C8 Weekly Bulletin: The asset class ‘du jour’ – corporate bonds!15 February 2023 |

|

The latest Financial Times opinion piece ‘The Long View’ flags investor interest in an exciting new asset class – not crypto, not AI-driven stocks… but newly higher-yielding corporate bonds! January data on ETF inflows certainly underlined the revived US investor appetite for fixed income with overall inflows running slightly of those into equities. Amid this constructive backdrop, USD and EUR corporate bond markets begin 2023 on a robust note. High yield extends late-2022 rally into the new yearS&P corporate bond benchmark yields retreat |

|

|

USD and EUR high yield started this year on a particularly strong note – the S&P liquid benchmark total return indices climbing by 4.0% and 2.8% in January alone. The USD high yield index advance was not far off the 4.3% net gain posted for the whole of Q4 2022. A start-year risk recovery in risk appetite and robust investor inflows likely drove the USD HY corporate bond rally. The Q4 2022 earnings season failed to provide new direction for the overall complex – 70% of S&P 500 earnings reports beat consensus amid a -5.3% y/y projected earnings decline (according to Factset). However, US corporate earnings are not far from record levels and cash balances are, arguably, still healthy. Resilient economic data (such as the January US labour report) and prospective policy rate hikes have underpinned government yields – making it difficult in turn for IG corporate debt to rally. However, it is notable that USD IG benchmark yield has more than doubled since end-2021 (from 2.6% to 5.4%) while the liquid large cap sector of the EUR IG corporate bond market trades at a yield of 3.85% (vs just 0.7% at end-2021). USD Tracker, ESG Factor Portfolios Gain Ground vs Benchmark |

|

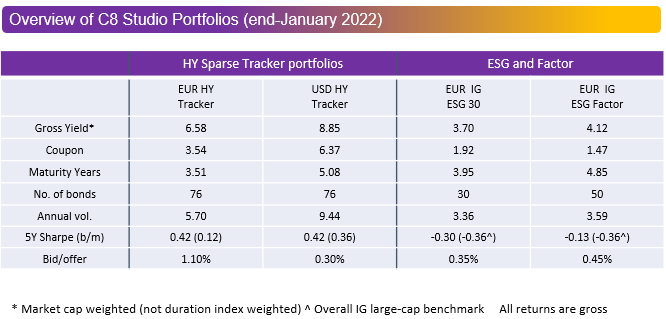

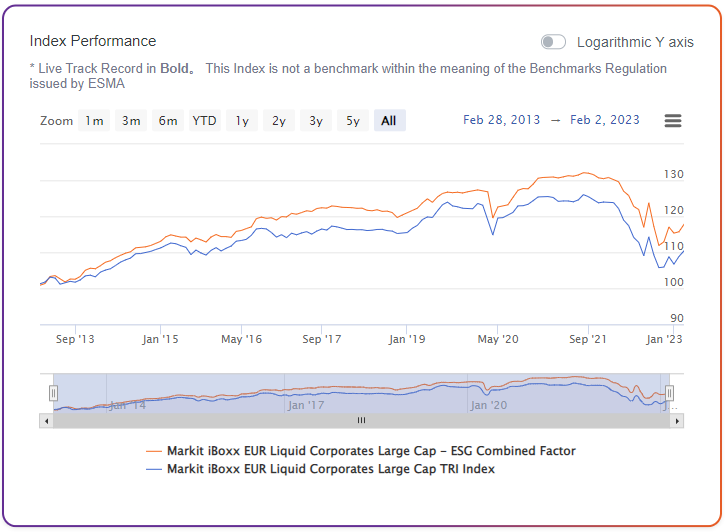

Our C8 USD high yield tracker portfolio managed to outpace the broader benchmark index rally by 135bps in January, further extending its 2022 outperformance vs the S&P index. In EUR, the tracker broadly matched the broader market advance. Reassuringly for direct bond market investors, January also brought signs of an improvement in liquidity conditions and narrower bid-offer spreads. In the EUR IG context, our C8 ESG portfolios also extended their recovery in January. Notably, the C8 ESG Factor portfolio started the year strongly, outperforming both the benchmark and our portfolio of the thirty largest ESG IG issues. Investment themes such as carry, value and defensive may drive new outperformance for the factor portfolio over the medium-term. |

|

iBOXX EUR Liquid Corporates Large Cap – ESG Factor on C8 Studio |

|