|

INNOVATIVE TRADING I COST-EFFICIENT I FULL CONTROL I TRULY GLOBAL I TRANSPARENT & ETHICAL |

C8 Monthly Update – The Next Step: Tactical Asset Allocation – Sep 2020 |

|

|

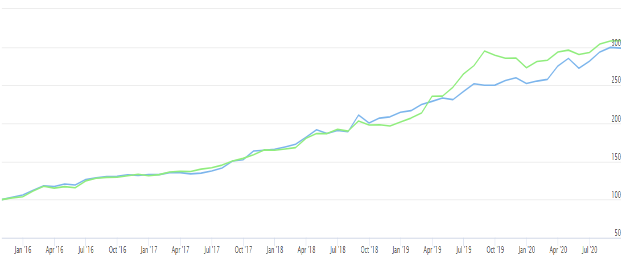

Power of Combination II: Tactical Asset AllocationIn May, we highlighted one of the major strengths of C8 Studio by focusing on the ‘power of combination’ in C8 Studio. In particular, we used Risk Parity to produce Alternative Risk Premia (ARP) combinations across 3, and then 5, asset classes. We have now released a new combination algorithm, Tactical Asset Allocation (TAA). In this case, instead of using a Risk Parity weighting across our 5 ARP combinations, we determine what combination of indices would produce the most consistent performance. In contrast to risk parity, which gives an equal risk-adjusted weight to each component of the portfolio, or mean variance, which always looks for the highest risk return, TAA focuses consistency. Indeed, unlike classic Mean-Variance, which overweights an outperforming index, Tactical Asset Allocation will underweight both an underperforming and outperforming index. We feel this has advantages over the more traditional approaches, given that, after a period of outperformance, there is a high probability of reversion to the mean. Therefore, both outperforming and underperforming strategies have their weight reduced. The chart below shows how the TAA performance (blue line) compares to the Risk Parity solution (green line). The index is rebalanced each year, looking back over the previous 2 years, using the same five ARP combinations that were the focus of the May 20 ‘Monthly Update’:

|

|

|

Note there is a more consistent performance of the TAA, in the chart above, reducing periods of under- and out-performance whilst achieving a similar overall performance over the past 4 years. So how is Tactical Asset Allocation determined? To quote Dr Ebrahim Kasenally, our Chief Research Officer: “The ideal performance of a portfolio will have Infinite Sharpe-ratio equivalent to a straight-line equity curve, then the objective aims to track said straight-line with a linear combination of N Indices. Tactical asset allocation is the task of timely allocating resources to strategies as they extend into positive excess returns in conjunction with de-gearing from strategies that continue to underperform. It is well understood that investment strategies are rarely stationary processes, with periods of strong performance and other periods of either lacklustre performance, sideways action or outright drawdown. As a tool for tactical asset allocation, our tracker is well suited to meet the task. One interesting view on the tracker approach is that it can be interpreted as a reversion strategy about the “slope”, as such, the method tactically de-gears over- and under-performers that take performance away from the desired tracking target, preferring instead to allocate resources to steady and consistent performers anticipating that they will maintain the tracking regime.” |

|

|

|

|

C8 APIC8 is making an important upgrade to our technology offering. Clients can now use their apps, web clients or tools to access our technology via an API, using the latest REST technology, which is independent of the client’s own technology. Full details in next month’s Update, but we already have our first user case. UpChina are launching a Robo-Adviser for use by Chinese brokerages. C8 are providing our Index Optimisation tools to allow a brokerage or their clients to combine a portfolio of Chinese mutual funds. These tools will be accessed via our new REST API, allowing the portfolio rebalancing to be managed by C8’s technology, whilst the Robo-Adviser infrastructure is run by UpChina. The domestic brokerages will see a seamless product offering, with C8 technology at the heart of the process. C8’s technology can now be broken down into 5 component parts:

We would be delighted to demo our new technology for you, ahead of next month’s launch. |

|

|

|

|

|

Thanks for reading, The C8 Team |

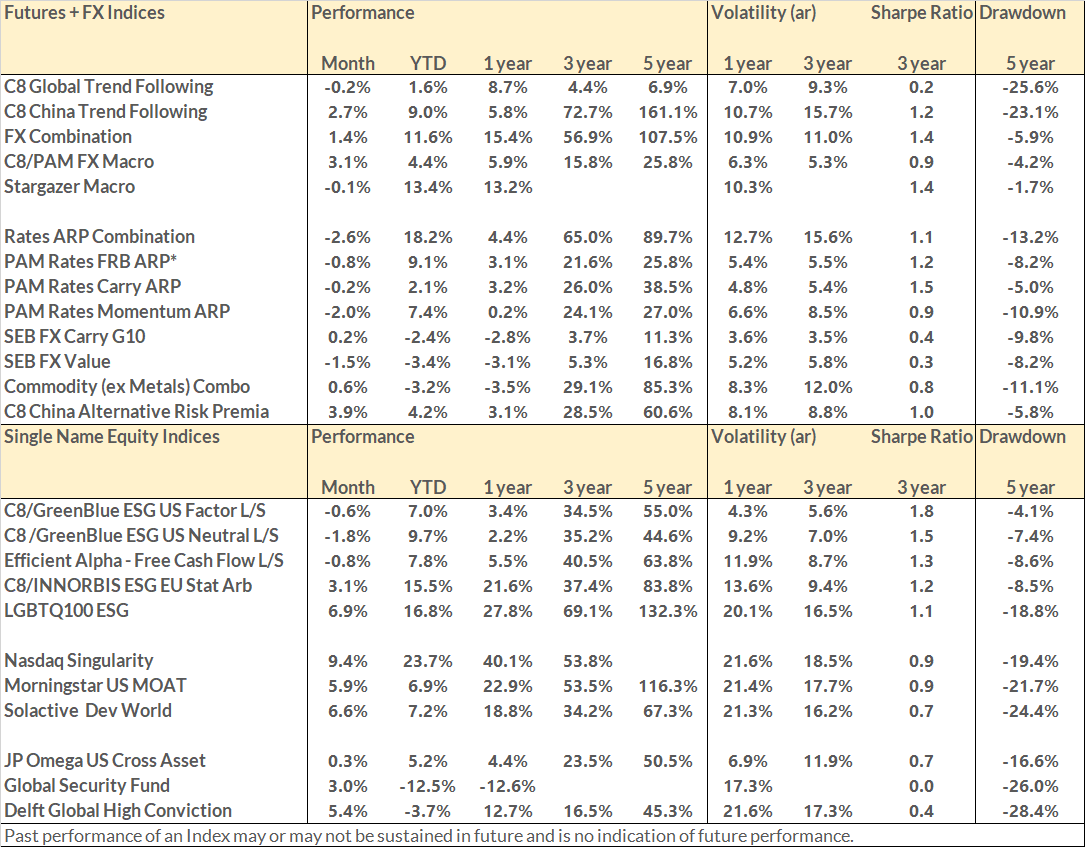

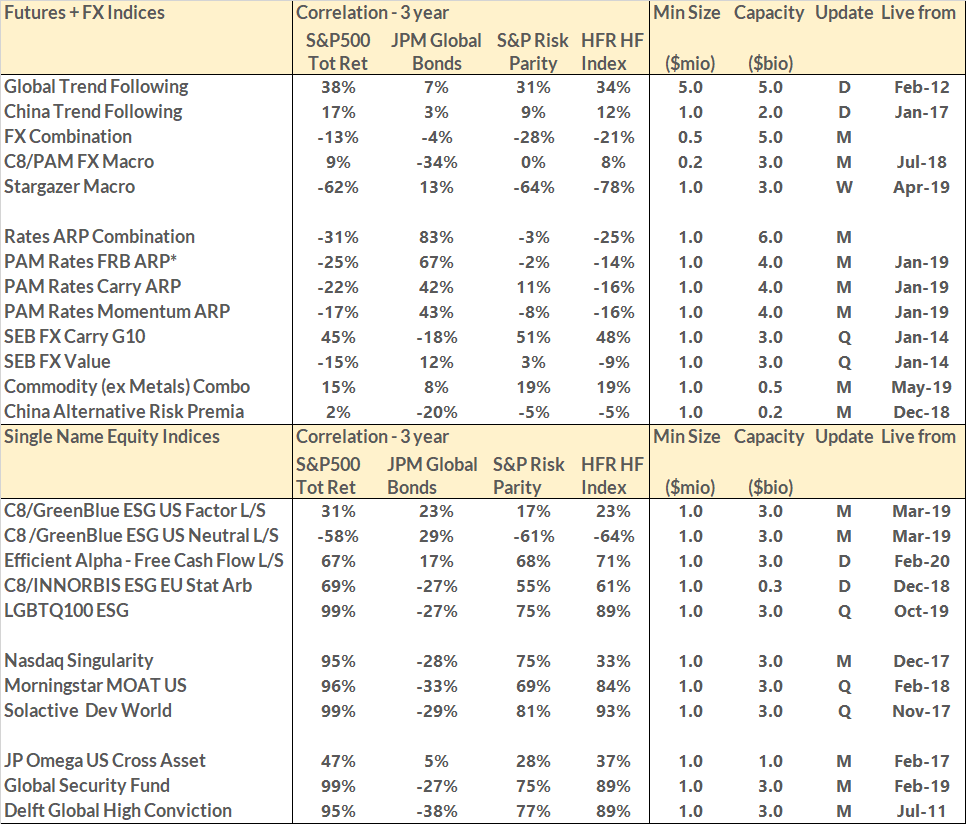

Aug 2020 PerformanceIn August, equity indexes continue to be the outperformers, as the sharp bounce back in equity markets continued through the summer. Nasdaq Singularity and LGBTQ100 indexes were the standout performers. Our sample FX alternative risk premia (ARP) combo made further gains, whilst Rates ARP gave back some their recent strong gains. Commodities ARP still have to find their feet after recent market dislocations, though the China ARP Index performed strongly. Stargazer Macro has also been a strong performer over the summer, taking advantage of the weaker USD.

|

|

|

|

|

|

| C8 Technologies, Michelin House, 81 Fulham Road, London, SW3 6RD, UK, +44 (0) 20 3826 0045

|