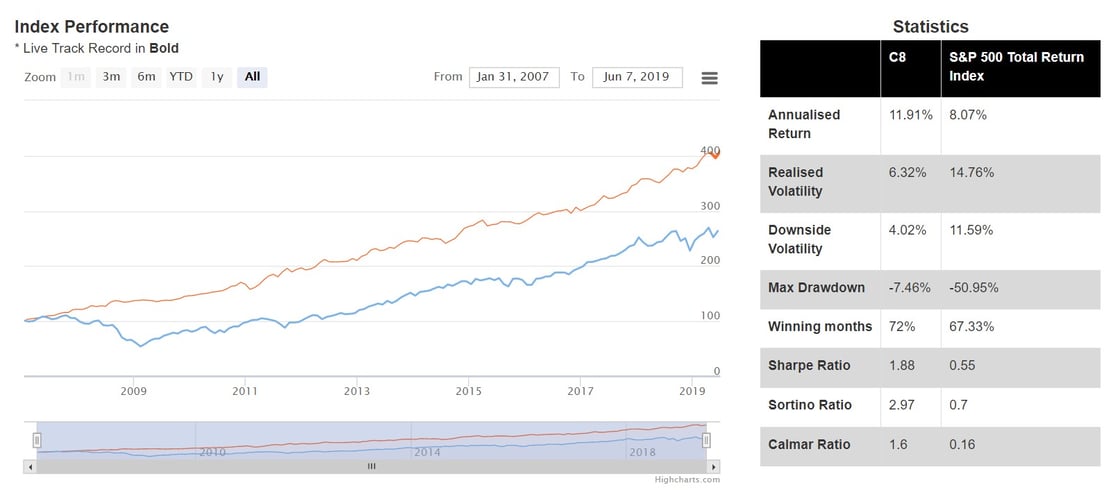

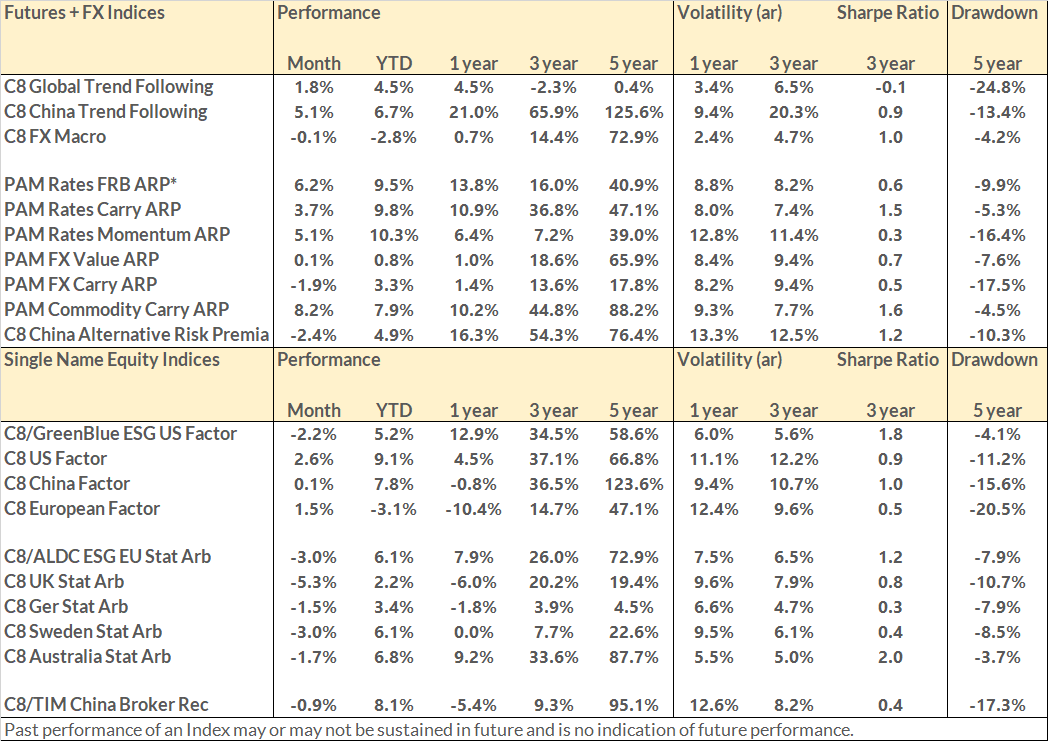

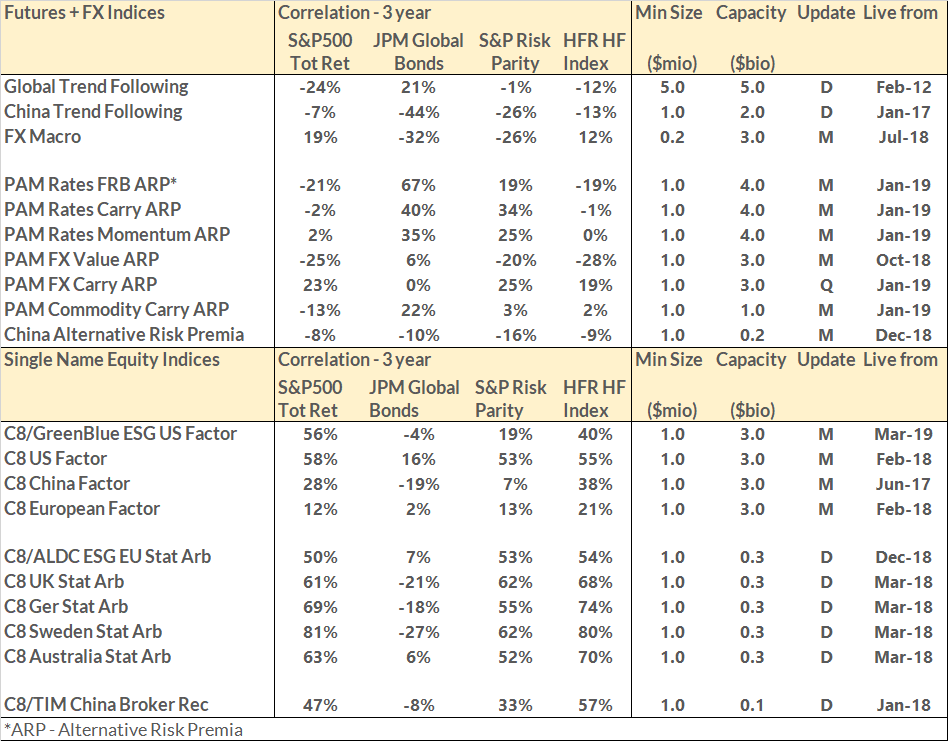

Please find below the May monthly performance tables for a selection of Indices on the C8 platform. It was a volatile month in the financial markets, helping our global and China trend-following indices, whilst the alternative risk premia were the stand-out performers as global interest rates fell. It was tougher market for the equity indices but these still remain well ahead on the year. |

|

|

|

|

|